A session on “Digital Financial Inclusion” was held as part of the Pakistan Pavilion at the World Economic Forum on 19th January, 2023 at Davos, Switzerland. It was held under the auspices of the Virtual Remittance Gateway, a company of Pathfinder Group. The event was moderated by Salman Ali, CEO, VRG.

Mr. Zarrar Sehgal Chairman Pathfinder Group: This is the VRG Pakistan breakfast at Davos, so on behalf of the Pathfinder group, VRG, i3 and iPath, I welcome you, thank you for joining us. We have a distinguished group of speakers today.

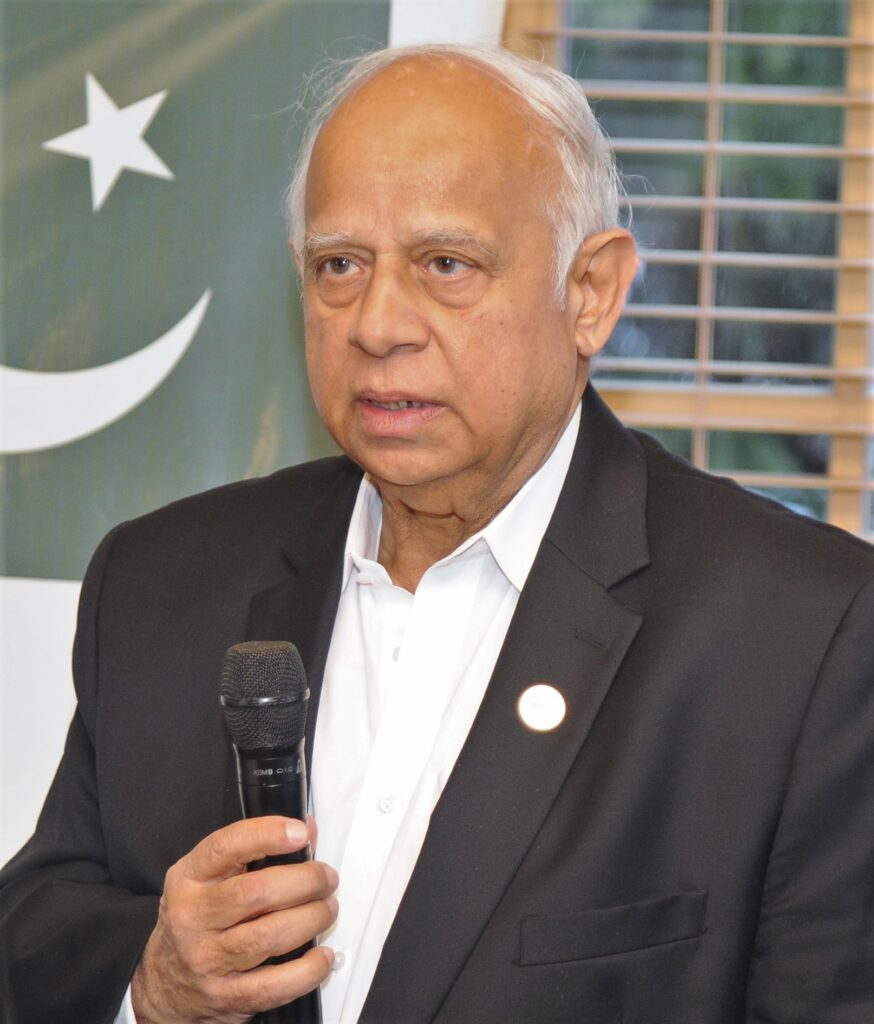

Tariq Malik Chairman, NADRA: Thank you very much for the kind introduction and many thanks for inviting me on this session. I’m very thankful and pleased and honored to be here, and thankful to Sehgal family and Mr. Kabeer and Maryam and all the learned people, the CEOs of Pakistan, which are contributing a lot in our economy. I would be brief because I have to catch a flight but I had prepared a presentation of about the role of NADRA – National Database Registration Authority in digital transformation. The topic today is financial inclusion, but you can’t be financially empowered or included before you are included in the social contract, so that’s where I will start and that’s where I will talk about the NADRA’s contribution, National Database and Registration Authority’s contribution in creating a transformative environment in Pakistan as far as digital inclusion is concerned.

So, we’ll talk about inclusion and then digital inclusion and then we will go towards financial inclusion. This is what NADRA is. We count the people. Why? Because people can count on the state, it’s that simple, right, so 140 million, 97% of population, we have their biometrics. We count them uniquely because each person is unique, so we take their fingerprints, 10 fingerprints and digital photograph and now we are adding Iris also, so we have a rich digital ID layer that we use it to reform governance and to empower the people. So, people get a chip-based ID card, 18 and above the adults and we have infrastructure. 779 offices, and wherever the people cannot come to us we go to the people, we have 220, I think we have 222 mobile vans, we have man pack units and the mountains like Switzerland, you know we have K2 and all those mountains, up in the mountains we have trekkers with man pack units registering the people. So, the infrastructure is there. 140 million national ID cards have been produced but, that’s not the only success story that everybody is counted.

