The Investment in Pakistan Lunch was hosted by the Pathfinder Group, during the World Economic Forum Annual Meeting, held on 22nd January 2025 in Davos. The event was moderated by the Chairman of Pathfinder Group, Zarrar Sehgal.

Zarrar Sehgal, Moderator

Welcome to all our guests, especially our distinguished and honourable guest, Senator Muhammad Aurangzeb, Federal Minister for Finance and Revenue. Thank you very much for coming. We will start with the national anthem. Thank you. As you know, we’ve been doing this for over two decades and are much honoured to have Olivier Schwab over here from the World Economic Forum (WEF). The WEF has been a consistent partner, both for the Pathfinder group and also for Pakistan as well. Olivier serves as a Managing Director at the World Economic Forum and a particular note for me is that he’s always been the head of the technological innovations that the WEF has been pushing. So thank you very much Olivier for joining and I’d like to start with you.

Olivier Schwab Managing Director, World Economic Forum

Thank you, Zarrar for inviting me to the Investment in Pakistan Lunch. In the name of the World Economic Forum and the managing board that I represent, a warm welcome to Davos, although many of us have been in Davos for a few days already. We’re so grateful to the Pathfinder Group for a long-standing partnership with the WEF stretching for over 30 years. Thank you, Ikram and Zarrar for your long-standing commitment. When you first start ed coming to Davos, I was a student driving around in a Limousine in the early 90s, so a lot of time has passed since. We also have the privilege to have in Davos, the honourable Finance Minister of Pakistan, Mr Aurangzeb.

Thank you for joining us and for engaging with our program. While I have the stage, I also want to recognize the contribution of the Prime Minister of Pakistan, Shahbaz Sharif, at our World Economic Forum special meeting in Saudi Arabia, which we had last year in April, where he delivered the closing address, and we would love to build on his engagement and your engagement here, to continue our relationship with Pakistan.

As you know, we strive to build and promote Public-Private partnerships and we bring together leaders from business, government, academia, and civil society for over 50 years here in Davos. The theme of the annual meeting this year is ‘Collaboration for the Intelligent Age.’ And we need collaboration because of geopolitics, climate change, and technology. These are some of the big themes that are being discussed this year here in Davos. Intelligent Age refers to the notion that we have all these technologies now converging from AI to sensors to synthetic biology to Quantum Computing, converging and evolving exponentially. And that creates tremendous opportunities for medical research, climate change, energy, and also for education. But of course, we want to make sure that the development and deployment of these technologies benefit society and all humanity as a whole, and that is really at the core of the conversations here in Davos.

We’re currently running over 150 initiatives, spanning all of the issues that I mentioned, with our partners to drive impact at a global scale. One of the flagship initiatives I’d like to highlight here is the Edison Alliance. This is a collaboration to foster digital inclusion which has already achieved its objective to connect 1 billion people to essential services like healthcare, education and finance to digital platforms and the Pathfinder group has been one of the leaders in this initiative. Also, with its project, the Asaan Mobile Account (AMA) scheme, which provides financial access to the impoverished and vulnerable communities in Pakistan and has catalyzed financial inclusion in Pakistan.

I understand this scheme has already closed on 12 million accounts in a very few years, so congratulations on that. It’s a demonstration of our multi-stakeholder approach to working between industries, to working with regulators and we’re grateful to Ikram and your engagement and the Pathfinder Group’s engagement over so many years. I wish you a wonderful continuation of your stay here in Davos. Thank you very much.

Zarrar Sehgal, Moderator

Thank you for those kind words Olivier, we value our partnership with the WEF, and thank you for promoting Pakistan as well. I’d like to give our chief guest the next opportunity to speak. Senator Muhammad Aurangzeb, current Minister of Finance and Revenue for Pakistan. Previously he’s held notable positions as CEO and President of Habib Bank and he has also held senior positions in the banking industry for many years. He has the unenviable task of negotiating with the IMF and coming up with a package that uses not just the IMF but more importantly various Pakistani stakeholders, so no matter what you do, we will always criticize you but here we are, in support and we wish you the best and now you have the forum.

