“O you who believe! Be careful of (your duty to) Allah and relinquish what remains (due) from Riba (usury), if you are believers. (2:278)

But if you do (it) not, then be apprised of war from Allah and His Apostle; and if you desist, repent, then you shall have your capital; neither shall you oppress nor shall you be pressed” (Quran 2;279)

Executive Summary

Every citizen is concerned about the current state of Pakistan’s economy, which is being adversely affected by the skyrocketing electricity rates and the ever-swelling circular debt, which has reached nearly Rs.5 trillion. This predicament casts a looming shadow over both the domestic and national economy, necessitating a holistic solution. It is surprising that governmental initiatives to address this pressing issue appear lacking.[1]

However, an alternative approach grounded in Islamic principles, as delineated in the Quran and Sunnah, presents a potential pathway forward. At the heart of this alternative perspective lies the prohibition of Riba, or usury, a fundamental Islamic principle deeply embedded in the Quran.

This principle emphasizes the significance of fairness and honesty in all financial transactions. While ‘Riba al-Qard’ (usury in loans) receives considerable attention, ‘Riba al-Buyu’ (usury in sales) often goes overlooked. Simultaneously, the concept of ‘Gharar,’ denoting uncertainty and deception in Islamic finance remains relatively unfamiliar to the public.

A critical examination of the prevailing practice of ‘Capacity Charges’ disbursed to Independent Power Plants (IPPs) reveals a potential violation of Islamic principles. Paying (71%) for unused electricity based solely on IPPs’ capacity raises concerns related to ‘Riba al-Buyu’ and ‘Gharar,’ both considered haraam (prohibited) in Islam. Engaging in transactions involving nonexistent or never-produced items, whether through deception (Gharar) or usury of sales (Riba al-Buyu), contradicts common sense and ethical business practices. Moreover, the Constitution of Pakistan explicitly forbids any law that contradicts the Quran and Sunnah, underscoring the necessity to align policies with Islamic principles.

To address the energy crisis in Pakistan, a collective effort involving Islamic scholars, the government, and relevant institutions is imperative. The examination of the unjust ‘Capacity Charges’ from an Islamic perspective is crucial. Recommendations include the eradication of persistent “circular debt,” renegotiation of Independent Power Plants (IPPs) contracts, fair treatment of consumers with solar systems to encourage clean energy, and the implementation of measures to prevent one-sided contracts in the future.

The call for action is rooted in a plea to adhere to Islamic principles and laws. Islamic scholars are urged to issue Fatwas (edicts) against corruption and injustice in the power sector, particularly practices involving ‘Gharar’ and Riba al-Buyu, emphasizing the need for alignment with Islamic values. The Constitution of Pakistan explicitly forbids any law that contradicts the Quran and Sunnah, underscoring the necessity to align policies with Islamic principles.

Introduction

A pressing national issue requires immediate attention: a burgeoning circular debt of approximately 5 trillion rupees affecting 240 million people, coupled with rising energy rates. Neglecting this problem puts us and future generations at risk of debt slavery, exacerbated by the absence of a government plan for resolution. The Quran and Sunnah provide a solution; take a few minutes to understand and address the issue within legal means, including the issuance of a Fatwa by scholars.

Riba (excess, usury or interest) is prohibited in Islam because the principle is that any profit sought should be through one’s own efforts and at one’s own expense, not through exploiting other people or at their expense. In Islamic finance, riba refers to the prohibition of usury or interest. However, this term is much broader and is not limited to usury or interest on lending money alone. Even the exchange of inferior dates, which weigh more, with superior quality dates that weigh less is considered riba and is prohibited as unjust enrichment and exploitation. One general principle emphasized in Islamic teachings is the concept of fairness and honesty in transactions. In order to fully understand this paper, it is important to also refer to the documents available at

(i) https://bit.ly/ElectricShocks, and (ii) https://SalaamOne.com/riba.

Quran forbids Riba & Injustice

The Quran condemns Riba in several different verses (3:130, 4:161, 30:39 and Quran;2:275-2:280):

● O you who have believed, do not consume Riba (Usury), doubled and multiplied, but fear Allah that you may be successful. (Quran;3:130)

● And [for] their taking of Riba (usury) while they had been forbidden from it, and their consuming of the people’s wealth unjustly. And we have prepared for the disbelievers among them a painful punishment. (Quran 4:161)

● And whatever you give for Riba to increase within the wealth of people will not increase with Allah. But what you give in zakah, desiring the countenance of Allah – those are the multipliers. Quran (30:39)

