The Asaan Mobile Account (AMA) scheme is a groundbreaking initiative that allows individuals to open a bank account using their mobile phone, without internet connectivity. It is launched by the State Bank of Pakistan (SBP) in collaboration with the Pakistan Telecommunication Authority (PTA) and Virtual Remittance Gateway (VRG). The AMA platform has been launched under the National Financial Inclusion Strategy (NFIS) and it aims to facilitate the general masses, especially the low-income segments, to digitally open their BB accounts and use the available financial services in a swift, easy and affordable manner. It is designed to allow individuals an easy gateway to mobile payments in Pakistan. This innovative scheme aims to increase financial inclusion among the unbanked population, particularly women, low-income segments, and those living in remote areas.

Cashless Bill Payment – A step towards digitization of the economy

In a country with a population of 242.8 million, there are 192.3 million mobile phone subscribers. Notably, 98% of these subscribers are prepaid customers, with the remaining 2% being postpaid subscribers. Postpaid customers have multiple payment options available, including cash, online bank payments, mobile wallet accounts, and over-the-counter (OTC) payments. They can also use Asaan Mobile (AMA) Accounts. Prepaid customers primarily use cash at retail agents or their wallet or AMA accounts for airtime topup and other services. AMA will increase financial inclusion in Pakistan by shifting from cash-based to digital payments for bills and mobile recharges.

The SBP should promote digital bill payments through banks and the AMA account. The PTA should mandate digital payments for telecom services and work with energy regulators to enforce digital payments for utilities. The PTA has the following options: (1) NEPRA may request that all utility providers, including all electricity companies (IESCO, LESCO, KE, etc.); and (2) OGRA may discontinue accepting cash payments for bills and mandate that major gas companies (SNGPL, SSGC) only accept payments via bank accounts, online payment methods, and digital payment accounts, including AMA exclusively.

The government will get the additional benefit of documentation of the economy, it can accelerate financial inclusion, improve economic transparency, and increase tax revenue. Citizens will enjoy greater convenience, cost savings, and access to a wider range of financial services.

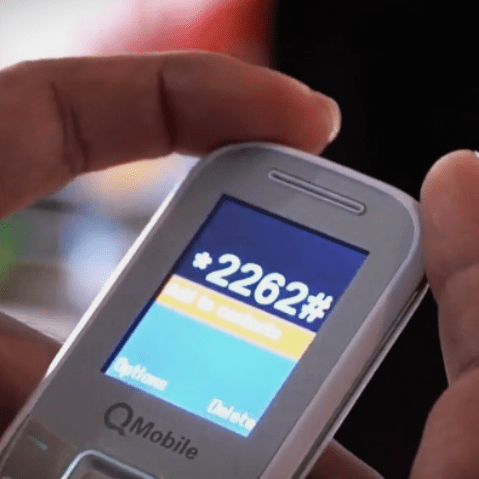

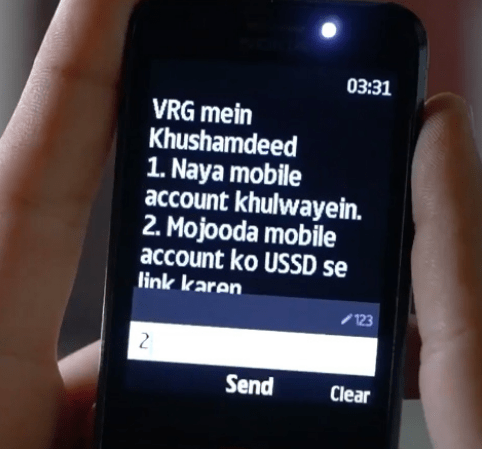

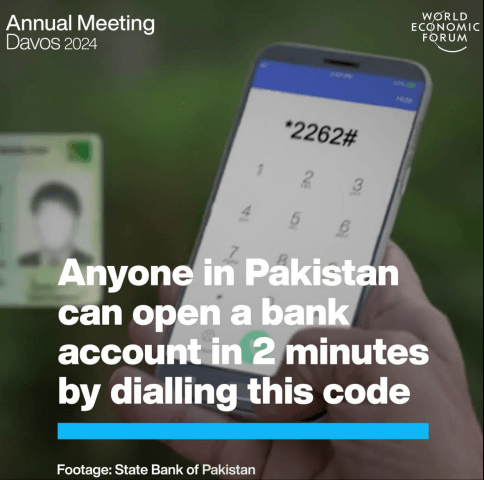

Individuals who lack an account or find it difficult or inconvenient to open an account through banking channels can open an AMA account in the Bank of their choice without physically visiting the bank. AMA users can open an account in under two minutes by dialling *2262# and providing their CNIC credentials. The account can be accessed and operated remotely using a simple mobile phone. The program utilizes USSD technology, which is perfect for linking customers in remote areas with financial institutions.

At present, there are 13 Branchless Banking (BB) provider banks accessible on the AMA platform. Customers can instantly open bank accounts with any of the listed banks and carry out transactions available on the AMA Platform. It has already attracted millions of unbanked people due to its simple requirements i.e. CNIC and a valid mobile number. It offers convenient services including utility bill payments, mobile recharges, and postpaid mobile bill settlements. Customers can also deposit or withdraw cash at designated branches and agent locations after biometric verification. To check account details, users can simply dial *2262# and select the statement option.

The path of digital payments is through AMA accounts and other digital payment options creating an ecosystem for accelerating Pakistan’s digital journey, with several benefits for the people of Pakistan as well as for the Government. The key benefits include:

• Financial inclusion will be achieved through an increased number of AMA accounts.