The success story is when I was working in United Nation as Chief Technical Advisor, advising 130 member states on digital governance. We figured out that the countries who have strong foundational systems, they can roll out digital public goods quickly in the event of crisis, poly crisis, in the event of disaster, in in the event of pandemics. So what is actually a foundational system? These are foundational systems, CRVS – Civil Registration and Vital Statistics System, national ID, digital ID program and if you have digital census. So, if these foundational systems are there you can roll out all of these digital public goods which Pakistan already has. We have disaster relief systems, we will talk about it. We can find out who’s paying the taxes and who is not, but of course, there is a political will that is required to collect the taxes from that segment of the society who isn’t paying.

We can manage our borders efficiently and you know access to health, social protection programs, all those are coming in the next slide. We do South-South Cooperation. We have about 77 national projects and then some international projects. We helped Kenya to come up with a machine-readable passport and now Kenya is being upgraded to e-passport system developed indigenously by NADRA software engineers. We are helping Somalia come up with the first national ID system, Sudan; Civil Registration System, Nigeria; National Identity Management System, Fiji; Election Management System. We are helping European Union to actually use our re-admission system. We developed it for 34 countries of European Union and Bangladesh driver’s license, so on and so forth. I have about 13 countries waiting but this was the model that I presented in United Nations, that in order to reform the governance, you have various threads of government and then you have various technologies.

You know mobile technology, block-chain technology, hashgraph, BI tools. All these technologies, biometric technologies. but you don’t want to just set up a technology theater. You see the technology from the prism of the citizen’s eyes, from the citizen lens, and then you do citizen-centric intervention using technology. You use only that technology that empowers the citizen and then, you focus on the derived values that you want to achieve. You want to enhance state capacity, you want the social contract to be strengthened, you want to roll out targeted subsidies, tax the rich but provide subsidy to the poor, but how would you find out that who is poor and who is rich. The data would tell you. You want to roll out financial inclusion programs, so on and so forth. So, for smarter safer government, the digital ID is the key, the foundational system is the key, and then you connect them with the SDGs.

There is SDG 16.9, social justice but the target is 9, which says that by 2030, everybody should have a legal ID, including children. So, all these SDGs, you can measure them with real data, not with statistical data, not by chance theory, not by probability, but real data. We in NADRA are tracking these SDGs with real data, by real intervention, digital intervention, and these are interventions that I have listed out, but I will share the presentation with you and you can read out. Now, we come to digital inclusion. We have financial inclusion; we will talk about it, but we are doing digital intervention in healthcare. We have Sehat Sahulat Program in Pakistan, we are doing a digital intervention in education also, so an ID card has all the ecosystem built in. You can scan it, you can swipe it, you can dip it, you can visually inspect it.

When you dip it, what is on the ID card is on the chip also, so you don’t need a big infrastructure, you would need one-to-one authentication with one device, where you take the fingerprint and what is stored in the chip, you can read it and you can provide the service. So e-KYC is very easy in Pakistan and that’s where we have done some intervention where all NADRA offices, 779 are there, but we are taking the NADRA office in your mobile phone. People used to go to give their biometrics in NADRA’s office. Pakistan became the first country in the world who has started taking biometric by phone by this innovation that we have done.

So now you take your fingerprints’ picture and it is verified and you take your IQ-compliant photograph from the phone and you submit your documents on the phone, so the Prime Minister is going to inaugurate that hopefully next month, but this is ready and this has created a revolution in financial inclusion industry, in banking industry for digital onboarding and microfinance industry, insurance industry and credit card and all those healthcare insurances also, they are using that. So digital onboarding is easy now, we have various services that we are going to roll out next month, it’s a platform called Nishan Pakistan platform. We will give sandbox to all the entrepreneurs of Pakistan, so that they can use it to build the identity related services in whatever product that they are rolling out, so that is also in line.

These are our interventions where identity layer is used. If you have to pay your taxes, if you want to open a bank account, if you want to have a SIM, you want to buy a property, you want to pay your bill, you want to have a passport, domicile, you want to vote, social protection program and health program. In all these programs NADRA’s digital ID layer is included. We come to an Asaan Mobile Account and the thing is that the government cannot work in isolation. Even if we do some innovation, we open NADRA’s platform for public private partnership and that’s where the fusion happens, that’s where the transformation happens. I mean you have Siri but it was not developed by Apple. You know you have LASIK surgery, you have night vision goggles, and all these were invented by some agency of the government all across the world but, you know it is integrated and built in the private sector, so private sector provides you the scalability. When Sehgal Sahab came to me and he said that we want to integrate for e-KYC, I said okay. In my previous stint, when I was Chairman, I got a lot of criticism that, why I allowed EasyPaisa to be rolled out, why NADRA didn’t do it? We can do it, but I think what we can do is that we can provide a platform and various other platforms to private sector where they can scale that product, and create that transformation, so here is the transformation.

