Energy has become one of the most important actors of sustainable economic development, security and above all human survival in the world. Energy gears development, massive industrialization and channels of production and Kazakhstan being the biggest producers and hub of energy in the Central Asia Region (CARs) has a comprehensive energy policy. It is dynamic and forward-looking. It promotes regional connectivity. It shares socio-economic prosperity in the region and beyond. It is diversified in terms of supplies and demands. It promotes elements of energy security and efficiency. It reduces incidents of climate change by announcing and implementing various projects of green/renewable energy in the country. Indeed, Kazakhstan is the champion of energy reserves in the CARs.

Main Characteristics

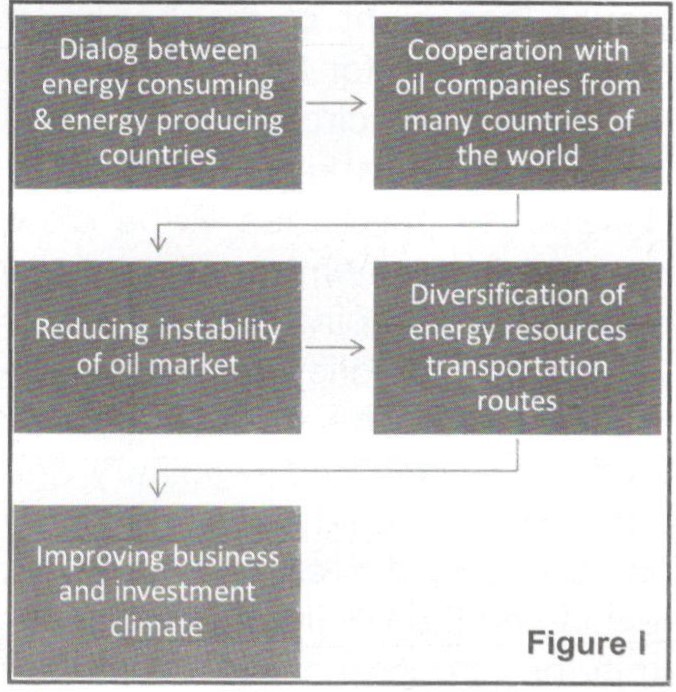

The figure I clearly demonstrates the importance of Kazakhstan’s energy policy for achieving desired goals of socio-economic integration, greater energy connectivity, qualitative life and human survival. It values the concept of further diversification of energy resources (solar, wind, biomass) and has a comprehensive plan for diversification of supplies and demands.

Kazakhstan’s Holistic Approach

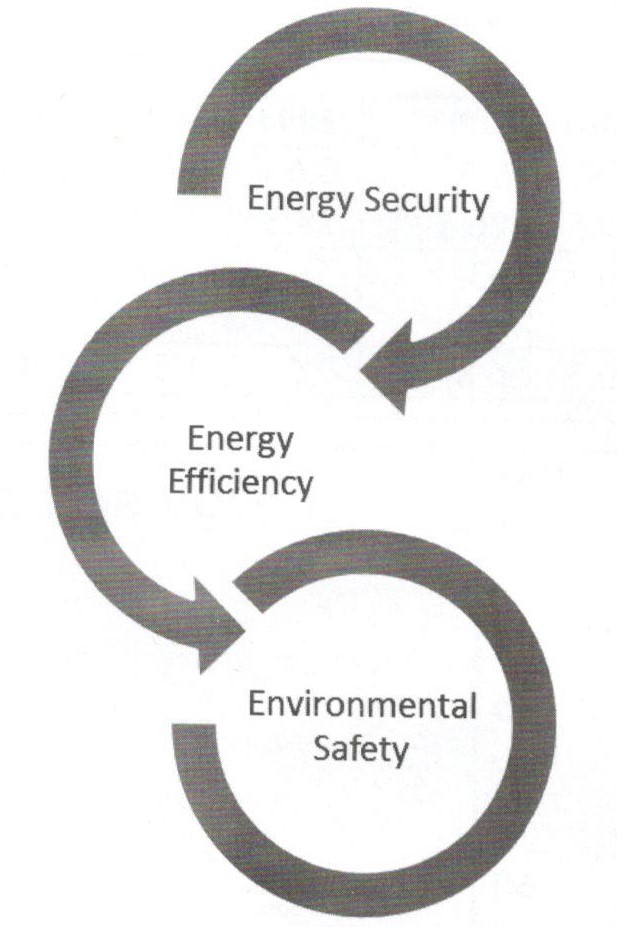

Figure II shows guidelines of Kazakhstan’s energy policy which are based on 3Es i.e. energy security, energy efficiency and environ-mental safety. It has short as well as long term policies, programs and projects which are given in Figure III.