● Those who consume Riba cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, “Trade is [just] like Riba.” But Allah has permitted trade and has forbidden Riba. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah. But whoever returns to [dealing in Riba or Usury] – those are the companions of the Fire; they will abide eternally therein. (275) Allah destroys Riba and gives increase for charities. And Allah does not like every sinning disbeliever. (276) Indeed those who believe and do righteous deeds and establish prayer and give zakah will have their reward with their Lord, and there will be no fear concerning them, nor will they grieve. (Quran;2:275-2:277)

●”And if you do not (give it up), then take notice of war from Allah and His Messenger. And if you agree to desist then for you is the Original sum of your wealth[2]. Neither you shall commit injustice (zulm), nor injustice (zulm) would be done to you (Quran;2:279)[3], No one can change His words, and you shall not find any other source beside it.(Quran;18:27)[4] Nor shall you obey one whose heart we rendered oblivious to our message; one who pursues his own desires, and whose priorities are confused.(Quran;18:28)[5]

● Therefore, establish Balance in the society in absolute justice. And never belittle the Scale of Justice in the community and in all your transactions with your own ‘Self’ and with others (Quran;55:9)[6]

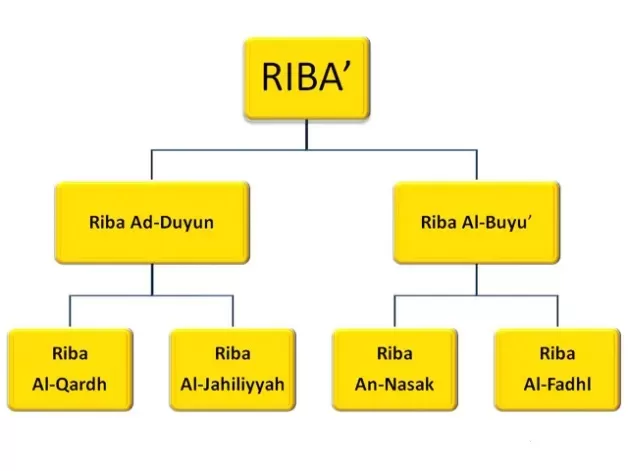

Types of Riba

There are two main forms of Riba (excess): Firstly, “Riba al-Qard” (Loan usury), which pertains to usury in loans, occurs when a lender imposes additional interest on a loan. Secondly, “Riba al-Buyu” (Usury of sales) involves usury in trade or exchange, where unjust enrichment in transactions is deemed exploitative and contrary to the principles of fairness in commerce. The objective of Riba is to ensure equitable exchanges, preventing one party from unfairly benefiting at the expense of the other. “Riba al-buyu” is sometimes referred to as riba khafi/ riba khafy.[7]

Few Examples of Riba al-Buyu'(ربا البیوع)

Here are some examples of Riba al-Buyu, which may overlap’[8]

Unequal Exchange of Goods

● If there is an exchange of goods or services, and one party receives more value than the other without a justifiable reason,(for example 71% Capacity Charges by IPPs) it may be considered Riba. Islamic finance promotes fair and equitable exchanges.[9],[10]

● Conditionality in Sales: Adding conditions to a sales contract that lead to an unjust enrichment of one party is prohibited. For example, specifying a price increase based on future events that are uncertain and unrelated to the nature of the transaction could be considered riba. The “Capacity Charges”[11] by IPPs may also fall under this category, which could be called ‘Riba Khafy’ (ربا خفي) for unapparent usury (implicit riba/ hidden riba/ disguised riba/ riba in disguise/ concealed riba).[12]

● Riba Al Fadhl (surplus riba): This type of Riba al-Buyu’ occurs when two ribawi items (gold, silver, dates, wheat, salt, and barley) are exchanged with different weights, measurements, or numbers at the same time. For example, exchanging 2 kg of dates for 3 kg of dates on December 1, at the same time, is an example of Riba Al Fadhl. Another example, the exchange of 10 kg of excellent-quality dates for 20 kg of poor quality dates.

● Riba An Nasiah (deferment riba): This type of Riba al-Buyu happens because of the deferment at the time of the exchange. The exchange of ribawi material in this scenario is equal to weights, measurements, and numbers, but both the payment of the price and the delivery are not at the same time. In other words, it is a sale transaction of a homogeneous and equal commodity and postponement of the delivery. An example: the sale of 1 kg of gold at $10,000 on a deferred basis, whether one or both counter values are deferred.

● Delaying Payments for Additional Profit: If a seller agrees to sell goods to a buyer on credit but imposes an additional charge if the payment is delayed, this is considered riba. Charging extra for time-based delays in payment is inconsistent with Islamic finance principles.