In one year, you know seven million accounts, actually when I prepared this presentation from departing Pakistan, 6.7 or 6.8 million Assan Mobile Accounts were there, but we crossed 7 million yesterday. 47.8 billion financial transactions took place, 52.6 million total transactions processed and the good story is that 40% of 7 million accounts are owned by women. Benazir Income Support Program; I was one of the small contributors when we were architecting that program. It is now a flagship program, so 8.7 million beneficiaries so far. It’ll be, in last 10 years, 1.3 trillion rupees have been dispersed and 114 million biometric verifications have taken place. Pension disbursement, we just rolled out this product, I think three days ago when I was departing from Pakistan for senior citizens and it is AI based model which asks the personal question for e-KYC for the senior citizens whose biometrics are not read.

When I left United Nations, I had a cheat sheet of 43 project. In one year, I have completed 33, so I have revised, because world has moved on in one year, and now we have portfolio of 77 projects and initiatives. So, every fourth day, we are launching a new initiative. I want to get it done by 2024. So, this was another initiative I launched in 2008, where the students who couldn’t complete their education, university education, we gave them our software, we gave them the computer and we said you just collect the utility bills and here is our platform, we call it e-Sahulat, and you know when I left in 2014, there were only five – six thousand.

Today, 17,000 of those people who have continued their education and they are earning on average 50,000 – 60,000 rupees by getting the franchise of e-Sahulat. US dollar, 105 billion have moved in last 13 – 14 years of transaction, 2.1 trillion transactions, have gone through that system, so it is panning out very well. In Pakistan, there are 16,400 ATMs. I had to, just three weeks ago add, 17,000 of our franchises into that equation and you have now 17,000 human ATMs because we have linked with 1Link, e-payment system so you can do the cash in and cash out, so that’s also a very transformative project. Sehat Sahulat Program, everybody knows, it’s a healthcare insurance program and anchored in digital ID and, so far it has 97% satisfaction rate and 175 million total beneficiaries have actually utilized this program.

When there is any disaster or crisis, NADRA takes it as a black swan moment, as an opportunity, as a creative moment. We were asked to put together quickly, a system based on digital ID which can track your Covid vaccine. Who got the first dose, so that second, third dose could be given to us, I said no we will develop a National Immunization Management System. Covid is just part of it and now we have rolled it out to track the yellow fever, for polio vaccines and the next level, we are taking it in the third quarter of this year, where I want to track all the kids that they got their vaccination done or not digitally. Just a comparison I have, I still have my UN yellow card, as the Covid vaccine card handwritten. I have US vaccination card handwritten by CDC and look at our card which can be verified on phone and any immigration officer can see by just clicking on the QR code, that whether it is issued by the government or not. Similarly, school enrollment, CRVS, we are facilitating and I won’t go into the detail but I want to narrate another story, that we have dismantled the barriers of registration to vulnerable community, that was my goal. I set up a department, it’s called Inclusive Registration Department. Inclusivity is my main goal and by dismantling the woman registration barriers, we were able to register 4.4 million women and we are able to reduce the registration gap from 14% a year ago to 6.4 percent. My goal is that I am registering every month, more than what I registered last month. We are the only institution in South Asia actually which caters government organizations, which caters 136,000 applicants a day. 136,000 applicants a day, 57% of them are women now.

Persons with disabilities and transgenders – Pakistan is the only country that recognizes the third gender and so we actually empower them with that identity and we track the persons with disabilities by giving them these cards, a special card with a logo. For disaster management, Sherry spoke yesterday, but we have a program which is best kept secret so far, but a lot of African countries are moving into that. It is a simple program, we have digital identities, so we need to identify who was flood affected or not. We can do it with one scan, with one click and we can verify that person who is eligible for some cash grant or relief by biometrics and we can disperse the cash. So, this is the model that we have presented and it is built in in the 4RF strategy. We did it in 2010 flood in 72 hours, and so 1.74 million Visa cards were distributed among flood affected and 34 billion was paid. This is our emergency cash transfer program, during the Covid-19 pandemic, so we have a registry of social protection. We just use that registry and 16.95 million beneficiaries were identified and 179.2 billion amount was dispersed. This is our road map for this year and we are moving very fast.

In this year, we want to launch Nishan Pakistan Platform, identity authentication online or offline mode, any entrepreneur can get that sandbox. Digital signing of transaction, we will offer, single sign-on service, we want Amazon, we want PayPal, we bought all these international players who are not trusting buyer or seller of Pakistan. We will give them that trust by rolling out the digital ID middle layer. Citizen privacy, we are taking it to the next level. I am rolling out, even next month, the consent regime where every Pakistani would own their own data, so if you want to use their data, you have to get their consent electronically through OTP.