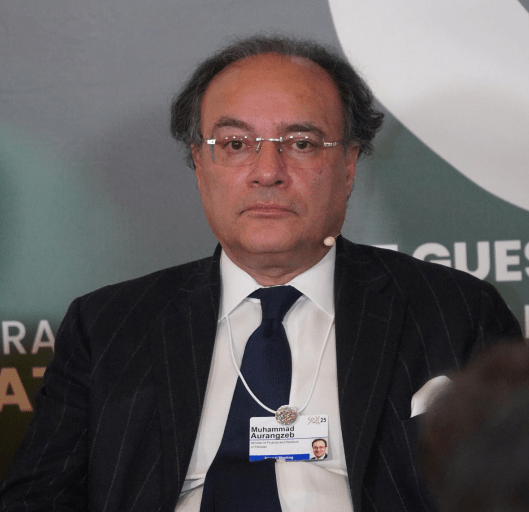

Senator Muhammad Aurangzeb Finance Minister of Pakistan

Thank you Zarrar, and thank you, Ikram Sahab. Greatly appreciate Pathfinder Group’s invite and it’s a real pleasure to be here this afternoon. I think I’ll keep it brief and short. I probably want to mention two or three things. The first is, that over the last 12 to 14 months, we have moved and made significant progress in terms of macroeconomic stability. It’s evidenced by various matrices which you have all seen where we saw the FX reserves, which had dipped down to two weeks of import cover, they are a little over two months of import cover. We have a stable currency and we have gotten to a situation concerning the trend deficits which have been the bane of our country for the longest time.

After a very long time, we have a primary balance on the fiscal side and the current account has been positive over the last five months. It’s on the back of very strong remittance flows and also the exports. The good news about exports is that we are diversifying. The number which has come in in terms of IT services in December is $384 million of IT services export, which is an all-time high for the country and boards, well in terms of how we take things forward.

The institutional flows are back, both in terms of fixed-income investors – although now given the policy coming down and the arbitrage opportunity going down, some of that is going back again – and on the equity side as well. So the stock market is at an alltime high, although much more to do over there as well. We did see some ratings upgrades in terms of the sovereign rating over the last few months. InshAllah, as we stay the course, I’m quite confident that we will move back into the single B category over the next few months, Insha Allah. Now this is all around the macroeconomic stability and I keep on saying and I know you are talking about digital tomorrow as well. This is the foundation, this is the bare minimum that any country can do to get their macro-economic stability in place.

When you have something like that, especially for foreign investors, what we can do is and what we did back in May and June is, all the stuck-up dividends and profit repatriation and admittances close to 2 a half billion dollars were paid, between May and June of last year on the back of the stability that we had, so that we could get into this year on a cleaner slate and hopefully not to be repeated.

The other thing is concerning the fund discussion. I think there are two things that we decided under Prime Minister Shahbaz Sharif’s leadership, that on the back of the 9-month SBA, right away we have to get into an extended and larger program for two reasons. One is to bring permanence into the macroeconomic stability and the other is to execute structural reforms. Now as far as these structural reforms are concerned, all of you have covered Pakistan and you’ve been looking at Pakistan for the longest time or you’ve lived in Pakistan for the longest time, we have known that why for the longest time we just didn’t do it. So, there is no rocket science, there’s nothing sort of that we have to go and look for policy prescriptions and you know it’s fine, everyone has their views and they want to give their views Countries with a tax-to-GDP ratio around 9 to 10% must increase it to double digits to join the international community and establish fiscal discipline.

On the energy side, affordable energy, renewable energy, SVs, the kind of drag these SVs have had on our exchequer for years and years together, and our privatization, Qasim is sitting here, I always admired him for the public-private partnership and the leadership he has taken in the government of Sindh, we should learn from that discussion and what they have done and put it in practice in Sindh, for the rest of the country and certainly in federation.

The last thing is public finance in terms of reducing the size of the federal government. Especially after the 18th Amendment, we are still hanging on to things that are devolved subjects. There’s no reason that we have to have these Ministries. There are 43 Ministries and 400 attached departments. Then also around the pension reforms, what we’ve done is for all the civil bureaucracy colleagues as of July 1st of last year, we have said that anyone who’s a new joiner will be on defined contribution. So we still have to deal with the stock and the stock is a very large number, but at least we have stopped the bleeding and it wasn’t easy. These attempts have been made previously.

