A recent report by the World Bank (WB) had India recording a 22.5% increase in home remittances to US$ 80 billion in 2018, retaining its position as the world’s top recipient of remittances for five years in a row. The last three years surge carried remittances from US$ 62.7 billion in 2016 to U$ $65.3 billion in 2017. The 10 top recipient nations include China ($67 billion), Mexico and the Philippines ($34 billion each) and Egypt ($26 billion), Pakistan is 7th in line. Remittances to South Asia are projected to increase by 13.5% to US$ 132 billion in 2018, a stronger pace than the 5.7% growth seen in 2017. Even than Bangladesh has experienced a strong uptick of 17.9%. The upsurge is not only due to robust economic conditions in advanced economies, but the increase in oil prices increasing outflows from some GCC countries.

Due to downsizing employment opportunities in Saudi Arabia and the GCC countries Pakistan’s remittances growth remains moderate at 6.2% due to significant commensurate reductions in inflows. Saudi Arabia’s policy enabling its native population for jobs meant deporting more than 39,000 Pakistanis. Receiving $20.9 billion in 2018, overseas employment for Pakistani workers dropped 41% (0.83 million in 2016 to 0.5 million in 2017). Over the past decade, cheaper and better trained Indians and Bangladeshis have replaced Pakistani manpower. The 8 million Pakistanis living abroad, means a scope to boost the monthly inward remittances. After exports, inward remittances approximately of US $2 billion are the second most important contributor to Pakistan’s cash starved foreign exchange reserves. Pakistan’s increased dependence on remittances is due is its widening current account deficit.

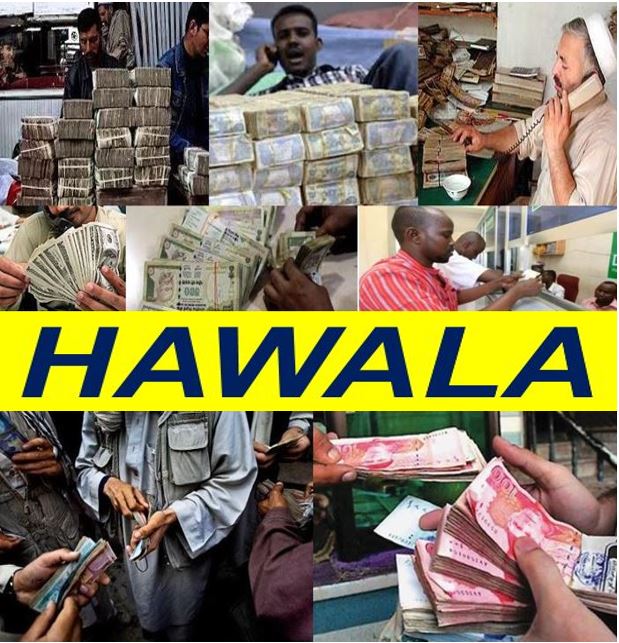

The “Hundi” or “Hawala” remittance system exists and operates as an alternative outside of or to parallel to traditional banking or financial channels. Unlike formal transfer system, hundi providing total anonymity enhances money laundering and facilitates terrorism. Not disclosing of identities allows terrorists and criminals to use it. This system facilitates the illegal flow of funds that works by transferring money without actually moving it, it requires no bank accounts and is consummated without leaving a paper trail. The corrupt who can easily send their ill-gotten gains abroad for purchase of assets and property outside Pakistan, “hundi mafia” has thus great influence with the establishment. Estimated at around $14-15 billion in 2014, the “hundi system” facilitators earned about $1.3 billion annually.

The “hundi system” was declared illegal by India to (1) stop circulation of black money (2) stop funds for terrorism (3) stop drug trafficking and (4) stop other illegal activities. Imposing emergency rule in 1975, former Indian PM Indira Gandhi jailed all hundi traders, confiscated their properties and bank accounts and even funds en route. Indian expatriate on an average send $4,000 per head annually, all through the banking system. Given 8-9 million non-resident Indians (NRIs) abroad it has grown from $30-35 billion annually in 2004 to more than US$ 80 billion today. In Pakistan the “hundi” system continues despite measures taken by the State Bank of Pakistan (SBP). The “Hundi System” has inadvertently provided a perfect electronic platform by the SBP “permission to the TELCOS to open commercial banks. The “hundi” trade is hurting Pakistan financially and economically as this deprives the country of legitimate taxes as well as precious foreign exchange.

Research carried out in Pakistan, Sri Lanka, Bangladesh and the Philippines in 2004 showed 3.2 million Filipinos were registered as employed abroad in 2003, 82% were women. Investing money in a particular software Philippine Central Bank gave it free to banks open 24/7, meant to disburse money instantly to the many branches of many banks on one platform. Because of this plan $8.6 billion was remitted through banking channels in 2003, approximately $2,700 per expatriate Filipino per year. The banking system was used more than “hundi” a negligible amount of money transacted outside banking channels. In 2003 2.3 million Bangladeshis had sent $800 million annually, about $350 per head. While Bangladesh has a very active “hundi” trade, Pakistan was and remains the worst easily. Non-resident Indians (NRIs) sent as much as $4,000 per head home in 2003. Comparing Pakistan’s sending US$ 300.

“Financial Inclusion” requires the govt to initiate sweeping reforms in the banking system, accompanied with some really stringent measures. Those operating the &” hundi” system are now armed with the latest technology. The foreign-owned TELCOS are providing an electronic platform instead of an old manual one to conveniently transfer funds anywhere, TELCOS must be stopped from establishing a parallel banking system. Stringent monitoring must be done by PTA by extensive use of modern technology. To stop” Hundi” operations increasing of Home Remittances electronically will enhance collection by almost 20-25% as in the India and Philippines.