So that would be a revolutionary service and then we have developed a software which will actually uniquely identify which document it is by just taking the picture of that document. Whether it’s a birth certificate. whether it’s, you know death certificate, ID card, passport so we are going to roll out, so we want to become the gateway for all services.

This is Nishan Pakistan, I already told you and this data exchange layer we are working on. That’s my presentation I have to rush to the airport but all of these publications are available on the internet. You can read on each slide, there is a publication that I have written and you can browse through, thank you very much.

Salman Ali, CEO – VRG: Our next speaker is a very dynamic lady. A grad of London School of Economics, 21 years of experience, played a very vital role especially in the banking industry for real transformation. I personally know and I have seen the transformation not only within the organization due to the role played by her, but also as a lady who actually really progresses her career onto the next level. Digital financial services, digital inclusive finance, these all words really fit to her portfolio, so ladies and gentlemen, Ms. Ambreen Malik, the Chief Digital Officer and the Chief Business officer of UBank.

Ambreen Malik Chief Digital Officer and the Chief Business Officer, UBank: When we were designing, this particular session, the kind of things that we talked about were, how we can showcase the best of things that are being done in Pakistan in the digital space. There are many things that like Mr. Malik just shared as well, have been happening but, many partners are coming in who are doing work which is yet to be shared and seen, so I’ll start first not with digital financial inclusion but with exact opposite of that. I want to talk about exclusion first. When you understand exclusion, you will understand why inclusion is so important, and I want to share a personal story. It was a watershed moment for me to understand what exclusion is. I’ve been a banker for more than 20 years or so, and while I work very closely on ground with our customers, with our staff, I never understood the definition as well as I understood about two years ago, and it relates to a personal story.

I found myself in a hospital preparing for a brain surgery two years ago to remove a tumor from my brain. As I was preparing for the surgery, next day a team of doctors walked in and asked me if I will give consent regarding certain medical data, because they wanted to use that data with a partner university hospital in US. I asked them why do you need data? And women data? I’m sure it’s available, you guys are a big hospital, what’s wrong? And the lead doctor said you’ll be very surprised; we don’t have medical data pertaining to women. You know why? Women rarely make it to the treatment stage, so you’re one of very few lucky women who have made it here and will in sha Allah go through the surgery and make it on the other side. I made it on the other side. Now, what I learned. What I learned was that because there is no medical data available for men and women both, South Asians are kind of left out of the research that is needed to develop medicine, procedures, processes needed to treat us, we’re different, right? That particular moment made me understand what exclusion is. I got better, because I was included. The other people didn’t get better, because they were not included.

Now, here we are, we need to understand when people are not included, it’s the exclusion of data, it’s the exclusion of information, it’s the exclusion of access to medical treatment, it’s the exclusion of not having access to schools, colleges, universities, credit, saving, bank accounts and the story goes on, so it’s important to understand the baseline of why we are here right now, and we are here to talk about exclusion first as a baseline and then talk about inclusion. Now, I will talk about inclusion. Somebody wise said what exactly is darkness and the response was, it was just an absence of light, that’s what it is, so let’s talk about inclusion. How do we see inclusion in Pakistan? Since yesterday we’ve been meeting, the Chairman – NADRA as well, talked about the landscaping of Pakistan and I will also do it again.

In the country of 220 million people, 18% of Pakistan is banked, which is a very tragic figure when you ask a banker, and I also feel ashamed every time I talk about this figure. About 60% of our population is under the age of 32 years and they are waiting to be banked. If you do the math, about 40 million people are banked and they are overbanked, they are not the unique account holders, they’re people like all of us, who will have two accounts or three accounts, have credit cards, have mortgage, have a car lease, and many bank accounts here and there, and then you talk about the banking density.

In the country of 220 million people, about 180 million people have SIMs. They’re connected through phones, so when you talk about inclusion, the idea was, can we marry the two and take banking to the last mile, that’s how it started about 10-13 years ago. But a lot of work is still needed to be done. We’re not there yet, so we at UBank, when we started about seven years ago, what we did was that, we did some very interesting things and we wanted to go and understand the landscape of the market ourselves first, so we sat in the car and drove to the last mile in Pakistan and this is the management team sitting here of UBank and CEO is also sitting here, who will speak about it later. To landscape and understand what we see in terms of inclusion, what is real and what is not, because the buzzword became the digital inclusion, and when we got on ground we found two things. One, for digital inclusion you need to have access to data or what do you call it, the 3Gs and the 4Gs, so your customer can reach you. You get out of Islamabad, Lahore, Karachi, there is hardly any 3G and 4G.