● There are many other related terminologies which can be explored at given links; Riba al-Yad, Reverse Tawarruq, Reverse Inah, Riba Ghair Mubashir, Ba’i al-Muamalah, Trade Riba, Ribawi Commodities and Riba al-Hadeeth.[13]

The underlying principle is to ensure that trade and business transactions are conducted in a manner that is fair, transparent, and does not exploit one party over another. Islamic finance seeks to promote economic justice and ethical conduct in commercial dealings. Capacity payments also carry elements of ‘Gharar’.

Gharar

Gharar is an Arabic term that refers to ‘uncertainty’, ‘ambiguity’, and ‘deceit’ within business or financial dealings in Islamic finance. It states that uncertainty or the lack of information about a financial transaction is unacceptable and ‘haram’ (prohibited). It has been described as “the sale of what is not yet present,” such as crops not yet harvested or fish not yet netted. (add unused electricity, Capacity payments to IPPs). In Islamic finance, gharar is prohibited because it runs counter to the notion of certainty and openness in business dealings. Gharar (غرر (is used to measure the legitimacy of a risky investment pertaining to short selling, gambling, the selling of goods or assets of uncertain quality.

According to Sami Al-Suwailem, “researchers in Islamic finance” do not agree on the “precise meaning” of [14]Gharar (غرر(, although there is not necessarily a significant difference between schools of Islamic jurisprudence (madhabs) in the definition of the term.

The Hanafi legal school defines Gharar (غرر) as “that whose effects are hidden,” (according to Sami Al-Suwailem).[15] According to Muhammad Akbar al-Din, scholars of the Hanafi school of jurisprudence (Islamic jurisprudence ) defined Gharar (غرر) as “something whose outcome is not determined.” Sarakhsi , an Islamic scholar of the Hanafi school, described Gharar (غرر) as “anything for which the final outcome is hidden or the risk is equally uncommon, whether it exists or not.”

Likewise, the Shafi’i legal school defined Gharar (غرر) (according to Sami Al-Suwailem) as “that hidden nature and its consequences” or “that which accepts two possibilities, with one possibility being less likely.”[16] Shafi’i jurisprudence scholars described it as “something hidden in its method and consequences.[17]

The Hanbali school defined gharar as “its consequences are unknown” or “undeliverable, whether they exist or not.”[18] Ibn Hazm al-Zahiri , the jurisprudential school, wrote, “Gharar is the situation where the buyer does not know what he bought, or the seller does not know what he sold.”[19]]

For the Islamic scholar Al-Qarafi,Gharar (غرر) is “that which has a pleasant appearance and a reprehensible essence.”[20]

Among contemporary Islamic scholars, Mustafa al-Zarqa writes that “Gharar (غرر) is the sale of potential things that do not exist or whose properties are uncertain, due to the risky nature that makes the trade similar to gambling.”[21] Sami Al-Suwailem has used game theory to try to arrive at a more precise and measurable definition of a game, describing it as a “zero-sum game with unequal returns.”[22]

How much electricity will not be used or used? It is not known. Then paying for unused electricity – “The Capacity Charges”, or to any contract that is not drawn out in clear terms.

“Gharar” discourages transactions where the terms and conditions are highly uncertain or ambiguous, potentially leading to exploitation or unfairness. Gharar is considered undesirable because it introduces an element of speculation that may harm one party and result in unjust enrichment for the other.

Islamic financial principles emphasize transparency, fairness, and avoidance of exploitation. Transactions involving gharar may be deemed unacceptable because they go against these principles. Examples of transactions with gharar include those with unclear terms, ambiguity about the subject matter, or excessive uncertainty about the outcome.

It is a peculiar contract in which one party (Government/ DISCOs) the buyer agrees to pay for something that is neither produced nor purchased. Profits to IPPs are guaranteed in advance on something that does not yet exist، how much it will be produced and used in future, it is also not yet known, a clear case of Ghrar and Riba al-Bayou.

Constitution Does not Allow Laws against Quran and Sunnah

As per the Constitution of Pakistan Islam is the state religion (Article 2), all existing laws shall be brought in conformity with the Injunctions of Islam as laid down in the Holy Quran and Sunnah (Injunctions of Islam), and no law shall be enacted which is repugnant to such Injunctions.[23]

The Federal Shariat Court (FSC) in April 2022 declared that the prohibition of Riba is the “cornerstone of the Islamic economic system”. The ruling added that “elimination of Riba from our economic system is our religious as well as our constitutional duty; hence it has to be eliminated from Pakistan ”. The FSC declared the prevailing interest-based banking system as against the Sharia and directed the government to facilitate all loans under an interest-free system.[24] It must be clear that apart from the banking system, the Riba has to be eliminated in all forms like ‘Riba al-Buyu'(ربا البیوع) and un-Islamic ‘Gharar’.

