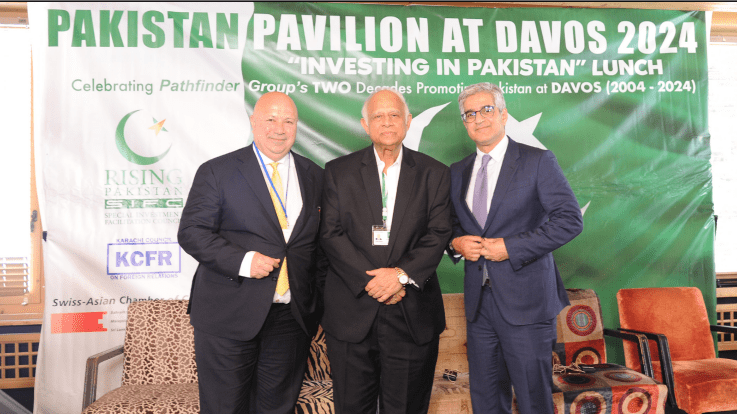

The Pathfinder Group and Karachi Council on Foreign Relations (KCFR) organized an event “Investing in Pakistan Lunch” on Wednesday, January 17, 2024, at the Pakistan Pavilion in Davos, Switzerland during the World Economic Forum’s Annual Meeting at the Morosani Posthotel. The event was moderated by Haya Fatima Sehgal, renowned author of “Resilient Pakistan.” Among the notable speakers were Mr Kaan Terzioğlu, Group CEO of VEON, Maj Gen Tabassum Habib, Director General of SIFC, Dr Amjad Saqib, Chairman of BISP and Founder of Akhuwat Foundation, Zaman Muhammad Akhtar, Chairman of 6G Digital, Singapore and Ikram Sehgal, Co-Chairman Pathfinder Group.

Haya Fatima Sehgal, Moderator & Author Resilient Pakistan

I’m going to leave it open to all the panelists here today, and I would like them to talk about the wide framework of inclusion, privatization, leveraging opportunities, and most of all startup funding. Thank you.

Maj Gen Tabassum Habib, DG SIFC

Bismillahir Rahmanir Rahim. First of all, my thanks to the host organizers for affording me this opportunity to introduce you to the government initiative known as the Special Investment Facilitation Council, commonly referred to as SIFC. Since morning, we have heard from several speakers, including the Prime Minister himself, stating that Pakistan is a country of immense potential and opportunities. I prepared this talk over an hour and a half, but I’ve been allocated only 15 minutes, so I must significantly shorten it. I won’t delve into the statistics explaining why this country has immense potential and opportunities. Nevertheless, the current passion and conditions in Pakistan do not align with its potential. Pakistan and its people deserve a position and stature in the global community much higher than our current economic standing. With a population of 240 million, being the 15th largest agricultural country, and excelling in exports such as Milk, Wheat, Maize, Mango, Citrus, and Rice (all ranking in the top 10 globally), there is immense potential. The IT sector boasts being the second-largest in terms of entrepreneurial manpower, the seventh-largest in IT professional manpower, and having 70% cheaper professionals. Examining the Mineral sector reveals reservoirs worth approximately 6.8 trillion dollars beneath the Earth and on the Earth, in the territory, we call Pakistan. Considering the increasing energy needs due to population growth, expected to rise 1.5 times in the next 8 years, there is immense potential for investment and economic growth. However, our current economic standing falls short of where we should be.