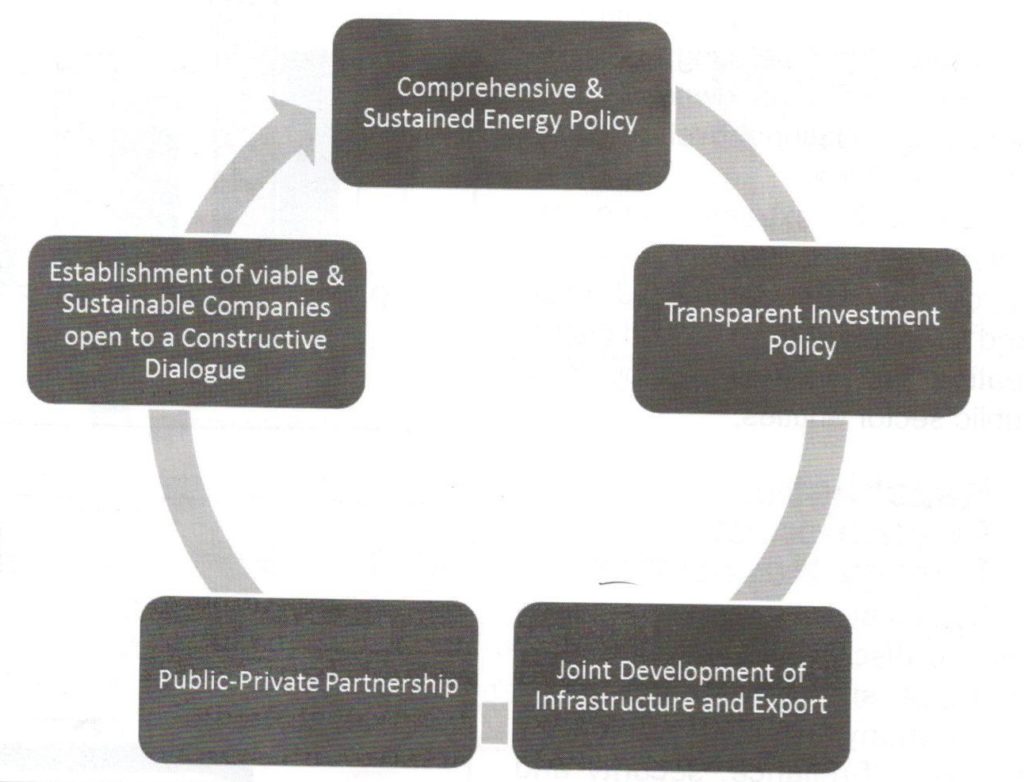

Figure III represents guiding lines of Kazakhstan’s energy policy which speaks about foreign direct investments (FDIs), joint ventures (JVs), public-private partnership (PPPs) and last but not the least, sustained development of companies and constructive dialogue to maintain energy price stability and security. It is one the ideal countries of FDIs in oil & gas sectors in the region. It facilitates national as well as inter-national investors to make investments in various projects of conventional as well as non-conventional energy. It chalks out Strategic Road Map (SRP) for the development of national companies for exploration of oil & gas reserves in the countries. It has befitting proposition even for inter-national companies.

State Committee on resources (SCR)