IPPs Capacity Charges

Unfortunately the total emphasis of public, media and Ulema (Islamic scholars) is towards “Riba al-Qard”, interest/ usury on money lending, while ignoring other heinous types of “Riba al-Buyu” responsible for extreme inflation and economic debacles of the public and the state. If the exchange or contract in trade involves an unfair or unequal exchange, where one party is gaining at the expense of the other in a way that is considered exploitative, it may be considered “Riba al-Buyu”.

Contracts with Independent Power Plants (IPPs) that include capacity charges, demanding payment for electricity based on the IPPs’ capacity even if the electricity is not utilized (averaging 71% of electricity bills), fall within the category of Riba.

In this scenario, if an IPP has the capacity to produce 100 Kwh but the government utilizes only 25 Kwh due to any reason ((lower demand and increased electricity production from dams, hydel and other resources during the rainy season or lower transmission capacity), the payment is still required for the full 100 Kwh, including the 75 Kwh that goes unused. This practice is unequivocally unfair, exploitative, and considered “Riba al-Buyu (Usury in trade or exchange), making it Haraam.

Load Shedding with Surplus Power?

Different figures are quoted with slight variations. Here are the average approximate figures for FY2021-22: Installed capacity: 41 GW, peak demand 28 gigawatts (GW) (surplus 13 GW), transmission capacity/infrastructure: 23 GW (41-23=18 GW surplus). Since the transmission system capacity is 23 GW, this surplus cannot be utilized, and load shedding continues. Logic and intellect demand that instead of contracting new IPPs, the Transmission infrastructure be given top priority. Contacting new IPPs in such a situation means a lethal combination of; “Corruption, Riba and Gharar”.

Indeed, the worst of living creatures in the sight of Allah are the deaf and dumb who do not use reason. (Quran 8:22)[25]

There is clearly something suspicious about this plan, as it seems to unfairly benefit the Independent Power Producers (IPPs) at the expense of the public. (This is Gharar, Riba al-Buyu, Riba Khafy.).[26] The people have placed their trust in the rulers for good governance. Rs.99 bn were paid to around hundred plants in capacity payments in Oct-Dec 2022, despite most of them operating at below 20 pc[27].

So on average around Rs.400Bn is being paid annually while using much less electricity. Even if people use less electricity or don’t use electricity, the IPPs will have to be paid according to their installed capacity and amount. Money extracted from consumers on various pretexts is like leeching the blood of its victims. It is nothing but extortion and plundering of people by the government to fulfill their corrupt deals.

Instead of paying Capacity Charges to IPPs, they could be required to generate electricity at their maximum capacity, and that electricity could be supplied to consumers at lower subsidized rates instead of paying additional money to IPPs. This approach would also uncover any fraudulent activity or deceitful agreements by IPPs that falsely claim higher capacity when the actual capacity is lower. However, authorities choose to pay additional ‘Capacity Charges’ to IPPs instead of providing relief to consumers due to their own vested interests.[28]

The capacity charges also fall in the category of “Gharar,” which discourages transactions with highly uncertain or ambiguous terms and conditions. This can potentially lead to exploitation or unfairness, harming one party (consumers) and resulting in unjust enrichment for the other (IPPs). On average, these charges amount to 71% in addition to the agreed upon profit of 15%, making a total of 86%. For example, a Rs.10,000 electric bill contains Rs.7100 as capacity charges and only Rs.2900 as the actual cost of consumed electricity (this just an example actual numbers may vary slightly). This means that, on average, a unit of electricity has a capacity charge of Rs.28, while the actual cost of a unit is Rs.12 (just a rough estimate). One can imagine the impact on inflation and the hardships faced by consumers.[29] Is this fair, just, or simply oppressive? Such practices are not acceptable even according to common sense standards and are rejected by Islam.

“… Oppress none and no one will oppress you”(Quran 2;279)

In Islamic finance, the concept of “speculative trade” is impermissible, guided by Sharia law. Islamic banking seeks to offer an alternative to conventional banking, adhering to principles such as the prohibition of usury (riba), avoiding goods like pork or alcohol, and prohibiting practices related to gambling (maisir) and excessive risk (bayu al-Gharar). Transactions involving maisir or Gharar, including margin trading, day trading, short selling, and financial derivatives, are forbidden due to their association with interest payments or speculative elements.