With a population of 240 million, the State Bank and foreign exchange reserves are under $7 billion, a current account deficit of $250 billion, and a debt of about $128 billion, resulting in a balance of payment crisis every few months. The leadership seeks bailout packages from countries like GCC countries, China, and the IMF, affecting the destiny of a nation of 240 million people. About 9 months ago, a crucial decision was made recognizing that this is no longer sustainable, and a comprehensive plan for the Economic Revival of Pakistan was devised. One principal aspect was attracting investments from countries like China, GCC countries, and certain Western countries. To facilitate this, a special body, the SIFC, was created. The necessity for this body arose from feedback received from potential investors, especially from GCC countries, expressing that they wish to invest in Pakistan but find bureaucracy obstructive. Therefore, the SIFC was established as a single-window platform to guide potential investors through the intricacies of bureaucracy, policy regulations, federal-provincial divides, etc., and facilitate their investments. This platform is unique in that both civil and military representatives sit at the decision-making table. If you have any questions about why the military is part of the decision-making process in SIFC, I would be happy to address them.

The tasks assigned to SIFC include acting as a single window to incentivize investments in Pakistan, raising awareness about the latent potential of investments and economic activity in the country, creating a sustainable and cohesive policy framework to facilitate investments, and navigating through the hurdles posed by federal and provincial governments, as well as multiple ministries and regulators. Additionally, SIFC is tasked with overseeing the privatization of SEOs and increasing the state’s annual revenue. Practically every sector of the economy and every economic activity whether taking place or failing to do so in the country, falls under the purview of SIFC in one way or another. The concept behind SIFC is to incentivize investment from friendly countries, fostering government-to-government, business-to-business, government-to-business, or business-to-government relationships. Pakistan is committed to providing any necessary structure that suits the investor, be it land for agriculture, natural reserves for mining, technical human resources for IT, or energy potential. The contributions from Pakistan, including infrastructure and resources are paired with investments from various countries both governmental and private. Technologies are shared if both Pakistan and the investing country possess them, and in case of technological gaps, efforts are made to acquire the needed technology from a third country. This triangular arrangement defines the entire concept of SIFC.

The decision-making structure of SIFC consists of three tiers. The apex tier, the highest decision-making body, is headed by the Prime Minister, with representation from the Chief of Army Staff by special invitation. The body includes all federal ministers, the complete cabinet, chief ministers, chief secretaries, and stakeholders related to economic activities in Pakistan. The second tier, the executive tier, is led by the Minister of Planning and co-chaired by a three-star serving General Officer of the Pakistan Army, the Chief of the General Staff. This tier includes important ministers, chief secretaries, and federal and provincial secretaries. Below this, there is an Implementation Committee headed by the Special Assistant to the Prime Minister on Government Effectiveness, Dr. Jahanzeb.

I represent the Pakistan Army at the implementation tier. Additionally, we have several working groups dealing with five sectors: Defense, Information Technology, Agriculture, Mines and Minerals, and Power and Energy. These working groups operate under the ambit of the implementation committee, with each headed by their respective Federal Secretaries. All individuals directly or indirectly involved in the execution of projects within the domain of these working groups form part of these committees, facilitating efficient execution. The identification of projects is carried out by the Implementation Committee, which then recommends them to the Executive Committee. The Executive Committee deliberates on all projects and makes decisions, and some are further recommended to the Apex Committee. When the Apex Committee convenes, all decisions are finalized. This streamlined process expedites government decision-making, resolving issues that have lingered for years within 10 to 20 days.

When the Strategic Implementation and Facilitation Committee (SIFC) was initiated, we outlined its mandate and terms of reference. Soon, we recognized that addressing only investments was insufficient; the overall business environment of the country needed improvement. Engaging with the business community, chambers of commerce, and investors revealed numerous complaints, requests, and suggestions. Projects with pending decisions for decades surfaced, and investors struggled to find avenues for resolution. This prompted the SIFC to intervene, addressing the concerns of existing investors and those with advanced investment plans. Our primary focus at SIFC is now dedicated to resolving these issues. Although we are dealing with five sectors, time constraints prevent a detailed discussion of each.