I know I will upset few of my colleagues in Telecom sector but that’s the way it is. Then you talk about the customer, they are in the far remote locations and they have no means to come to you. They have no means to understand what banking is and we sitting in Islamabad are thinking, well, maybe they can dial a code or they can make a phone call and understand banking and we found out it didn’t work, so we came up with one hybrid model that we call the Figital model and I want to talk about it, especially because, where we are as a country in the journey, it has to be a dual model that needs to work before we become fully digital as a country.

Chairman – NADRA actually explained it really beautifully, and I really like what he said in terms of the digital inclusion and the financial inclusion. For us bankers as well, we divide it in two parts the financial inclusion part and then the digital inclusion part, financial inclusion is the first part of digitization. Till the time you will not have people in banking net, you cannot digitize them, so that’s first thing and for us to do that it’s very important that we take banking services to the last mile and help them come into the banking net, that will also increase the tax net. Once that happens, you help them understand how digitization works and this digitization will make life easier for them as well as for us because, when you go to the last mile and you see your customer cannot read and write, he does not have access to data, you need to become the boots on ground where you can teach them the importance of inclusion and teach them how to get on the digital journey.

So, as we live with the Figital model and we at UBank, Ma sha Allah; we are the fastest growing microfinance Bank in Pakistan. 300 branches on ground and In sha Allah by the time we will close this year, we will be 400 plus branches on the ground and our objective is to make sure that we take banking to the last mile. While we do that, we are very aware and mindful of the fact, that collaborations are the key for us to take the digital part of our services to the last mile that’s where people like AMA, VRG, our friends, last five or six years, I’m very proud to say that we were the first bank that signed up with you guys about five or six years ago. This is a partnership that goes way back as well, so our handshakes with partners like AMA, our handshake with partners like NADRA are what we are looking towards in order to take the physical form of banking to the last mile either through a USSD, either through an app or through any portal that allows us to service the customer better.

In terms of collaboration, we are very clear that everybody cannot do everything. Pakistan is at a stage where the digital ecosystem is slowly coming to life, and the speed unfortunately is not as fast as we would have liked to see, but what is happening now with the arrival of EMIs, digital banks, more organizations, smaller banks, microfinance bank, MFIs, the ecosystem is slowly developing. Everybody can’t do everything. The banks can only do the bank’s job.

Partners like VRG can only do their part, we need more and more people to come in to help us develop that ecosystem, the railroads that are needed to take the digital banking services to the next level, and I am particularly very happy that we are standing at a phase in Pakistan’s life, at a very interesting place, where more and more partners are coming in, AMA being one and we are proud that we are now seeing more of our customers using this particular channel even when we are a branchless banking license holder. This is working out very well for us and for our customers. Also Chairman – NADRA has just left, I think one thing that I want to convey to him particularly is that it will be such a win for everyone if organizations like NADRA actually let the walls down and allow something similar to issuing a bank account against every CNIC. We’ve been talking about it as a bank and if every single child born in Pakistan who is issued a B form or a CNIC, gets a bank account as a default setting. The thought and the worry of financial inclusion will just disappear from Pakistan, so maybe that is something that you and me need to do once we are back in Islamabad and we hope that more and more receptive people and partners will come forward and help us design the ecosystem in a way that will move Pakistan forward.

In the end, I would just say we will be talking more about these issues and the things that we’re doing going forward. Collaboration is all that we focus on, and as a bank, as U Microfinance Bank, UBank, the figital way of life is what has done beautifully for us and for our customers and we will go digital as a nation in maybe five to seven years. But that road needs to be taken one step at a time, with a lot many partners walking with us slow and steady and having faith that we’ll get there. Pakistan is at a very interesting place and I am very excited to see Pakistan transform into a fully digital economy inshaAllah in next five to eight years’ time, that is my optimistic view. Thank you very much!

Salman Ali, CEO – VRG: Let me give you some brief about what the Chairman NADRA is talking about. Assan Mobile Account and how UBank is also doing their part but what other banks are doing and what we are actually planning to do, but not only this, what we have done up till now, but to start with, let me give you a very quick brief for what VRG is. VRG was founded nearly nine years back and with the vision that we have to remain focused towards financial inclusion and women empowerment, but more towards women financial empowerment, but to build these things and these concepts to be implemented, two things need to be done. First, build the rails and the payment economical, low, cost effective and these rails need to be built through a proper channel and by acquiring certain licenses. If you want to include people in the financial network, you have to give them access channels which Ambreen was talking about so being VRG, how we can do it.

First of all, we acquire a license for PSO/PSP, a license issued by the State Bank of Pakistan. By the virtue of this, we are now a payment gateway and the second channel is how people will access us, so my few comments may offend some people over here but making fancy fancy web apps, doesn’t serve the purpose. You need to study well about the country dynamics. The people who are actually in Pakistan and developing countries, they don’t have the access to the internet. Country like Pakistan which has a 194.6 million subscribers of Telecom, 41% are using smartphone, 59% are using feature phones and they are the real masses who need to be included. How you can do that? By giving them a mobile app? They can’t use it. They don’t have the access to internet, so you need to give them certain technological solution, a technological channel, through which they can access your platform and then they can acquire the services.