I’ve said in several forums that Dr Ishrat, during the PTI Administration, did a fantastic job. I picked up their report and it went into a lot of detail and was presented in the cabinet in June or July of 2019, but it never saw the light of the day because when you are trying to go for a bigbang approach, at times it doesn’t work and it didn’t work. So what we are now doing is taking it sort of bite size. We are taking five Ministries at a time, looking at the attached departments, making decisions, taking into the cabinet, taking to the PM, getting decisions, and then looking at their implementation. So we are now at sort of a wave four, 15 Ministries are already done. Some Ministries will be abolished, others merged, and certain departments eliminated, leading to the removal of 150,000 federal government vacancies. These changes have been announced and will be addressed by June as part of our structural reforms.

The last thing I want to mention is a kind of roadmap back to the market. If this is intended to be the last fund program, there must be a clear framework around it because, during the stabilization phase, the first temptation is to shift focus to growth immediately. We have seen this happen in the recent past as well. Historically, whenever our GDP growth touches 4%, being an import-led and dependent economy, we quickly face a balance of payments problem. Once we face a balance of payments problem, we end up running back to the lender of last resort. We have seen these cycles repeat time and again. What we need to do is fundamentally change the structure of the economy to make it export-led. Regarding FDI, as you all know, we deeply value all the investments that have come in and appreciate all foreign investors. Veon is here, and we had a very good discussion yesterday, along with other investments such as BYD and Aramco over the last five to six months. However, we need to shift towards efficiency-led FDI rather than market-led FDI. Of course, we are a country of 240 million people, with a significant middle class, but every FDI must include a component of producing exportable surplus; otherwise, we will remain in this situation.

Lastly, there is the matter of accessing international capital markets. As I mentioned, once we reach a single B rating, we often turn to Eurobonds and Sukuk. However, we are now making a sincere effort to tap into Chinese capital markets for the first time through the inaugural Panda bond issue, following the Egyptian model. This represents a step toward returning to the market. The homegrown economic plan was outlined by the Prime Minister on December 31. What makes it different this time is that it is backed by sectoral plans. This is not just a broad discussion about numbers like 10,000 or 15,000; there are detailed, bottom-up plans from various ministries that are now entering the execution phase. I’ll stop here to give the other speakers a chance.

Zarrar Sehgal, Moderator

Thank you very much, Minister, for those words and we’ll have a question-answer session at the end. Next, I’d like to go to Michael Kugelman. Michael is the Director of the South Asia Institute at the Wilson Center. A noted foreign policy expert specifically in the South Asian region. He has written and commented extensively and sometimes created controversy as well.

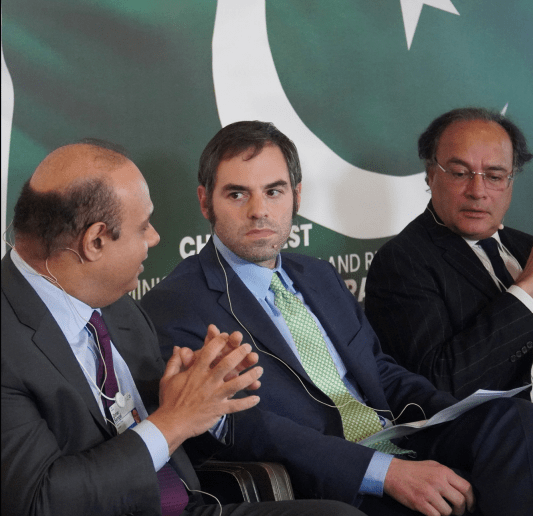

Michael Kugelman, Director Wilson Center’s South Asia Institute

Thank you very much Zarrar and I want to thank the Sehgal family and the Pathfinder group as well. It’s an honour to be here and sharing the stage with the honourable Minister and Mr Schwab. From the perspective of US-Pakistan relations which I follow closely, the question of investment is a very salient one. US investors have operated in Pakistan for quite some time in a range of spaces and there is a well-established and long-standing US Pakistan Business Council attached to the US Chamber of Commerce in Washington. Some of the biggest American companies like Coca-Cola, Procter & Gamble, and many others have invested in Pakistan for quite some time. And more broadly as many of you will know, the US has invested in Pakistani infrastructure such as dams as well as schools and hospitals over the years. Others are more qualified than me to talk about the best sectors to look at and the challenges and opportunities in each of them so I thought that I’d use my few minutes to talk about a broader issue related to today’s Pakistan.