In the defence sector, Pakistan’s substantial defence infrastructure has attracted interest from GCC countries for technology and hardware sharing. In Mines and Minerals, Pakistan boasts a potential worth approximately $6.8 trillion, primarily concentrated in Thar Coal and Chaghi District. Notably, Reko Diq faced challenges, but it is now making significant progress. Pakistan, primarily an agricultural country with 24 million hectares of cultivable land, aims to transition from a food-dependent nation to a food-surplus one. Information Technology, with its immense potential, is another focus area for us. Regarding energy, we recognize the need to capitalize on renewable and hydro potential to address the challenges of expensive energy and gas shortages, contributing to increased business and manufacturing costs. These specific problems within individual sectors are our current areas of concern and intervention.

I want to highlight some of the steps we have taken. I want to emphasize that all these actions have been carried out under the umbrella of SIFC. Much has been reported in the press regarding the dollars invested and the progress made by SIFC. Allow me to provide you with an update on these matters. In the inaugural meeting of SIFC, the Defense Minister of Pakistan shared an incident where an individual wished to invest in Sialkot but faced a year-long struggle to obtain a visa. This complexity prompted a reevaluation of Pakistan’s entire visa regime. Alhamdulillah, SIFC is now authorized to facilitate visas for investors. Any individual seeking a visa for investment-related projects can approach SIFC and, upon its recommendation, obtain a visa within 24 hours, eliminating the need to involve the Ministry of Interior or any other entity. Another concern for investors coming to Pakistan was the dispute resolution mechanism, with a reluctance to navigate through lower and high courts. To address this, an Investment Ombudsman has been appointed, providing a platform for dispute resolution. This not only resolves disputes but also instils confidence in investors regarding the existence of a domestic dispute resolution mechanism. Responding to a longstanding demand, an EXIM Bank focusing solely on exports and trade was established within six weeks. Thanks to the swift action of the Ministry of Finance and the State Bank of Pakistan, it is now operational and functional. Regarding profit repatriation, many companies faced challenges in repatriating their profits from investments in Pakistan. While the situation is not fully resolved, significant progress, around 70% to 80%, has been made. Foreign investors can now repatriate a substantial portion of their earnings. In the realm of Information Technology (IT), an issue with retaining profits in foreign exchange has been addressed. SIFC recommended an increase in the retention rate from 35% to 50%, contributing to a notable rise in IT-related exports from Pakistan. This adjustment has played a significant role in fostering growth in this sector.

Next, let’s discuss the National Space Policy, which has been stagnant for the past 20 years. Over this period, Pakistan struggled to formulate a decisive space policy. However, within one month, SIFC successfully obtained approval for the policy. The rules are currently in the finalization stage. This development is poised to open avenues for Pakistan in the realm of Starlink internet, communication, and similar facilities, which had been stalled for two decades. Moving on to the topic of 5G, I recently engaged in a discussion with technical professionals from Jazz. Despite some differences of opinion, we aim to resolve them. Through SIFC, we initiated the effort to expedite the rollout of 5G facilities in Pakistan. The 5G implementation had faced a 12-year stay order from the high court, resulting in a cost of approximately $1.1 billion for Pakistan. With the removal of the stay order, the spectrum is now available, and Pakistan is poised to launch the 5G Spectrum. Technical details beyond my expertise will be addressed by the relevant stakeholders.

Transitioning to agriculture, Pakistan is fundamentally an agricultural country with 9.8 million hectares of available land. Despite abundant water resources, the non-development of land and the criminal misuse of freshwater resources hindered its utilization. However, within the past five months, almost one million hectares have been prepared. The first maize crop has been successfully harvested with 100% exported from Pakistan. The second crop, wheat, has been sown on these one million hectares, and within the next five years, Insha’Allah, 7 out of the 9.8 million hectares will be under cultivation, transforming Pakistan into a food surplus country. Despite its agricultural focus, Pakistan’s per-hectare yield in most crops lags behind India, Bangladesh, and other regional countries. A 15% increase in yield could shift Pakistan from a net deficit to a net surplus country. To achieve this, various measures have been implemented. Traditional flood irrigation techniques are being replaced with modern methods in newly cultivated areas, where flood irrigation is no longer permitted by law.

