According to CGAP, it is estimated that around 1.2 billion adults worldwide were able to gain access to formal financial accounts for the first time between 2011 and 2017, which represents a 35% growth over a six-year period. This tremendous feat was achieved due to the efforts of players other than banks such as mobile money operators and fin-techs which were supported by Government initiatives to bring the “un-banked” within the financial system.

The concept of establishing a Virtual Remittance Gateway (VRG) was initiated in 2012, when the Sehgal family realized that in order to uplift the condition of the underprivileged, the starting point is “financial inclusion”. VRG was established in 2013 and since then has maintained a clear focus on providing financial services as an enabler and a disruptor through a secure/regulated platform for a number of industries. The company has developed cost-effective products with advanced technologies under a B2B model that provides convenience in payments to the un-banked/ low-end customers for their banking and financial needs. VRG has a proprietary system that has been designed and created by its in-house technology team for the sole purpose of digital financial inclusion under a unified payment platform that enables information exchange for creating a knowledge-based economy.

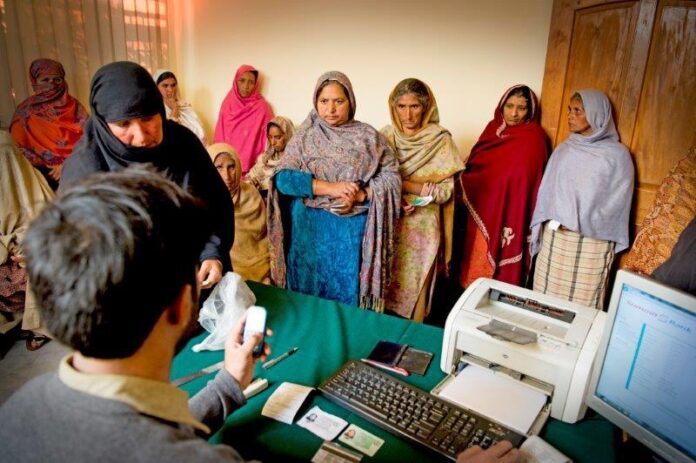

VRG is a key play in implementing the National Financial Inclusion Strategy (NFIS). The target of having by 2023 at least 50% of Pakistan’s adult population and 25% of the total adult women population, by warrants that access to transactional accounts can only be undertaken by a technology-driven platform that can reach the masses without the bricks and mortar branch network.

Asaan Mobile Account (AMA) platform is a revolutionary initiative undertaken by SBP for branchless banking (BB) providers and telecom operators and a game changer for “financial inclusion” of the poor in Pakistan. This scheme is a successful public-private sector initiative creating a new ECO system for digital transformation.

The AMA scheme is a World Bank initiative undertaken by the State Bank of Pakistan (SBP) through a Third Party Service Provider (TPSP). As the telecom operators are an integral part of the many-to-many model, therefore the TPSP is jointly regulated by SBP and Pakistan Telecommunication Authority (PTA). Thus the SBP AMA Scheme is the stepping stone for affordable credit, insurance, and saving products and a pathway for the low-end customers, to realize their dream of owning a house “Makan”. VRG at present is the only TPSP license holder, thus having a first mover advantage.

The SBP AMA scheme is accessible by dialing *2262#, the system guides the end user to open a bank account with any of the branchless financial institutions by providing CNIC# and issuance date only. The system does real-time verification of the person’s ID using CNIC/MSISDN pairing and routes the bank account opening request to the respective bank using the AMA scheme platform. VRG’s products are bi-lingual therefore these can be understood by the masses. As YouTube and Facebook are among the top social media platforms in Pakistan, VRG has developed tutorials on the operations of accounts. The advertisement campaign for the launch is also in Urdu which will go a long way towards creating awareness.

The total financial transactions performed till Jun 30 are 5.85 Million. These include Interbank Fund Transfer (IBFT), Local Fund Transfer (LFT), and Utility Bill Payment (UBP). In terms of financial transaction types, LFTs contribute 48.9% followed by IBFTs & UBPs at 35.4% and 15.8% respectively. In regional terms, Punjab leads the way contributing 58.2% of total transactions followed by KPK and Sindh at 21.25% and 11.1% respectively. In gender terms, transactions by females in Punjab are high as compared to other provinces, accounting for 81.2% of total financial transactions conducted by females. However, female inclusion remains low in Balochistan & KPK and is expected to improve considerably after the formal launch of AMA scheme expected shortly.

Another upcoming unique feature of this platform is the concept of “interoperability” on the telecommunication side for access to the USSD network. As VRG is the only TPSP license holder, it can solve this problem and allow Branchless Banking Institutions to access all the BB agents and thus doing away with the need to have multiple bank accounts.

VRG’s in-house technological capabilities allow it to improve specific functions of the banking value chain. It is important to these that previously, these applications were developed in-house by Financial Institutions but have now been outsourced end-to-end, to VRG as it has a robust and intelligent platform. This platform is PA-DSS certified (Payment Application Data Security Standard) and VA/PT (vulnerability assessment/ penetration testing) audited platform making VRG an ideal financial services enabler for Banks, telecom operators, and FinTechs. SBP, PTA, and law enforcement agencies have inspected and approved VRG’s platform from security, reliability, robustness, and operational standpoints.

VRG is a 100% equity financed entity by Mr. Ikram Sehgal and his family with no external financial support from any government or donor-related entities. Thus the completion risk, operational risk, and technology risks have been fully mitigated as the required investments for infrastructure, software business development, and HR have been undertaken and operations are underway. VRG is now seeking growth capital that is required for scalability and enhancement in the platform and new business initiatives. SBP and PTA have been fully supportive of VRG initiatives for new product development and adding more features to the existing product portfolio is a limited regulatory risk.

VRG is closely working with RAAST (an initiative of SBP for Real-time payments and settlement of funds) to enable the access of RAAST services to 196.4 million subscribers of the telecom industry to avail financial services. Through AMA Scheme, 4.27 million new accounts have been opened and after the commercial launch due shortly, the new accounts will reach up to 20 million in a few months having access to RAAST services. AMA scheme is all geared up to extend RAAST services primarily RAAST ID Creation having linking and de-linking functionality, Person to Merchant payments and more importantly Open Banking services. VRG is a game changer not only for Pakistan but also for other developing countries that do not have the know-how, branch/agent network, and infrastructure to undertake financial inclusion fast-track basis. This model of providing financial access to the underprivileged can be replicated across the globe which can have wide-ranging social and economic benefits for the masses. VRG has been duly acknowledged at the global level and its AMA case study has been showcased at the World Economic Forum (WEF) in the future Pakistan will be included in WEF’s Lighthouse Countries program under the EDISON Alliance digital inclusion goal of providing 1 billion people with affordable digital solutions by 2025.