Forward contracts are deemed impermissible in Islamic finance as they introduce speculation and uncertainty. Predicting the exact amount of electricity produced or unused involves uncertainty (Gharar), akin to paying for a crop from fields that were never harvested. This uncertainty conflicts with the Islamic finance principle of conducting transactions based on real economic activity and tangible assets to ensure fairness, transparency, and prevent unjust enrichment.

Islamic finance discourages engaging in transactions where the buyer pays for non-existent or unknown quantities, as it goes against the principles of tangible evidence and transparency. The emphasis is on “real and tangible assets”, where buyers know what they are paying for, and sellers possess or can deliver the actual goods or services.

Incentivizing investors with payments based on capacity rather than actual electricity usage raises concerns in Islamic finance. This arrangement may be seen as offering extra profit (Riba), and the combination of Riba and Gharar in “Capacity Charges” is viewed unfavorably within Islamic financial principles.

Different Prices of Solar Electricity between IPPs and Domestic Consumers

Loss/ Exploitation and Oppression of domestic users in many ways

1. The government purchases electricity from a solar IPP at the rate of Rs.50 per unit (different prices for each IPP) but from domestic consumers who have installed rooftop Solar System (Net Metering), the rate is around Rs.22.42 per unit for extra electricity generated by them. Logic given by NEPRA is that Rs.22.42 (it was Rs.19 previously[30]) is NAPPP (National Average Power Purchase Price). The average incorporates the electricity generated cost/rates of Thermal, Hydel, Nuclear, Wind, Solar & Bagasse etc.[31]. This unfairness, injustice by applying different , lower rates to domestic users.

2. To cause further loss to consumers, the peak hours which are charged [32] @ Rs.41/unit to all, but instead of firstly adjusting them on exported units @35.57 and then charging excess peak hour @ Rs.6.32/unit [41.89-35.57=6.32], they straightway charge @ Rs.41.89 while calculating surplus exported units by consumer with netmetering @ Rs.22.42, thus causing further loss to the users.

3. These tricky practices are unfair, unjust and oppressive are also against common sense and Islamic commands being Riba al-Bayou and Gharar.

4. Why different rates (NAPPP) to the domestic users? Because they are powerless they can easily be oppressed by NEPRA (National Electric Power Regulators) and can’t do anything.

5. NEPRA may cause further loss to users by further reducing rates of all exported units @ Rs 22.42/unit (NAPPP rate) while charging consumers @35.57 or more? Or equating it with hydel power rate which is much less, around Rs.6.94/unit or for all units?[33]

6. Exploitation and oppression has no limits, no one checks them or asks. The Constitution, Quran and Sunnah are just for knowledge not action. The Quran have been abandoned.

وَقَالَ الرَّسُولُ يَا رَبِّ إِنَّ قَوْمِي اتَّخَذُوا هَٰذَا الْقُرْآنَ مَهْجُورًا ﴿٣٠﴾

And the Messenger has said, “O my Lord, indeed my people have taken this Qur’an as [a thing] abandoned.”(25:30) [34]

Such deceptive, tricky, cheating practices are not acceptable even according to common sense standards and are rejected by Islam being injustice, oppression (zulm) as Riba-al Bayu and Ghrar. It needs immediate rectification to apply similar rates, if not equal to IPPs, then at least at the rate which is charged from consumers (around Rs.35/unit presently, which keep increasing).

Government Inquiry

In July 2020, the government ordered an investigation into the Independent Power Producers (IPPs) contracts in Pakistan. A 278-page report from a government Committee[35] was submitted which outlined a number of alleged transgressions.[36] Here are some of the key findings and recommendations.

Findings:[37]

1. IPPs had been receiving excessive profits due to flawed contracts and agreements with the government.[38]

2. Many of the IPPs had overcharged the government for electricity and had been operating inefficiently, resulting in significant losses to the national exchequer.

3. The contracts were poorly negotiated and were heavily skewed in favor of the IPPs.

4. There was a lack of transparency and accountability in the procurement process for IPPs contracts.

5. The IPPs had a significant influence over the policymaking process and were able to secure favorable policies and regulations.

Recommendations

1. The government should renegotiate the contracts with the IPPs to ensure that they are fair and equitable.

2. The government should improve the transparency and accountability in the procurement process for IPPs contracts.

3. The government should establish an independent regulator for the power sector to ensure that the interests of the consumers are protected.

4. The government should take measures to improve the efficiency of the power sector, including reducing transmission and distribution losses, increasing the use of renewable energy, and improving the collection of bills from consumers.

5. The government should ensure that the policies and regulations for the power sector are based on a comprehensive and objective assessment of the sector’s needs and requirements.

The report played a key role in triggering the government’s decision to investigate the matter further and to renegotiate the contracts with the IPPs.