Pakistan’s seed policy, the first of its kind, is in the final stages of implementation. The widespread misuse and hoarding of seeds, along with the use of unauthorized seeds leading to low yields, will be effectively addressed. Insha’Allah, within the next six months, all seeds will be certified, and traceable through QR codes, ensuring that no illicit or incorrect seeds reach the farmers. Regarding Urea in Pakistan, a simple formula is recommended across the country, from north to south: applying two bags of Urea and one bag of DAP per acre, regardless of soil type. To facilitate this, a state-of-the-art system named LIMBS (Land Information and Management System) has been established. This satellite-based system, supported by ground personnel equipped with tablets, conducts soil analysis, and the comprehensive data is uploaded. Farmers now have access to information about organic matter usage, soil conditions, weather forecasts, optimal crop-sowing times, and more. This advanced information system is expected to significantly contribute to increasing Pakistan’s per-acre yield. Addressing the potential of Reko Diq, which faces connectivity challenges due to the lack of roads, railway tracks, and water sources, a comprehensive master plan has been developed by the Planning Division, currently led by Dr Jahanzeb. Despite financial constraints, substantial funds have been allocated to provide essential infrastructure to the Chaghi district. These projects are deemed of immense national importance. In the realm of renewable energy, the government of Pakistan has issued LOIs (Letters of Intent) and LOSs (Letters of Support). Over the past three to four years, various companies held these documents, yet the projects were not progressing at a satisfactory pace. This issue has been resolved, ensuring that all projects assigned to any company will be completed expeditiously. If a project is found to be unfeasible, a swift decision will be made, allowing investors to move forward without prolonged deliberations.

I previously mentioned privatization, and after a decade, the first project in Pakistan to be privatized was the Heavy Electrical Complex. The privatization process has been completed and the facility handed over. Regarding the privatization of Pakistan International Airlines (PIA), a topic that has garnered significant attention, I acknowledge the diverse opinions surrounding it. However, this initiative is being actively pursued with minimum energy and maximum pace through the platform of SIFC. Despite understanding the opposing views, we firmly believe that the National Carrier Pakistan cannot sustain a daily loss of 50 crore rupees. It is simply not a sustainable model and we are committed to privatizing PIA as expeditiously as possible, overcoming any impediments that may arise.

Earlier today, the Prime Minister of Pakistan emphasized the need for Pakistan to increase its revenue. Presently, Pakistan has a net revenue of about 8 trillion, with five trillion allocated to debt servicing. Significant reforms, long overdue, are currently underway in the Federal Board of Revenue (FBR). While I won’t delve into the details, as they are likely available in the media, it’s worth noting that the complete structure of the FBR is transforming. We are optimistic that, with the new configuration, both the customs and the Inland Revenue will significantly enhance Pakistan’s revenue. Our target is to increase revenue from the current 8.5% to 10%, then to 15%, and eventually to 20%. Achieving a revenue of 20% is crucial to meeting the fiscal requirements of the country.

The final point I wish to emphasize is the presence of some Ambassadors here. From the platform of SIFC, we made a sincere request for a reorientation of our diplomacy, placing a heightened focus on economic interests. While the geopolitical and geostrategic aspects are crucial, the economy takes precedence. Collaborating with our Foreign Office and the Ministry of Commerce, a significant effort has been initiated, wherein all our foreign missions are actively supporting SIFC’s endeavours. The unprecedented support from our ambassadors is noteworthy. Additionally, we have around 50 missions with various roles such as Commerce Attaché and Investment Attaché in different missions. Previously, these appointments were not aligned with the business and investment interests of the country. However, a comprehensive overhaul has taken place with new selections made and new investment and commerce Attachés being deployed. We anticipate their performance will surpass that of their predecessors. It is an ongoing process that requires persistence and we believe that over time this entire regime will see improvement. I will conclude here, acknowledging that I have exceeded the allotted time. I want to emphasize that SIFC is a permanent fixture. Some misconceptions label it as an ad hoc arrangement, but, as the Prime Minister mentioned earlier, SIFC derives legal legitimacy from Chapter 2 of the Board of Investment (BOI Act)—an Act of Parliament providing complete authorization. SIFC has the authority to direct any Ministry, department, or regulator to expedite decision-making and avoid bureaucratic hurdles. The military is at the table of SIFC to assist, not take ownership of the process. All decisions made within SIFC are ultimately implemented by the relevant stakeholders, ministries, ministers, and secretaries. The Army’s role is solely to facilitate without any financial gain from investments or projects. For instance, in the agriculture sector, any joint venture yields 40% to the provincial government, 40% to stakeholders, and 20% for research and development—none goes to the Pakistan Army.