Again, as Ambreen said make them available to you, so that they can have a bank account, and then you can digitize them, and this is the same thing which VRG has done. By covering this, we are the only company in Pakistan who have two licenses that is PSO/PSP and TPSP – Third Party Service Provider. It means that 196.4 million subscribers are live on our platform. This is a huge number which has never been done in Pakistan, so let me start with something, we have created a platform. What I am talking about is by having a complete aggregation of the banks and by having a complete aggregation of the all-Telecom operators in Pakistan, we have introduced a model which is called a many-to-many interoperable model. By using this, any person in Pakistan having us any SIM issued by any Telecom operator can access any bank and open a bank account within a minute by using a USSD technology through which the person doesn’t require any smartphone or internet. Without internet or without smartphone, you are now able to open a bank account on a real-time manner. It’s a homegrown technology/platform being developed by our own people, Pakistani people, by our own company like iPath, but let me tell you something very crazy. In the last 14 months, we have opened seven million accounts, and again this is very important. See the stats, so these stats really make a difference. Maybe Kabeer will be very interested in seeing this especially,

Mohsin as well. These accounts have been opened, we have two functions; you can open a bank account or your existing account can be linked on the platform so that you can access this account through USSD, all in all if you see that the female account numbers with respect to the provinces. Punjab is on the top, but the main thing is Balochistan. So, from Balochistan, we have a good number of females opening bank accounts, so this is something which has never been done in Pakistan up till now. What I’m trying to project here is that this platform is now changing the destinies of Pakistanis. They now have the access channel by using a simple phone, a button phone and they can use the banking services. This service is now not only live but is being recognized by many international forums which I’ll cover later.

The female account ratio especially in Sindh, you can see this has never been done, so women are getting empowered and this platform is not only giving them a new option of using this banking channel but also giving a new platform of services which comprises of instant loan without visiting your bank account, without using any bank branch. They can get instant insurance without visiting any insurance company’s office, by sitting by the at their home they can request those services. The biggest challenge of Pakistan’s people who actually want micro loans or nano loans, one of the best banks in Pakistan, who’s giving microloans and manual loans especially like micro loans with a higher limit, is from the UBank. Those people are now having this channel available that they can use their services by using a simple phone.

I personally want to share this story that when we started this journey, most of the companies who are already doing this thing but on a one-to-one manner, they have a USSD channel and they are one bank, they came to us and said that we won’t be integrating with you. You are a competitor to us and I said no I’m actually complimenting your business. I’m giving your customers an access of multiple services which have actually been offered by other banks on this platform. Later on, they realized this and one of those guys who is right now number one in having all these accounts, they have a ratio of nearly 40% of the accounts is actually the same bank who said this to me. So, this is the real success that we are actually having all those banks with us, who were giving a very hard time in launching this service. I’m really thankful to State Bank and the Pakistan Telecommunication Authority, that they are actually working with us like a team. This process has been built now, you can open a bank account you can transfer funds, you can take statements, but what’s next? Now we are working with State Bank to expand these services from branchless banking to the commercial banks. Right now, we have 16 banks on board like the whole branchless banking industry is directly integrated with us, but now we are moving the service to 36 banks, and this notification will be shown in next two weeks, so this is something really big which is coming up for the Pakistan.

Pakistan has been hit by a flood very badly. We have seen that in the past, when such situation surfaces, what happened? People get registered, they have a paperwork done, we have seen that out of those affected, many of them are not the affected, so we need a transparent system, where an affected person will directly register themselves to the system, open a bank account directly, which has been visualized. By using that data, the funds will be transferred to that account instantly. How can this be done? Through our platform. A user, an affected person, can dial a code from their feature phone, by using his credentials from the Telecom industry, from NADRA, on a real-time basis, we will get a current account opened, by using the maps, you can directly find out the location, that it is the right location, and see if he is an affected individual, his account has been opened, has been approved.

On a real-time basis, a bank like UBank, which is integrated with us and has been integrated with the National Disaster Authority, will disburse the money directly to their accounts. This system is right now live, we are in high-level talks with Sindh government on the flood affected program and our solution for account opening has already been approved, so this is something which is a role model on how this platform can work in multiple ways.

Last but not the least, I must say before ending my speech is, you need good partners. You always need good partners. You always need good clients but I must say ‘clients’ word is not good. You always need good partners. These are my partners – nearly all the banks in Pakistan, dynamic banks, they all the branchless banking industry, all the telecom operators. They are all live with me and thanks to all those partners especially UBank, who are doing some big things with us in the coming time. Because of these people, government, VRG and the financial sector, they are making an example for the world. So, this is our local recognition, but what about a recognition on the international level. In May 2021, Queen Maxima recognized our system in her speech during the World Economic Forum and in her speech, she said that, if someone wants to see the pro poor Payment Systems as those set up in Pakistan, exemplify this.