In that regard, I’ll make a modest proposal as a friend of Pakistan and it relates to the issue of what I would describe as Pakistan’s story. Officials and business leaders often aim to attract investment from the international community by presenting pitches to foreign stakeholders about why Pakistan is a worthwhile investment destination. These pitches typically highlight factors such as Pakistan’s untapped mineral reserves, its textile industry, its large and youthful population, its emerging tech sector, and so on. However, I would argue there may be a shortcoming in this approach. If we look at the world around Pakistan—both in the region and beyond—other countries, including key targets for Pakistani investment like the West and the Gulf, are already investing heavily and with greater confidence in other Asian countries that possess similar assets. India, for example, offers mineral reserves, a significant youth bulge, and a thriving tech industry. Rapidly growing economies like Vietnam and Singapore showcase significant tech growth potential, while Bangladesh has established itself as a strong player in the textile industry. This presents a challenge for Pakistan to differentiate itself and make its case more compelling to investors.

I think that this idea of rethinking the pitch so to speak, is especially salient when it comes to the US. As you all know, we have a new Administration that just took office this week and I think that it will be a challenge at least initially to get the attention of the Trump Administration and to move the relationship forward. I would argue that pitching Pakistan as an important country because of its demographics and its strategic location, which is very true, might not get you as far as you would like with the next Administration. So what I’m saying is that Pakistan’s investment prospects might receive a boost if that pitch can be adjusted a bit so that it hones in on what truly makes Pakistan unique as an investment destination. And I think that the onus will need to be on Pakistan and its government to take the initiative and be proactive about this. I think that with macroeconomic indicators having stabilized a bit in Pakistan as the Minister was just noting, the terms of inflation coming down, foreign reserves coming down, with the new IMF support in place, perhaps now can be the time to think about how best to approach key partners, donors, investors in the United States and elsewhere.

If you look at some of the figures that came out last year from the government of Pakistan about investment, it is notable that even though we saw some stabilization of the macro-economy last year, there are indications that Pakistan’s investment ratio went down. And I believe, I’ll be corrected if I’m wrong, Pakistan’s investment ratio sunk to a 50-year low and it fell to just 133% of the size of the economy and that’s pretty significant particularly since the economy had stabilized. I’m probably the last person that the government of Pakistan should listen to, but I do think that as we look at how the world operates today, we look at how Washington operates today. As we look at Pakistan’s place in the region and in the world, I think it’s worth having some useful conversations. And it’s not my place to be saying what should be at the forefront of those conversations and what should be Pakistan’s story, what can it offer to the world. There’s much that it can offer, I’m sure. But now might be a useful time to think more about that. Thank you.

Zarrar Sehgal, Moderator

Thank you Michael I was going to ask you about the Trump Administration but I think you’ve answered that very well. I think the one thing the Finance Minister didn’t talk about was that the government’s done extraordinarily well in setting up these special technology zones. And I think these will be a game changer because you have a liberalized investment climate there, you have tax exemptions both on custom duties and tax breaks when it comes to dividends and so forth. And I think that really will boost what I believe is going to be the next stage of growth. We are much honoured to have Abu Bakar, Chairman of the Pakistan Software Export Board. He’s been a noted CIO of many companies in America as well and comes with a vast background. We’re delighted that he has taken over the Chairmanship of this very important institution. So, Abu Bakar please if you’d like to go ahead.

Abu Bakar, CEO Pakistan Software Export Board

Thank you, Ikram Sahab and Zarrar for inviting me over, and thank you everyone for attending this event here. It’s an honour to be here. If I can share just a little bit of my background so that people can have a context of it. I joined the Pakistan Software Export Board three months ago as a Chairman or a CEO, but before that, I was in the US for 30 years. I worked in Venture Cap for private equity as well as more Tech space for the last 30 years. I was always on the other side when I was getting work done, delivering the work, or presenting the work, so I understood some of these opportunities as well as the challenges that were there.