In conclusion, I express gratitude and emphasize that Pakistan is facing unprecedented challenges. Together, as a nation, we must work to overcome this economic crisis. As I mentioned at the beginning, Pakistan deserves a higher standing in the community of nations and we all must strive to achieve that. Thank you very much.

Haya Fatima Sehgal, Moderator

My next guest will be Dr. Amjad Saqib, the chairman of BISP, and the founder of the Akhuwat Foundation. Dr Amjad Saqib is a recipient of the Sitara-e-Imtiaz, from the government of Pakistan and recently it was announced that he would be receiving a Hilal-e-Imtiaz in 2023-24. These are two of the most coveted Civil Awards of Pakistan.

Dr Amjad Saqib, Founder Akhuwat Foundation

Bismillahir Rahmanir Rahim, thank you very much for this kind introduction and the invitation. I spoke at ‘Rising Pakistan’ just yesterday, and today we find ourselves echoing the same narrative. Pakistan is on the rise, fully poised to script a new chapter. Yesterday, my focus was on philanthropy, delving into two significant initiatives in Pakistan. One of them is the Benazir Income Support Program (BISP), a tangible expression of compassion from the people and government of Pakistan. This program stands as one of the largest globally, championing a social safety net for nearly 9.3 million families, soon to reach 10 million. These families receive consistent support from the government of Pakistan. Typically, when discussing welfare, accolades are reserved for Scandinavian countries. However, in Pakistan, supporting the underprivileged are often labelled as charity but it is crucial to understand that this is not merely charity; it is a right bestowed upon those who have been left behind, marginalized, and disadvantaged. Now, let me shift briefly to another model – the Akhuwat model. This initiative extends interest-free loans to those with potential, skills, and a desire to progress. The challenge lies in the absence of collateral and financial resources, which bars their entry through the doors of conventional banks. Achieving financial inclusion is paramount, and through Akhuwat, we have inspired numerous microfinance institutions to provide interest-free loans to the impoverished, aiding them in breaking free from the shackles of poverty. As we discuss investments, these two projects are fundamentally philanthropic. However, our endeavours have extended into various avenues where we channel funds with dividend expectations and profit considerations. Our commitment remains unwavering in exploring diverse paths to make a positive impact.

Number one, we have established an Institute of Tourism and Hospitality Management, and there are many similar institutions in Pakistan. Please join us and let us know what kind of management professionals you require. Provide us with the curriculum, specify the demand, and tell us the qualities of the individuals you need us to produce. Number two, I was just speaking with Mr Niazi about enhancing the number of professionals in the health sector. We have nurses, paramedics, and various technicians in all medical-related fields. Kindly inform us about the number of people you need for nursing, elderly care, and assistance for physically and mentally challenged individuals.

Currently, more than 40 to 50 medical colleges in Pakistan are willing to produce nurses and paramedics and we can facilitate connections with these institutions if you are working in the health industry. We are eager to provide you with highly trained professionals who can contribute to your organization. Number three is the IT sector. We have numerous institutions and a consortium. Specify the requirements for Artificial Intelligence, Cyber Security, and Digital Marketing professionals, as these fields align with market needs. We can produce qualified human resources to meet these demands. Investments may extend to agriculture as highlighted by General Tabassum, but we also encourage you to consider investing in human resources. Whether it is in financial inclusion or other sectors, we have a large number of skilled individuals.

