Introduction

Without addressing “financial inclusion” on a war footing it will be impossible to close the gap between the haves and have-nots with respect to benefitting from the banking system. Their lives must be brought into the financial comfort zone by access to services, products and commodities presently available only to limited number of citizens of nations having digital capacity.

Risks and Opportunities

Many of the developing countries need to be force fed on one or more of the three aspects of the ecosystem viz (1) a National Identification System (ID system) to identify and register individual and households of low income groups (2) Financial access facilitated by opening of bank accounts with ease, particularly for the not so literate. During Industry 4.0, the concepts that emerged were automation technologies, IoT and the smart factories, entering Industry 5.0 production model the focus lies on the interaction between humans and (3) a network of IT infrastructure in the country, telecom penetration and digital access on a wider geographic basis. According to ITU’s 2020, “Measuring digital development report”, in 2019, about 3.7 billion people globally were offline, i.e., not using the internet. In least developed countries (LDCs), 17% of the rural population has no mobile coverage and 19% of the rural population is only covered by a 2G network” unquote.

Eco system

Because it means additional work without adequate return. Bank Managers tend to discourage those below a certain level of income. The simple filling of bank application forms to open an account is a non-starter. Digital transformation makes it “easy” and seamless for any telecom subscriber way to open a bank account on the “Many-to-Many” concept by providing National Identity credentials. With end-to-end integration with all telecom operators and financial institutions, a centralized data/credit history of citizens helps financial institutions, FinTechs and EMIs to offer other financial products. Making it furthermore more convenient for undertaking banking transactions, “Agent Interoperability” is a catalyst for financial inclusion, it is playing a critical role in helping government organizations in social welfare and relief programs, digital lending both Micro and Nano loans, as well as digital insurance issuance to masses.

To overcome the challenge of bureaucratic delays, governments must incentivize the private sector to invest in FinTech, IT and Telecom infrastructure to render digital financial services for poverty alleviation at an affordable cost. Take heed of ITU’s 2020 report “increasing digital transformation is amplifying these existing socioeconomic inequalities. The risk is particularly high for women and girls, youth, persons with disabilities, older persons, and people living in remote areas.” Unquote. Putting it bluntly, both the poor and the female population will be left so far behind they can never catch up. Back to the inequalities and miseries of the dark ages!

Asaan Mobile Account (AMA) Scheme

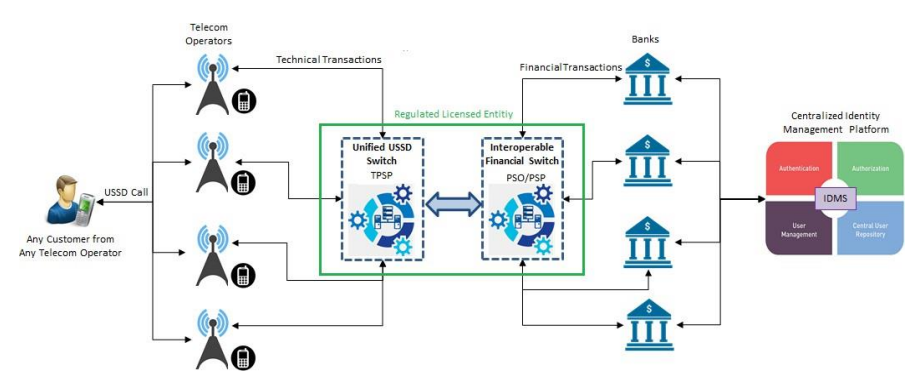

Working on USSD technology the AMA (Asaan means “easy”) Scheme in Pakistan connects the citizen telecom users from any of the four telecom operators with a panel of financial Institutions from which he (or she) can choose to open a bank account with customer verification, AML (Anti-Money Laundering) and KYC (Know-Your-Customer) using National Database and Registration Authority (NADRA) in less than a minute. All the comparable platforms in the world are one-to-one transactions possible but confined to that single platform. A multi-platform mandated to financially include 50% of the adult population of Pakistan by 2024, without any publicity whatsoever or even a formal launch, the AMA Scheme has produced some remarkable results in less than six months, 4.00 million new bank accounts, Rs. 29 million transactions processed and Rs. 28 billion value of financial transactions processed. At 31% women accounts have a higher ratio than their normal accounts (18%) in bank in Pakistan.

Good intentions aside, despite the World Bank and UNDP’s pushing of “financial inclusion” schemes, there are delays even when presented with a viable proposition and used cases. During the COVID-19 masses were given funds to buy food and medicines in Pakistan in a digital way with complete verification and validation of the beneficiary. Rather than throwing money into a crowd from a helicopter the Government-to-Person scheme regularly funds verifiable disbursement for disaster relief, pensions, scholarships, health etc. This will be a significant feature of the AMA Scheme when fully operational.

“Roti, Kapra aur Makan” (Bread, Clothing and Housing) is a very catchy political slogan, over 50 years old in Pakistan. Since the Mehargarh Civilization 8000 years ago the area comprising Pakistan has never been short of food or clothing, however the promise of housing has just been a pipedream and will remain so without the intending applicant having a bank account. This has been successfully achieved in Pakistan through effective public-private partnership, digital banks, telecoms and identification system combining to give a bank account and thus financial access (even) on a normal feature mobile phone.

An operating model for replication

Pakistan’s model is unique but simple enough to be replicated for developing countries lacking either the requisite banking/telecom policies combining with an ID system necessary to put it all together. A major hurdle could be the capital cost, funds for the equipment, capital cost in loans and grants may be available but without substantial capital expenditure can be feasible. On a “transaction mode” with principal manufacturers of required equipment ready to work with a “pay as you earn” method. Ensuring a smooth, simple and effective “payment system” for the underprivileged and poor, this working all-encompassing dynamic ecosystem can be replicated as a low-cost one-stop solution.

The one-stop robust, scalable and integrated business model operating in Pakistan can be easily adjusted to fill the each and any of gaps in any of the developing countries depending upon their differing requirements for not only of the poor and the impoverished but the grossly neglected female population. Bridging the great divide must be a well-coordinated crash program tailored separately for each individual country. Presently out in the “financial cold” and in danger of being left permanently behind, replicating the AMA Scheme will be a game changer for less fortunate citizens of the developing world.

(with courtesy of World Economic Forum (WEF) Blog dated May 19, 2022)