That puts me in a position where I feel strongly that the opportunities we have are far greater than the challenges we face. I’ve always felt that, at some point, I would take the plunge and do something about it. That moment came three months ago when I decided to act. Let me share a bit of the story about where we are now, I think Mr Aurangzeb has already elaborated extensively on the overall macro indicators. I’m not going to go into that. But very specifically, if you look into the tech sector or the IT sector or just general in the digital sector, things have been progressing well. But I think we have a tremendous opportunity. I think we have barely tipped the surface of it, although we’re growing probably as one of the fastest sectors. Even this year, we have been growing 28% on the exports in the first six months and we’re going to continue to accelerate that.

After my first three months here, I’ve made a few observations. I understand the potential and the existing infrastructure, as well as some of the challenges that come with it. Yet, despite these challenges, our resilience and commitment stand out. One of the most heartwarming things I’ve observed is the strong alignment across all levels of the Finance Ministry. From the Prime Minister down to every sector, there is a shared understanding and focus: this is the sector we must continue to prioritize, invest in, and drive forward. Notably, we are the only sector with the largest trade surplus in the country, and we remain committed to building on that success. I’m someone from the private sector, and transitioning into the public sector has been a tremendous learning experience. However, one thing that has been relatively easy for me is recognizing what needs to be done. I’ve noticed there is no shortage of studies, ideas, or plans about what we can and should do. The real issue has been execution. At times, we’ve had grand visions, but without a concrete implementation plan, proper execution, and the right people in the right roles to make it happen, progress becomes incredibly difficult. This leads to repeated cycles, eroding credibility both domestically and internationally. For those outside the country looking in, as well as for people within, it often feels like they’ve heard this story before – grand plans with little follow–through. However, having spent three months on the inside – don’t just take my word for it – I can confidently say that there is no shortage of commitment across the board. The focus now must be on execution to truly turn these plans into reality and rebuild trust.

Just yesterday, we met with various Ministries to discuss how we can improve the ease of doing business and address the infrastructure challenges we face, involving the Finance Ministry, the State Bank, FBR, and others. We were all present, and while everyone expressed a desire to make progress, no one was willing to commit. We then presented our sectoral plans to the Prime Minister, and within two hours, he expressed strong alignment with our approach. He made it clear that this is exactly what he wants to do and how he wants to do it. He also ensured that we submit a monthly report on our progress, which is rare. I don’t think any Prime Minister would ask for an IT report every 30 days, but our Prime Minister does because he’s deeply passionate about it and sees many opportunities ahead. I’ll stop here, as I know you’ll have follow-up questions. Thank you.

Zarrar Sehgal, Moderator

Thank you very much, Abu Bakar, and we wish you the best of luck. I know people often shy away from discussing potential, but if you look at Pakistan’s existing landscape, there is much to be proud of. For example, the Pathfinder group (VRG) has created a homemade switch, developed entirely by Pakistanis using Pakistani software – nothing was imported. This is a matter of pride, showing that these innovations are being created within Pakistan by Pakistanis. And it’s not just the special technology zones; it’s also the 50 software parks that have been established in Pakistan by this government and the previous one. Additionally, we are one of the top five English-speaking countries, which is another advantage. While our geopolitical location is often seen as a challenge, with unstable borders, it also presents significant benefits. We are the gateway to Central Asia, Europe, and potentially Africa as well. These elements position Pakistan for great success. Thank you to all our speakers. I will now open the floor for the question-and-answer session.

Question & Answer Session

Question: My name is Kabool Khatian, and I am the Chairman of the Sindh Irrigation and Drainage Authority. Additionally, I am a member of the Sindh Investment Board and one of the directors accompanying the minister today. The question everyone asks us here is: many people come to Karachi from London, the USA, and other places – doctors, friends, and others – who are interested in investing in Karachi. However, they have two main concerns: When they invest in Karachi or Pakistan and earn money, they worry about currency devaluation. They say there should be a mechanism to fix the exchange rate for at least five or ten years so they can plan their exit without losses caused by devaluation. When they make a profit, they often face challenges in repatriating that profit to their home countries.

Senator Muhammad Aurangzeb Finance Minister of Pakistan

I understand that whether it’s local or foreign investors, the key thing they are looking for is a stable policy framework, and even more importantly, policy continuity. That’s what we need to deliver. While you’re focusing on one aspect – FX and currency – which is important, the real issue for us is that successive administrations have failed to follow through, and this lack of consistency is what we need to address. As far as the currency is concerned, it must be determined by supply and demand and follow a market-based exchange rate. We cannot predict where the currency will be in the next five to six years.