Recently, the Securities Exchange Commission of Pakistan granted licenses to four housing finance companies. With a demand for 10 million houses in Pakistan, we invite you to invest in the housing industry. Basic infrastructure is available and we have extensive databases from programs like BISP and Akhuwat, showcasing millions of people willing to buy, build, renovate, or improve their homes.

Similarly, in solar energy, we are enthusiastic about connecting you with millions of people willing to be included through financial inclusion. Solar energy is another promising avenue for investment. Though my time is limited to four minutes, I urge you to consider investing in human resources – one of the most rewarding investments. Whether you need skilled individuals in the health sector, IT sector, education, or finance, we are eager to collaborate with SIFC and be a part of your efforts. Thank you, ladies and gentlemen. Pakistan awaits you, and with your investments, we can collectively make Pakistan and the world a better place.

Haya Fatima Sehgal, Moderator

Our next guest is Mr Kaan Terzioglu. He’s the group CEO of VEON. As the group chief executive officer of the VEON group since 2021, Mr Kaan leads the executive teams of the company’s digital operators, providing connectivity and digital solutions, empowering their customers with digital finance, education, entertainment, and health services amongst many others, as well as supporting the economic growth of the company’s operating markets. Before joining the company, Mr Terzioglu held regional and global leadership roles with Anderson Auto, CISCO and Turkcell, in Belgium, the United States and Turkey. I welcome Mr. Kaan Terzioglu.

Mr Kaan Terzioglu, CEO VEON Group

The question in your mind must be, “What is VEON?” But if I tell you that we proudly serve one out of two Pakistani citizens under brands like Jazz, JazzCash, Mobilink Bank, Tamasha, Deodar, and Garaj, it might shed some light. I can also mention that our Pakistan Chief Executive Officer, Amir Ibrahim, is present here. We take immense pride in the fact that over the last decade, VEON has invested $10 billion in Pakistan. We are not just investors for the good days; we have witnessed both good and bad days. I am extremely impressed by this morning’s discussions, particularly the Prime Minister’s focus on making Pakistan attractive to international investors. The Major General’s emphasis on stability, predictability, and execution power that SIFC brings to the investor landscape is also noteworthy.

Let me share our understanding of why we believe in Pakistan. VEON operates in six markets: Pakistan, Bangladesh, Ukraine, Uzbekistan, Kazakhstan, and Kyrgyzstan. We specialize in emerging markets that are underserved, experiencing population growth, and have significant potential for digital asset creation.

While in the ‘70s and ‘80s, everyone talked about oil-producing countries, today Pakistan is one of our most significant markets. Pakistan is a data-producing country and it is crucial for that data to stay in Pakistan, processed by Pakistani engineers and converted into solutions like Garaj, Tamasha, Jazz Cash, and Mobilink Microfinance Bank.

Unfortunately, in Pakistan only one out of two people currently have access to mobile internet, less than one out of three have utilized a bank account, and our enterprises lack sufficient access to Cloud Infrastructure, hindering their competitiveness. Everywhere in Davos, two words stand out: AI, Artificial Intelligence, or as I’d like to name it, Augmented Intelligence. It is our responsibility to ensure that we take Pakistan’s data and convert it into digital applications that can make farmers in Lahore the best in the world, doctors in Karachi the best, and teachers in Islamabad the best. We can achieve this by developing technologies that co-pilot them through their business challenges.

Our commitment to Pakistan is long-term, and while we have expectations as foreign investors, I am pleased to hear from Maj Gen Tabassum that the path for repatriating dividends and profits will be open for foreign investors. Furthermore, the promise of streamlined bureaucracy for establishing new businesses, and obtaining work permits and visas is equally welcomed. We must collaborate to create the necessary regulatory environment, improve infrastructure, and ensure the data sovereignty of Pakistan.