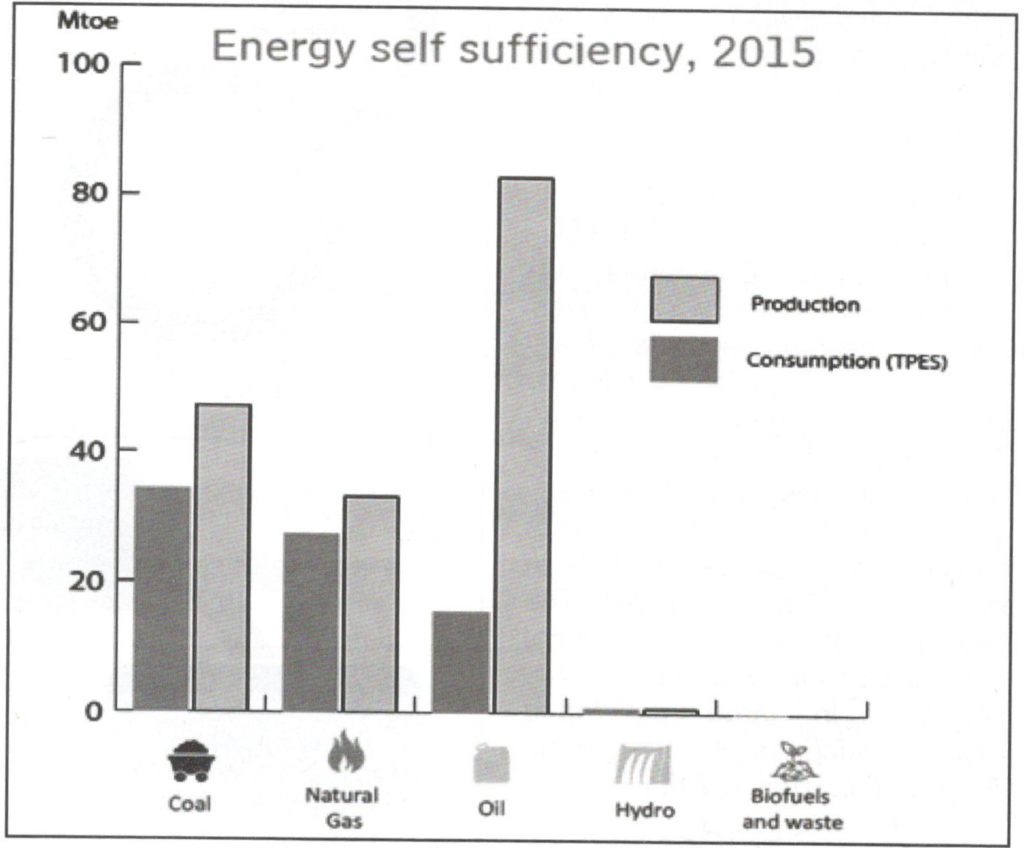

The State Committee on Resources (SCR) indicates recoverable hydrocarbon reserves of the Republic of Kazakhstan onshore which are highlighted in the above given figure IV. According to SCR report Kazakhstan ranks among ten leading countries in the world in terms of hydrocarbon reserves and 15th in the world projected reserves. The largest explored reserves of natural gas dissolved in crude oil are concentrated in large developed deposits such as Karachaganak, Tengiz, Zhanazhol, Urikhtau.

Latest Energy Potential

According to latest official figures Kazakhstan has 4.1 Gt for oil, around 2000 bcm for gas and 33.6 Gt for coal the 7th largest coal reserves in the world, end of 2016. About 70 percent of the Kazakhstan’s oil potential is located in the west of the country, particularly in the Caspian Sea Kashagan.

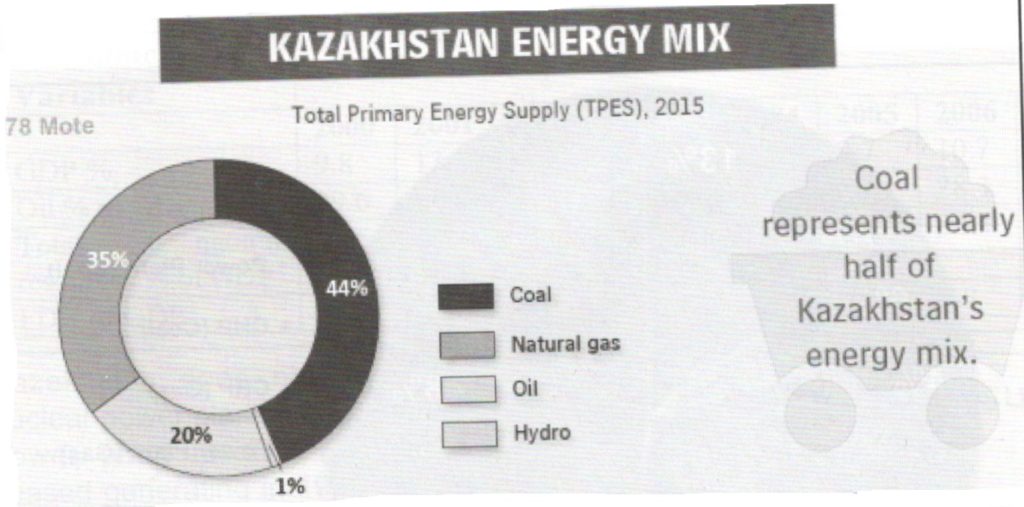

Kazakhstan’s Energy Composition

Kazakhstan is rich in natural resources including coal, oil, natural gas and uranium. It has significant renewable potential from wind, solar, hydro-power and biomass. Coal-fired plants account for 75 percent of total power generation. Recent economic growth in Kazakhstan has driven increased demand for energy services, making the construction of additional generating capacity necessary for enabling sustained economic growth. In this context, renewable energy resources are becoming an increasingly attractive option to help bridge the demand supply gap and to decrease national greenhouse gas emissions.