This is something which has been achieved Pakistan, by the financial institutions, by State Bank, PTA, our partners and in the last, VRG. We are right now in talking to WEF and Edison Alliance that Pakistan should be considered as a lighthouse country for the financial inclusion and women empowerment. We are very much near; we have had multiple sessions already. There are only two countries who are being declared as a lighthouse country but one is for education and one is for internet penetration but for the financial inclusion and women empowerment, we are right now very much there. We are hopeful that in a very short span of time Pakistan would be considered as a lighthouse country. Last point which I haven’t covered in my speech, and also in my presentation that being the first PSO/ PSP of Pakistan, being the first and the only TPSP licensed company in Pakistan, being the only company providing this many-to-many platform, to become the first company in Pakistan who is providing Cloud infrastructure based financial services approved by State Bank of Pakistan. Before coming to WEF we went live, three days back, so we are the only company in Pakistan, who is providing end-to-end financial services through Cloud infrastructure. So before end of this session, I would like to call upon one of the most dynamic persons in the banking industry of Pakistan, who’s really transformed a bank with a portfolio of only 2 billion to 200 billion, and doing so much especially in the digital sector, so ladies and gentlemen, please welcome, Kabeer Naqvi, the President of UBank.

Kabeer Naqvi President, U Microfinance Bank: I will be brief because I think a lot has been said regarding the UBank strategy, I think Ambreen, in quite a lot of detail, explained what we did, what we have been doing and what we plan on doing, so in two minutes I would just request you all to just zoom out a little. When we talk about financial inclusion or digital financial inclusion or figital financial inclusion. Why? What’s the objective? What are we trying to achieve? So in a country of 220 million people, if you look at the money supply, 9 trillion rupees – the latest estimate is, 9 trillion rupees are lying outside of a formal banking sector, and as a student of Economics, I’ve studied, I’ve heard and read that a Rupee or a Dollar outside of the sector coming into the formal sector has a multiplier effect of one is to four, so that is the kind of difference that we can make. If you can imagine with me right now, that Pakistan is sort of a bank or a financial institution and imagine it as a balance sheet.

So, on your balance sheet you are missing 9 trillion rupees with which you can create high quality assets, which will give rise to productivity in the country, so as a microfinance bank what we’ve seen over the last seven years, and then in my previous life, nine years with Tameer Bank also. We had to shift the lens a little and by that I mean that when you work with the masses, when you actually go down there to the last mile and you see how things are done, that gives you perspective. And digital as Ambreen mentioned as well, is a means to an end, it’s a channel but the end objective, needs to be kept in mind, so in the Pakistani context, there is a lot that needs to be done in terms of providing brick and mortar presence. I’ll share some of the things that we are planning on doing in the physical brick and mortar space. People ask me, Kabeer, if this is 2023, in UK, banks are closing branches and we see you cutting ribbons every second day and you’re adding brick and mortar branches, what are you doing and I always invite them to come with me and go down to the last mile and see how the country’s landscape really is. Now we’ve got five digital banks coming in now. The NFCs have been given. They will also need cash in cash out rich locations. Now somebody has got to be out there where nobody else is to provide that service to the digital banks to operate as well. What we tried to do back in 2008, when the branchless banking regulations came in. We tried to use the superstore or a Kiryana store model to provide Financial Services. Now, what happened is that the ability of the Kiryana store was only so much in order to provide liquidity, so the ticket size – what we had envisioned for domestic remittances, bill payments was maybe something else, but it was determined eventually by the size of the kitty of the Kiryana store.

14 years down, 4,500 Rupees average ticket size, if you just compound the inflationary impact, the size should have increased to say 30,000 – 40,000 and the other thing that nobody talks about is, what is the business model of the 400,000 kiryana stores, that we’re all using for branchless banking. 90% – 95% of the revenue or profit is coming from their core business which is maybe selling eggs and bread. Then they have four machines lying in the same shop, and whoever is paying the highest incentive, because there’s no entry barrier and there’s no USP, it’s the same service pretty much, provided by all the players and that service is being used. Now if we are to graduate from that, we have to look for cash rich brick and mortar locations for all of us, for ourselves, our own digital products, the new digital banks, commercial banks, telecoms, whoever wants to get into financial services, they will need a reasonable cash in cash out location, and what could be better than a bank branch, so we took a brave decision, went to our shareholders in the year 2023 and asked for permission to open a hundred more full menu branches which is quite the opposite of what people are trying to do. That does not make us digital averse.

We get some flak on that also, that maybe you don’t want to go digital. Now we just say let’s not fix what’s not broken.There is a dire need for physical locations, not only for us and it will help the remaining, the rest of the digital players also. So, I leave you with this thought, 9 trillion rupees in Pakistan, out of the sector, huge opportunity, brick and mortar is going to be there. As a practitioner, I can tell you, we do 6,000 – 7,000 Miles, road miles, every quarter, I can tell you that there is a dire need of bank branches, ATM and physical location or kiosks in Pakistan, so let’s work together. As Salman also mentioned and we are going to be signing something very interesting just now and work together for financial inclusion via digital modes or through brick and mortar. Thank you very much.