Action Taken

Following the release of the report, the government formed a high-level committee to investigate the matter further and to renegotiate the IPPs contracts. The committee was tasked with examining the terms of the contracts and identifying any irregularities or illegalities.

In December 2020, the government announced that it had successfully renegotiated contracts with 46 IPPs, resulting in savings of approximately $3billion for the national exchequer. The government claimed that the renegotiated contracts would help reduce the cost of electricity for consumers and improve the financial sustainability of the power sector.[39]

Under the renegotiated contracts, the government and the IPPs agreed to revise terms for the purchase of electricity, which included a reduction in the capacity payments and a shift to a variable cost-based pricing model. The government had hoped that these changes would help reduce the cost of electricity for consumers and improve the financial sustainability of the power sector.

Problems

However, the renegotiated contracts were not without controversy, and some of the IPPs challenged the government’s decision in court. In February 2021, the Lahore High Court issued a stay order on the implementation of the renegotiated contracts, following petitions filed by several IPPs. The court directed the government to provide a detailed response to the petitions and to address the concerns raised by the IPPs. The government was removed in April 2022 through a no trust vote. Did the IPPs, the beneficiary, play some role? It is conjecture, the concerned state institutions may work on this possibility. It is very strange that since then the successor governments and politicians have not talked about it, Senator Mushtaq of JI and their party head are the only exceptions.[40]

The fact that “Capacity Charges” constitute a form of Riba is clear, but the question remains

Why are the Parliament, the courts, successive governments, political parties, power centers, media, and Islamic scholars not addressing this crucial issue from an Islamic perspective? Are they part of the problem rather than the solution? They must come forward and play their role to eliminate this menace.

Conclusion

In the context of trade transactions, the concept of Riba in Islam relates to the prohibition of unfair or exploitative practices that result in unjust enrichment. This includes elements such as engaging in unequal exchanges, exploiting information imbalances, or manipulating prices to gain unfair advantages in trade. Islamic teachings emphasize the importance of fairness, transparency, and equity in all forms of commercial dealings.

This extends to the principle of avoiding Riba in trade transactions, ensuring that exchanges are conducted on a basis of mutual consent and benefit, without one party unfairly profiting at the expense of the other.

From a philosophical perspective, the prohibition of Riba in trade aligns with broader ethical considerations regarding justice, reciprocity, and respect for human dignity. It reflects a commitment to fostering economic relationships that are based on mutual respect and benefit, rather than exploitation or inequality.

The contracts involving Independent Power Plants (IPPs) that charge based on the Capacity of the plant rather than the actual units used. From an Islamic finance perspective, such a practice could be rejected on two grounds:Gharar and Riba al-Buyu.

Gharar (Excessive Uncertainty)

The unfair contracts (Capacity payments) in collaboration with corrupt politicians and government officials introduces a significant element of uncertainty and unfairness. The consumer (citizen) is obligated to pay for a capacity that might not be fully utilized. This uncertainty in the transaction can be considered a form of gharar, as it involves ambiguity and risk that may lead to unjust enrichment for one party.

Riba al-Buyu (Usury in Trade or Exchange)

If the payment is based on the capacity of the IPP rather than the actual units used, it may be seen as exploitative and against the principles of fair trade. Riba al-Buyu prohibits unjust enrichment in trade or exchange transactions, and if consumers (citizens) are paying for unused capacity, it is a form of usury in trade.

Final Recommendations

1. All those who are involved in these contracts and extract money from people should be made to pay back by selling their assets and be punished for committing great heinous sin, plundering the public. They must repent, seek pardon from Allah to save them from punishment from hell fire.

2. The Circular Debt of around Rs.5 Tr be abolished being Riba, Haraam.[41]

3. The Contracts with the IPPs be renegotiated and revised to abolish Riba being charged on the name of ‘Capacity Charges’, it happened in 2020, Implement it.

4. The consumers with netmetering (solar system) are charged fairly with justice with prevalent rates, no mysterious tricks (Riba/Gharar8/

5. one simple tariff for import/ exports.

6. Appropriate measures should be taken to ensure that such types of oppressive, unfair and un-Islamic contracts are not signed in future.

“And if you do not, then be informed of a war [against you] from Allah and His Messenger..(2:279)

Umema and Muftis should come forward and issue fatwas and save the nation from this agony and grave sin

● Corruption, embezzlement, taking bribes is forbidden (Al-Quran 2:188).

● There will be no intercession for the treacherous, the dishonest (corrupt) (Al-Bukhari 3073).