What we can do, however, is ensure permanent macroeconomic stability. If existing investors cannot repatriate their money due to boom-and-bust cycles that creates a significant problem. As a banker, I can tell you that during the ‘essential-non-essential’ regime, people couldn’t bring in the materials necessary to keep operations running. Once letters of credit came back, contracts started moving again. I’ve been very transparent about this; in May and June, we cleared the entire backlog. When you mentioned the Ameri can Business Council, the Overseas Chamber, and others, what we need to focus on right now is ensuring that this situation does not happen again. That’s our primary goal. Interest rates will fluctuate, and the currency will go up and down, as they always do. We know that very savvy investors are here, and that’s where political risk and hedging mechanisms come into play. But the key thing we must ensure is that we do not fall back into these boom-andbust cycles. I do understand the pain that people have felt, and we must begin with acknowledgement. If we say everything is fine when it’s not, we’re missing the point. People had to wait for their repatriations for two years. Having worked for global banks for most of my career, I know how risk managers operate, and I also know how generous head offices can be. Therefore, we must make sure we don’t find ourselves in this situation again.

Question: My name is Anjum, and I’m a Swiss-Pakistani national. I have a request. Mr Ikram Sehgal has dedicated his entire life to serving Pakistan. Why is the government of Pakistan not properly supporting him and giving these events the recognition they deserve? No matter who comes or goes, he has been here, working tirelessly throughout my life. I believe we should sponsor him in a way that reflects his significance to Pakistan – because to me, he is Pakistan.

You are a Minister today, but you may not be tomorrow. We’ve seen Prime Ministers and Presidents come and go, but there is still no government-level acknowledgement where we can reach out and gain support or information. As a banker, you understand the importance of connecting with clients. Right now, the best individuals in Switzerland representing Pakistan are Ikram Sehgal and Zarrar Sehgal. Please make sure they are well-supported.

Senator Muhammad Aurangzeb Finance Minister of Pakistan

The only thing I would say is that I’m not sure if there’s a question here, but if it’s a statement, I fully agree with it. Number one. And number two, let me be very clear:

As far as I’m concerned, the private sector has to lead, period. The government has no business being in business. The private sector must take the lead, and wherever the private sector has led, that’s where the most progress has been made. Now, regarding individuals, they must be acknowledged. I fully agree that we should recognize Ikram Sehgal in a significant way.

Ikram Sehgal, Co-Chairman Pathfinder Group

Thank you very much for your comments. I would just like to repeat something that the former Prime Minister of Pakistan said a few years ago. He said, ‘Let it be in the private sector because if the government gets involved, even this will not happen.’

Question: My question is regarding India. Is the government open to exploring trade agreements with India, to benefit from its large economy and vast market? Thank you.

Senator Muhammad Aurangzeb Finance Minister of Pakistan

I think at this point, quite frankly, we should just ensure that common sense prevails, and we can continue to have cross-border trade across all regions. That’s what we need to focus on. Of course, in any country, trade with neighbours is the obvious thing to do. But it has to start somewhere. We are very clear about what we’re doing with the Middle East and the Central Asian states. That’s a huge corridor for us now as we move forward. So, yeah, I’m sure the time will come.

Ikram Sehgal Co-Chairman, Pathfinder Group

Thank you, Minister, thank you for being here we’re very grateful and we heard a lot of people say a lot of good things. I’m very grateful. A lot of work has happened with the Edison Alliance and the Asaan Mobile Account has been because of the support the World Economic Forum has given us. And the only thing I will say is that we are recognized in the world not just in Pakistan.

Senator Muhammad Aurangzeb

I know sir, there’s a discussion on the digital side tomorrow. I do think that the work that you have done in terms of the Asaan Mobile Account, and the payment rails that have now been created vis-à-vis Raast, are all such key enablers in terms of financial inclusion. And of course, the Veon and Jazz team is sitting here, the sky is the limit for us.

Ikram Sehgal: Yes but what happens is, everybody takes into consideration their self-interest even though Jazz helped us a lot of time when we launched the Asaan Mobile Account. When it came to agents and interoperability, they put their foot down while we were waiting for Habib Connect and Easypaisa. But hopefully, they will look after the interest of Pakistan also not only in their interest. Thank you very much.