Artificial Intelligence is not hypothetical it is real. Artificial Intelligence (AI) is an area of the science relating to computers that focus on the development and creation of intelligent machines that are expected to work and react like humans. AI enabled computers are designed to include speech recognition, learning processes and planning. AI is awkwardly opposite to natural intelligence; the earlier is a human creation and the latter is a divine blessing.

The spirit behind the development of AI is to reduce human input or in other words it is designed to take over, the element of human discretion; the machine assumes the discretion to itself. This results in greater efficiency, productivity and accuracy; almost error free outputs. Daniel Faggela, CEO at Emerj, in a write up quoted the following definition of AI, by O’Reilly,” defining artificial intelligence isn’t just difficult; it is impossible, not the least because we don’t understand human intelligence. Paradoxically, advances in AI will help more to define what human intelligence is not than what artificial intelligence is.”. For ease of reference in this piece, I would begin by accepting the simplest definition of AI, by the University of Louisiana,” AI is the study of man-made computational devices and systems which can be made to act in a manner which we would be inclined to call intelligent.”

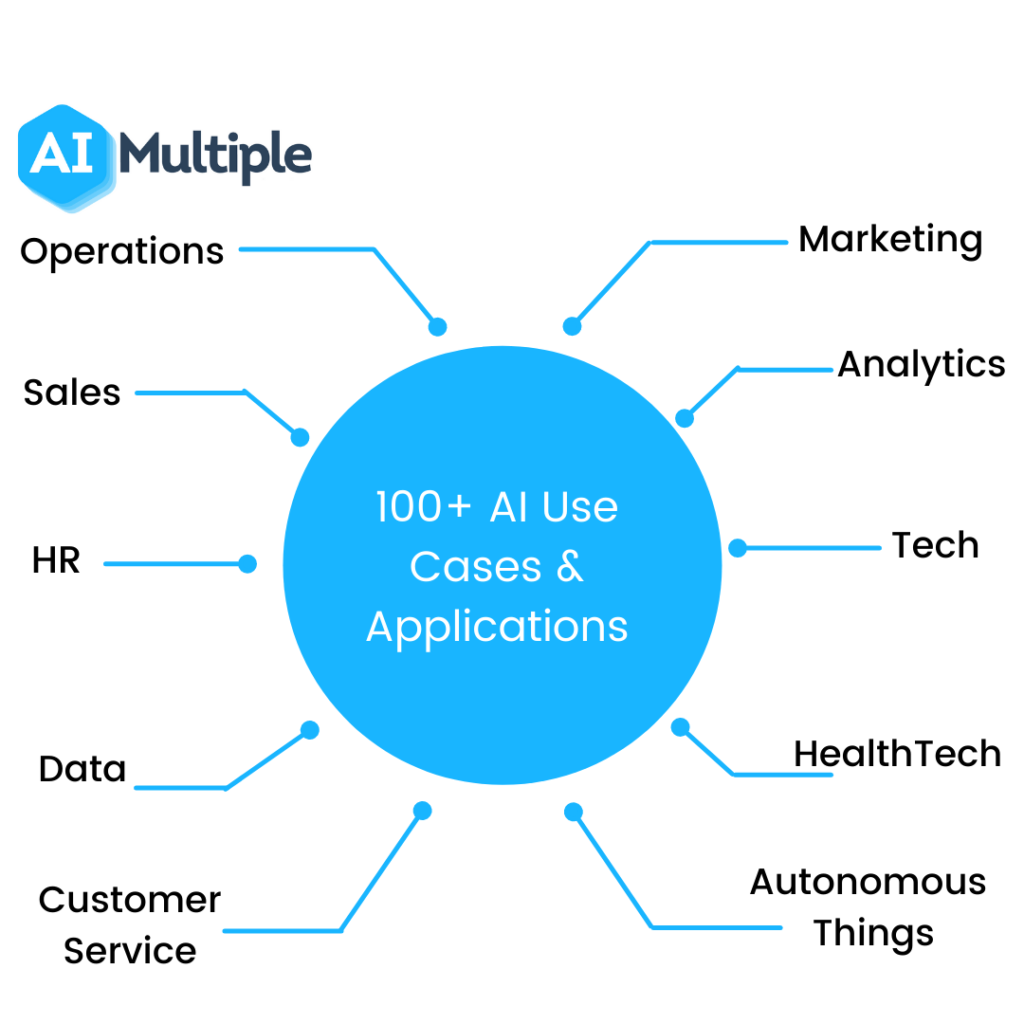

AI is gaining traction in the fields of finance, medical science, air transport, the manufacturing sector, with unbelievable and incredible results in financial engineering, research in health sciences and in the ever popular video games.

AI is of real use to Fintech’s and financial institutions. AI is incorporated into financial products and services. It is growing into a machine learning environment. Those users of AI utilize it for purposes such as efficient customer service, enhanced revenues and better analytics.

AI in financial services is designed to take away regular and mundane tasks. How does one quantify and predict future behavior? This is an evolutionary process in the development of products and services. The central theme is to not create new products and services but to improve upon the existing menu. AI must therefore be used for enhancing features of existing products and services.

AI is an important tool kit in relation to the development of fraud investigation technologies. When it is humanly impossible to evaluate the veracity of a transaction, using AI makes for a sensible decision.

AI is dependent entirely upon database. The obvious question is what kind of database? Large data or small quantum? Availability of good data is always a challenge. Data is never handed over in a pristine state; it has to be sifted and fine-tuned. Once this is done, only then can AI have the ability to analyze data for specific objectives.

Large pools of information help AI. Where is the data residing? How to cleanse it to make it of use, is the cause of the business manager. Then there is “dark data”, which is in obscurity and is not seen by the organization; it is the task of AI to bring such data to light and visibility.

AI is about data engineering and fine tuning for effective use. Before one starts framing and experimenting on data, it is best to have it cleansed for inherent impurities. The algorithms used can be only as good as the quality of data fed. The right kind of data will give the right results.

AI’s usage is increasing in risk and fraud prevention; it is helping in the reduction of fraudulent transactions.

How does one get started with AI? One has to look at its business impact; of what use it will be for better customer experience and also for enhanced revenue. It is, for example, a major customer service expectation of late night deposits, or the receipt of alerts on identification of suspicious transactions. AI is essentially applied more on the front end, because there are more mature applications in use at the front offices.

Bradesco in Brazil has applied AI in its call center’s; Royal Bank of Scotland has 8 different types of AI applications and U-Bank is totally digital. How does one advocate for AI? It depends upon each financial institutions priority that can range from cost reduction, enhanced revenue, risk mitigation, fraud prevention to enhancing business from using non traditional data. It is all about objectives of each organization.

AI has no limitations of geography; through its use, we can decipher what I-Phone the client is using, the type of version in use, where was the last log in or log out made? The cost implicit makes for a business case.

Is AI an assurance for good and sound decision making? The answer to this is the weightage to be given to bias that may be present in the data. The prejudice it may have. The past decision may not have the qualification for being called and adjudged as good decisions; so to re-emphasise, the decision is as good as the quality of data. We must look at AI as a pain killer, not a cure. AI’s ethical issue can be solved through the slogan of it being done only for good. The possibility of non-ethical usage of AI should be circumvented through sound regulatory framework.

Bankers and financial institutions need to strategize on AI application and prioritize the function it should be deployed upon. The future of banking is all about AI for better customer experience and to create a balance in risk management.