● Calling to goodness, enjoining good deeds and forbidding evil deeds is the main responsibility of the believers – (Qur’an 9:71, 3:104)

● مَنۡ یَّشۡفَعۡ شَفَاعَۃً حَسَنَۃً یَّکُنۡ لَّہٗ نَصِیۡبٌ مِّنۡہَا ۚ وَ مَنۡ یَّشۡفَعۡ شَفَاعَۃً سَیِّئَۃً یَّکُنۡ لَّہٗ کِفۡلٌ مِّنۡہَا ؕوَ کَانَ اللّٰہُ عَلٰی کُلِّ شَیۡءٍ مُّقِیۡتًا ﴿۸۵﴾

● Whoever intercedes for a good cause will have a reward therefrom; and whoever intercedes for an evil cause will have a burden therefrom. And ever is Allah , over all things, a Keeper.(Quran 4:85)

[1] https://jang.com.pk/news/1296921

[2] Original Capital, is the real value, i.e. a brick of 1 Kg Gold. 24 Karats and a brick of 1 Kg, 18 Karats Gold, though equal in weight, are not equal in value. Similarly Rs.100,000 returned after one year as Rs100,000 though equal in number is not equal in value, if there has been let’s say 12% inflation in a year. It will only be equal to principal capital, if 12% loss in capital value due to inflation is added to make it equal.to original principal value.It’s simple not rocket science involved.

[3] https://www.islamawakened.com/quran/2/279/default.htm , https://corpus.quran.com/qurandictionary.jsp?q=mwl#(2:279:13) , https://trueorators.com/quran-word-by-word/2/279

[4] https://www.islamawakened.com/quran/18/27/default.htm

[5] https://www.islamawakened.com/quran/18/28/default.htm

[6] Quran Commands ignored/disregarded by State Bank’s monetary System on Riba: (2:279, 18:27, 28, 55:9,11:85, 2:188);45:7-8, 38:29, 2:159, 49:6, 62:5, 8:22, & 2:18, 16:76)

[7] https://www.fincyclopedia.net/islamic-finance/r/riba-khafy

[8] (1) What Are the 4 Different Types of Riba (Interest)?. https://academy.musaffa.com/avoid-these-4-types-of-riba-in-your-transactions/

(2) Riba al-Buyu – Fincyclopedia. https://www.fincyclopedia.net/islamic-finance/r/riba-al-buyu .

(3) Riba al-Duyun – Fincyclopedia. https://www.fincyclopedia.net/islamic-finance/r/riba-al-duyun

(4) Types of Riba – Fiqh. https://fiqh.islamonline.net/en/types-of-riba/

[9] https://www.facebook.com/Salaam1Pakistan/posts/200336449651779 \ https://bit.ly/Pak-IssueNumber-1

[10] https://bit.ly/ElectricShocks

[11] https://www.dawn.com/news/1747377

[12] https://fincyclopedia.net/islamic-finance/u/unapparent-usury

[13] https://fincyclopedia.net/islamic-finance/r/riba-al-yad

[14] https://ar.wikipedia.org/wiki/%D8%BA%D8%B1%D8%B1#cite_note-AL-SUWAILEM-6

[15] https://ar.wikipedia.org/wiki/%D8%BA%D8%B1%D8%B1#cite_note-AL-SUWAILEM-6

[16] https://ar.wikipedia.org/wiki/%D8%BA%D8%B1%D8%B1#cite_note-AL-SUWAILEM-6

[17] https://ar.wikipedia.org/wiki/%D8%BA%D8%B1%D8%B1#cite_note-MPRA-7

[18] https://ar.wikipedia.org/wiki/%D8%BA%D8%B1%D8%B1#cite_note-AL-SUWAILEM-6

[19] https://ar.wikipedia.org/wiki/%D8%BA%D8%B1%D8%B1#cite_note-AL-SUWAILEM-6

[20] https://ar.wikipedia.org/wiki/%D8%BA%D8%B1%D8%B1#cite_note-IB-8

[21] https://ar.wikipedia.org/wiki/%D8%BA%D8%B1%D8%B1#cite_note-AL-SUWAILEM-6

[22] https://ar.wikipedia.org/wiki/%D8%BA%D8%B1%D8%B1#cite_note-AL-SUWAILEM2-9

[23] https://www.pakistani.org/pakistan/constitution/part9.html https://blogs.lse.ac.uk/southasia/2023/03/13/no-law-but-gods-law-islam-and-the-pakistani-legal-system

[24] https://www.dawn.com/news/1687237

[25] https://corpus.quran.com/translation.jsp?chapter=8&verse=22

[26] https://bit.ly/ElectricShocks , https://bit.ly/Pak-IssueNumber-1

[27] https://www.dawn.com/news/1747377

[28] (i) https://bit.ly/ElectricShocks \ https://SalaamOne.com/riba

(ii) Mengenal Riba Al Qardh – Islampos. https://www.islampos.com/riba-al-qardh-249306/