Ladies and gentlemen, as VEON, we are immensely proud of our company and operations in Pakistan. I thank you for allowing us to invest in your country and I can assure you that we will be ambassadors of Pakistan, inviting investors worldwide. Thank you very much.

Haya Fatima Sehgal, Moderator

Our next guest is Mr Zaman Muhammad Akhtar, the Chairman and CEO of 6G Digital. He started his career in 1979 as a commercial pilot and flight instructor, after graduating from Burnside OT Aviation Training Center in Miami. He is a Visionary and a Swedish entrepreneur, with more than 35 years of experience, in building over 9 billion US Dollars businesses for its shareholders, strategic partners and the host governments of Indo-China. He is the founding chairman and CEO of several Next Generation Ventures such as 6G Digital Sweden, Royal Falcon Fleet AB, and Money Channel 1, a cloud-based integrated digital ecosystem, deploying next-generation digital banking and payment services. 6G Digital is rolling out the first global remittance and financial services to serve the residents and citizens of six continents.

Mr Zaman Muhammad Akhtar, Chairman 6G Digital

Honorable Mr Ikram Sehgal, it is my distinct pleasure to stand here and speak in front of you. I find it very difficult to say something new after listening to so many distinguished guests. I was thrilled yesterday, listening to ‘Resilient Pakistan,’ ‘Legacy Pakistan,’ and ‘Pipeline Pakistan,’ creating opportunities for a lot of people. However, the story I loved yesterday was about the 10 million bank accounts opened over the last two years in Pakistan. Everything in our life starts with a vision. We stand here before you to salute Ikram Sehgal, who celebrates 20 years of coming to Davos, promoting Pakistan, and dedicating his time to help bank the unbanked.

My company, 6G Digital, and my previous company, Millicom International Cellular, have been very focused on building mobile telephony. Back in the ‘80s, ‘90s, and 2000s, my company was the world’s first mobile telephone company launched in 1981 in Sweden under the name of ‘Comviq.’ The second company we built was called ‘Vodafone.’ The first two mobile phone companies in Pakistan, ‘Pakcom’ and ‘Paktel,’ were also built by us. Across the border, ‘Airtel,’ ‘Sky Cell,’ and many other companies, a total of about 135 telephone companies, including the first 22 telephone companies in Russia, were built by us. So, we understand that infrastructure means something very important. Back in the ’80s and ’90s, building a mobile telephone company was a game-changer. But if you look at today in 2024, banking the unbanked, Mr Sehgal and his son’s journey is the game-changer.

The best thing I heard over the last couple of days is about the Pathfinder’s VRG initiative. It is not only a Pakistani initiative, it could be cut and pasted around the rising economies of the world and that’s the best part. So Pakistan in fact, could be at the forefront of helping tomorrow’s economy. Here in Davos, we hear two main buzzwords, war and rebuilding trust, and AI. Now, AI means many things to many people and war means many things. But if we look deep down at the core of our commitment to the world, I think the most important thing happening today is the gap between the rich and the poor which is getting bigger. It’s between the haves and the have-nots and it’s getting bigger. So, what I hear from Pakistan is the commitment to use AI and many other things to change the lives of the people. That is much more important than using AI for the privileged less than 1% of the world population, maybe helping them go from Mac 0.95 to Mac 1.05 in their copper jets. Listening to the Major General earlier, I think Pakistan is using AI in the right way. I’m very happy to be here and to have the opportunity to participate, listen, and understand. I can see a vision of banking the unbanked, and it can be exported to many countries. In short, my company is currently building digital banks in Canada, the US, Europe, and Asia. We are committed to working with Mr Sehgal to bring digital money transfers to Pakistan over the next few months. Recently, my company is also in the process of bringing in NVIDIA-powered, artificially intelligent digital data centers. We would be very happy to talk to the government of Pakistan about how we can build next-generation data centers with computing power more than 100 times that of the most powerful computers in the world today. Thank you very much for giving me the opportunity.