• Real-time data will be available and digitalization will increase.

• Economy will be documented.

• Customers can save money and have convenience.

• Revenues for FBR will be streamlined and increased.

• Transactional security will be enhanced.

The AMA Mobile Application

The development of the AMA Mobile App, a cutting-edge application designed to enhance the user experience and expand accessibility is another milestone. This revolutionary platform will provide users with the ability to effortlessly oversee their accounts and carry out transactions with unparalleled convenience. Recognizing the diverse linguistic needs of our customers, the AMA Mobile App will be available in both English and Roman Urdu, ensuring seamless interaction for everyone. The AMA Mobile app will bring several advantages, including convenience, ease of use, and increased accessibility. Users can access their accounts and perform transactions remotely with their basic mobile phones. The application is designed to be user-friendly, making it easy for individuals with limited digital literacy to use.

AMA App In Roman Urdu

Roman Urdu, the practice of writing the Urdu language using the English alphabet, holds significant importance in South Asia. Urdu is Pakistan’s national language and is widely spoken across five regions in South Asia. Despite the similarities in spoken Urdu and Hindi, their scripts differ, making Roman Urdu a preferred choice for communication on social media platforms across South Asia, including in Pakistan and India. Many people find it difficult to write in Urdu subscripts due to a lack of formal education or familiarity with digital Urdu keyboards.

Mostly, mobile apps are only available in English, which poses a challenge for the underprivileged segments of Pakistan. Moreover, literate individuals find it more convenient to communicate in Urdu. Pathfinder Group has initiated a remarkable solution for banking the unbanked poor people by developing the Asaan Mobile Account (AMA) app in Roman Urdu. This initiative will further increase its outreach and millions of Pakistanis will engage with digital financial services, especially among rural populations.

This will enable individuals who are not familiar with English to navigate the application and understand its features and benefits easily. Also, the AMA mobile application will provide a secure and reliable platform for individuals to manage their finances, make payments, and transfer money.

After success in Pakistan, the app can be adapted for other South Asian countries where similar challenges exist. Countries like India, Bangladesh, and Nepal have large populations familiar with Roman script but not necessarily with their respective native scripts. Roman Urdu can serve as a linguistic bridge across the South Asian region, enabling cross-border financial services and transactions, particularly in areas with shared cultural and linguistic ties.

Roman Urdu is widely understood and used by many Pakistanis, especially in rural areas, making it an effective medium. Roman Urdu helps to simplify complex financial concepts, making it easier for users to understand the benefits and features of the AMA scheme. Overall, the use of Roman Urdu in promoting the AMA scheme helped to increase its adoption rate and promote financial inclusion among the unbanked population.

AMA At The World Economic Forum

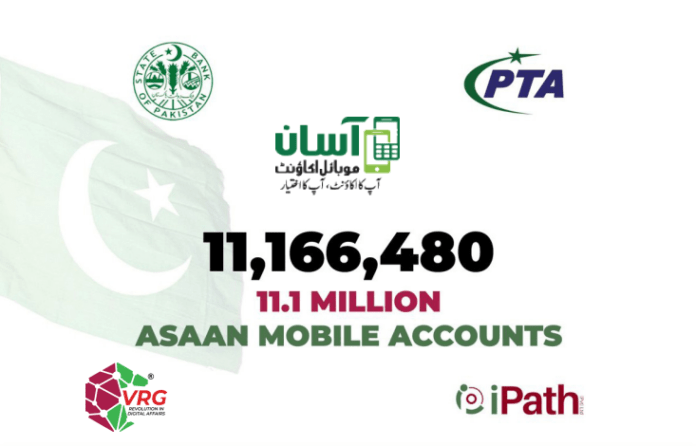

The World Economic Forum’s Edison Alliance applauded the AMA platform as a milestone in decreasing Pakistan’s financial gap. They declared the platform as a key component of Pakistan’s commitment to the World Economic Forum’s EDISON Alliance, providing a dedicated effort to bridge the digital divide in financial services. Since its launch, AMA has seen significant success, with over 11 million new accounts opened, and a notable 32% female users.

This achievement will undoubtedly revolutionize digital payments in Pakistan. To further enhance AMA’s outreach and impact, it is recommended to prioritize expanding agent networks in underserved areas, integrating advanced biometric security features, and developing innovative financial products tailored to specific customer segments. By focusing on these areas, AMA can solidify its position as a leading digital financial platform and contribute even more effectively to the nation’s economic growth. It is the right time to collaborate with local influencers and community leaders to advocate for financial literacy and expand partnerships with telecom providers to reach remote areas, which will ensure that AMA continues to drive financial inclusion effectively.

AMA offers a range of benefits, including the ability to receive and transfer cash, pay bills, make online purchases, and access digital financial services. The scheme also provides interoperability among payment schemes and services, tackling the last mile problem and promoting financial inclusion.

According to a report by the United Nations (UN), income inequality has widened the gap between the rich and poor in most of the world. The world’s 70% population is living in countries where inequality is growing. Economic inequality is bad for several reasons and the search for solutions is real. Many economists suggest financial inclusion as a remedy, the European Journal of Finance studied income inequality in 140 countries and found that financial inclusion reduces inequality at all quantiles of the inequality distribution. The Singapore Economic Review published a study which discovered that financial inclusion was the key to tackling income inequality.

The efforts of Pathfinder Group in this regard are applaudable and a lesson for other corporations. The AMA mobile application, operating in Roman Urdu, is expected to capture a larger target audience to open accounts due to its accessibility, simplicity, security, and range of financial services.

The benefits of the application will promote financial inclusion, and improve the overall economic well-being of individuals and communities.