(iii) Concept of Riba in Islamic Transaction – Studocu. https://www.studocu.com/my/document/international-islamic-university-malaysia/islamic-law-of-transactions/concept-of-riba-in-islamic-transaction/12936672

(iv) Pengertian Riba Qardi beserta Contoh dan Dalil tentang Larangan Riba …. https://kumparan.com/berita-update/pengertian-riba-qardi-beserta-contoh-dan-dalil-tentang-larangan-riba-1xi1JMzdYye

(v) Riba: Maksud, Jenis dan Pengharamannya – Aku Muslim. https://akumuslim.asia/mengenali-riba/

vi) Riba Al Qardh (riba Dalam Hutang Piutang) – PengusahaMuslim.com

[29] https://bit.ly/Capacity-Payments-Cancer \ https://bit.ly/Bijli-Rs15perUnit

https://www.samaa.tv/20873945-capacity-payments-of-ipps-how-it-is-draining-pakistan-s-battery

[30] https://www.brecorder.com/news/40200067

[31] Thermal: 60.9%, Hydel: 24.3%, Nuclear: 8.3%, Wind: 4.2%, Solar: 1.2%, Bagasse: 0.8%

[32] Calculated from a LESCO bill of August 2023, tariff rates change / increase with passage of time.

[33] Determining the reference power-purchase price is of utmost importance, according to the regulator, as it is a direct pass-through to consumers and accounts for a major (90pc) component of the consumer-end tariff. All future monthly fuel charge adjustments (FCAs) and quarterly adjustments (QTAs) are worked out based on the projected notified power-purchase price references. The regulator said that around 30pc of total generation during the current year is expected from hydel, 17pc from local coal, 12pc from imported coal, 18pc from nuclear, 10pc from local gas, 5pc from RLNG, 2pc from furnace oil and the remaining around 6pc would be contributed by renewables, such as wind, solar and bagasse. “The generation mix has shown considerable improvement, with around 63pc being forecasted from indigenous resources plus around 18pc from low-cost nuclear sources,” Nepra said.The third-most expensive generation —after RLNG and furnace oil — would be from imported coal at Rs40.54 per unit, followed by wind power (Rs33.64) and then electricity imported from Iran (Rs24.73). The sixth costliest power source is local coal (at Rs23.97 per unit), followed by nuclear fuel (Rs18.38) and solar (Rs15.04). The next three cheapest sources of power at present are bagasse (Rs14.83 per unit), local gas (Rs13.02), and the most cost-effective hydropower at Rs6.94 \ https://www.dawn.com/news/1765123

[34] https://quran1book.blogspot.com/2021/09/Quran-Neglected.html

[35] https://profit.pakistantoday.com.pk/2020/04/11/govt-asked-to-recover-rs100bn-from-corrupt-ipps/

Govt asked to recover Rs100bn from ‘corrupt’ IPPs: https://www.brecorder.com/news/588666

[36] Video on IPPs inquiry report:: https://youtu.be/g-Jv80IOdhQ?list=PLA3AF10D98832383E

[37] https://arynews.tv/ipp-report-power-sector/

https://propakistani.pk/2022/09/30/capacity-payments-to-ipps-increase-by-rs-107-billion-in-fy22/

https://tribune.com.pk/story/2296006/power-consumers-to-pay-rs11tr

https://senate.gov.pk/uploads/documents/1583320128_224.pdf

https://bit.ly/Pak-IssueNumber-1

[38] https://youtu.be/oBGBXOnU5kE \ https://www.facebook.com/Salaam1Pakistan/posts/200336449651779

https://www.dawn.com/news/1599191 \

[39]Revised power tariff: All 47 IPPs sign Master Agreements

https://www.thenews.com.pk/print/784220-revised-power-tariff-all-47-ipps-sign-master-agreements

[40]https://tribune.com.pk/story/2438205/nepra-faces-scrutiny-over-electricity-costs-capacity

https://www.dawn.com/news/1741847

https://file.pide.org.pk/pdfpideresearch/wp-0191-circular-debt-an-unfortunate-misnomer.pdf https://www.facebook.com/Salaam1Pakistan/posts/pfbid0xrCpT5y66MLSkpW8V6R4pLNTwnhkcZpgK7bAYEsacuvNtPSET9n8kD3K5EvDr5dl

[41] https://www.dawn.com/news/1779076/ \ https://bit.ly/Bijli-Rs15perUnit \https://www.dawn.com/news/1774637/waking-up