Haya Fatima Sehgal, Moderator

I’d like to invite the Co-Chairman of the Pathfinder group for the concluding remarks.

Ikram Sehgal, Co-Chairman Pathfinder Group

Bismillahir Rahmanir Rahim. I believe that the 20-year journey of promoting Pakistan has been worthwhile. It is gratifying to witness the structured and no-nonsense approach of the Special Investment Facilitation Council. This approach makes a significant difference, addressing the frustrations associated with navigating bureaucracy, obtaining numerous permissions, and managing foreign exchange repatriation. To give you an example, we had a contract worth several million dollars. We faced restrictions on retaining any part of it. We were compelled to purchase equipment and other necessities from abroad which involved interactions with multiple vendors. Simplifying these intricate systems would greatly benefit us.

Now, allow me to backtrack and begin with Mr Zaman. As one of the early investors in Pakistan, his notable contributions extend to China and the work he has undertaken in Vietnam. What holds particular importance for us is the effort to tap into the abundant energy in Southeast Asia for the repatriation of funds. This has never been systematically pursued until now, with 6G digital playing a pivotal role.

We are honoured to have Mr Mustaq Samsuddin, representing the renowned brand ‘Mustafa Samsuddin,’ present with us today. Regarding Mr Kaan, I can only express that our journey to being recognized by the World Economic Forum’s Edison Alliance would not have been possible without the initial decisive steps taken. I must acknowledge the crucial role played by Mr Amir Ibrahim and Ali Nasir. We initiated discussions with Ali Nasir first and later engaged in extensive conversations with Amir Ibrahim. Through these interactions, I gained valuable insights into the telecom industry addressing various reservations.

However, what resonates the most from Mr. Kaan’s remarks is the emphasis on the importance of people. Today, he highlighted that people matter, and investing $10 billion in Pakistan is a significant contribution. We extend our gratitude for this substantial investment in the country. We take great pride in our association with Jazz in various capacities. Even today, I mentioned to Amir that we were among your first customers on the cloud. Despite encountering challenges with the State Bank regarding data, AMA is now entirely on the cloud, thanks to the efforts of Salman and Ali Shah. Our transition to the domestic cloud has been instrumental in our progress.

Now, coming back to the SIFC, as I mentioned yesterday, I share a unique connection with two individuals from the 29th PMA Long Course: General Ali Kuli and General Pervez Musharraf. While they are vastly different personalities, General Ali Kuli, who has his industry, has honoured me by appointing me as the only non-family member on the board. I also had a significant association with General Musharraf bringing him to Davos.

During our discussions, I emphasized the need for a well-organized structure to facilitate investments, a sentiment echoed by General Tabassum in his speech. It was my first meeting with General Tabassum. I am pleased that SIFC is represented here in Davos, the epicenter of economic activity. This platform allows us to showcase what Pakistan has to offer and how we can make the investor experience smoother. To attract investors, confidence is key. They must believe that their investments will yield favourable returns and allow for the repatriation of profits.

Although our time here is limited, I hope General Tabassum will elaborate further with the help of charts and graphs in the future. I’d like to acknowledge the presence of Michele Molinari, who made a special effort to be here despite not feeling well.

Additionally, Justin Hover is exploring opportunities to collaborate on railways with a prominent Chinese firm. Western countries are expressing interest in investing in Pakistan. We had a project in the past that faced roadblocks, which was basically about Karachi to Gwadar Built Operate Transfer (BOT) and Railways, and then BOT on the main line, right up to Quetta and Chaman. The crucial point is that someone must keep the door open and SIFC plays a vital role in ensuring fair returns for investors.

In conclusion, I’d like to emphasize the importance of having boots on the ground to navigate challenges. SIFC, with its boots on the ground, will pave the way for investors to achieve fair returns on their investments. Thank you, everybody.