Salman Ali, CEO – VRG: I would like to invite Mr. Ikram Sehgal for few words on how we actually constructed this and how we are taking this thing forward.

Ikram Sehgal Co-Chairman, Pathfinder Group: Thank you Salman, thank you Kabeer and thank you, of course Tariq Malik is not here but one must thank him because obviously, NADRA has done tremendous work for Pakistan and in fact showed the world of what we can do outside. I think the high point for me was yesterday when Mirek Dusek said in his speech on the World Economic Forum, that we are considering Pakistan as a lighthouse country. Now having only two lighthouse countries at the moment and three in the offing to be considered in digital finance, the lighthouse country, is a great effect. After the United Nations gave an award to a company in Singapore, because they have an objective and ambition to do a billion accounts by the end of 2030, and last year they gave a company in Singapore which had just about reached a million accounts an award. We’ve done that, seven million accounts in less than a year. I’ll pick up something which Ambreen said – collaboration, we deal with a lot of banks but UBank has been a tremendous surprise and a tremendous support because the things of course I wish we had time to talk about Futafut, one of our services that we are collaborating with UBank which will really transform this thing, because something that did not occur to anybody was the small grocery store you mentioned.

Of course, a service which is known as direct assisted service, which enables you to deliver instead of going to a courier company into delivering, etc. You bring up anything, you can get that delivered. that of course, coming later in JhatSay and we’ll talk to UBank about that also. Now that is part of Futafut at the moment, but think about that grocery store. What is his biggest problem? His biggest problem is inventory.

He can only sell as much as he has got in the store, so now if you can get a loan through to him which UBank is working through, he will never have a problem of inventory. He will always have that store, that you will have, available to sell, so he really is contributing to the economy. The more that he can sell out of the stores – the more useful. This will not go away in Pakistan soon, somebody tried that, I’m not going to name the company, they are having huge warehouses out-imagining Amazon and they went bankrupt, right? Having thrown 700 million dollars down the drain in two years’ time, right, because they went bankrupt, and so I think that is a good example that you cannot do that. You have to have what I call, the virtual Amazon. You don’t have to have big warehouses; you have to have a virtual Amazon and that is the grocery store. The small grocery store, these are virtual amazons. If he maintains the stores, we deliver them, because of the loans provided by UBank. So, thank you very much everybody, and I’m going to request Zarrar to say something but because you know, really, we as a family invested a lot in this. We’ve invested in this particular dream of ours and it is really satisfying that it is now being recognized and one hopes that one day, it will be recognized in Pakistan also.

Zarrar Sehgal Chairman, Pathfinder Group: I’ll just quickly sum up. I think most of you are probably sick of hearing my voice from yesterday but look, I wanted to thank everybody. We, I think you can tell, we’re very proud of what we’ve achieved without any outside funding. This has been all, family developed, family funded, we’ve come to Davos and I thought, Senator Sherry Rehman was very gracious yesterday in acknowledging that year after year, we come, we do this, out of our own we promote Pakistan. Ultimately, we’re mentioning VRG today, we’re mentioning i3, iPath; obviously, the Pathfinder group is there, but ultimately we’ve tried to promote Pakistan year after year and it has been a bit of a thankless exercise at times. I think part of it sometimes reflects the state of the country as well.

I think when it’s uncertain, you see that happening more but particularly in this field of digital financial inclusion, I only see positive growth for Pakistan. I think we can go, we can keep mentioning the youth dividend in Pakistan but that’s the reality, you have a large population under the age of 30 which is currently unbanked which will want to be part of the financial network, which will demand to be part of the financial network, simply because, there will be things that they need as a basic necessity, whether it’s automobiles, whether it’s their desire to own a house or piece of land, I think that will all come through all of these applications and payment systems. I think Asaan Mobile Account will be one of those leading platforms that will see Pakistan into the future. I see an opportunity for Asaan Mobile Account, VRG, UBank. I think these things to be really tenfold, in the next three to five years and that may be a conservative estimate from where I sit, so thank you again.

I thank everybody for joining us and obviously I thank all our esteemed guests. I know the Chairman – NADRA had to leave but obviously thanks to him as well, I think people are dealing with snowy roads for the first time in Switzerland, as I understand it. I don’t think it’s ever snowed in Switzerland before so the way people are reacting but thanks to him.

I know it was a difficult journey for him to make it but I appreciate it, thank you again to all of family members who are here and thank you for all your hard work. I know he’s my father but I can’t stop mentioning it. It’s a tireless exercise and hopefully get some rest starting tomorrow, thank you.