According to many research studies and reports of World Bank, IMF and Asian Development Bank, Kazakhstan is the dominant nation of Central Asia economically, generating 60 percent of the region’s GDP primarily through its oil/ gas industry. It is a major producer of oil, gas and coal, as well as being the largest producer and exporter of uranium ore in the world. However, due to falling oil prices export revenue from oil and gas has declined by 35 percent since 2015.

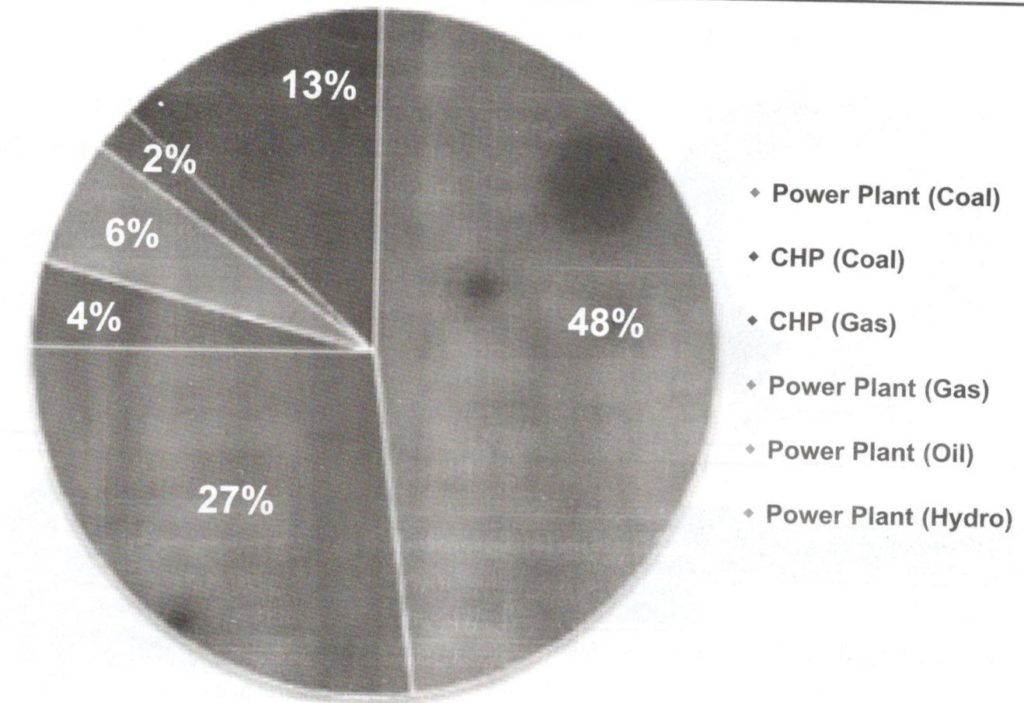

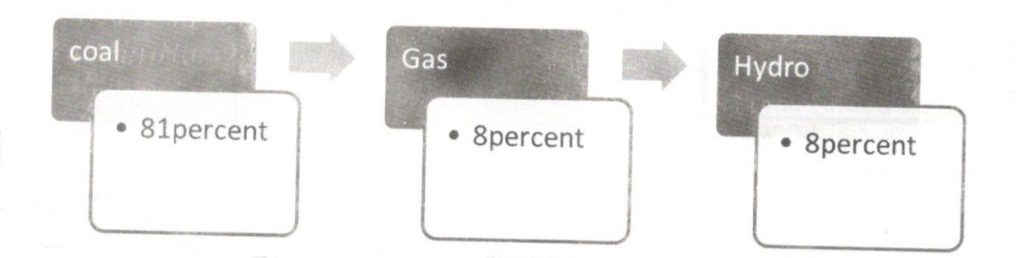

Domestic Electricity Production

Domestic Electricity production is around 94 billion kWh with 81 percent from coal, 8 percent from gas and 8 percent from hydro. 75 percent of electricity is consumed by industry, 11 percent by households and 2 percent by transportation. Kazakhstan’s does not have any Kazakhstan does not have any nuclear power plant, its only nuclear power plant located near Aktau ceased generating in 1999 after 26 years of operation and was decom- missioned in 2001.

About 87 percent of electricity generation in Kazakhstan is owned by the private sector. Of the 21 electricity distribution companies, only two remain state-owned. The national transmission and dispatch system is operated by the Kazakhstan Electricity Grid Operating Company (KEGOC), which is owned by the Kazakhstan National Welfare Fund Samruk-Kazyna.

Due to its extreme winter climate, heating for much of the country comes from centralized coal-fired cogeneration plants and district heating networks owned by local public sector entities.

Kazakhstan: Champion of Energy Resources

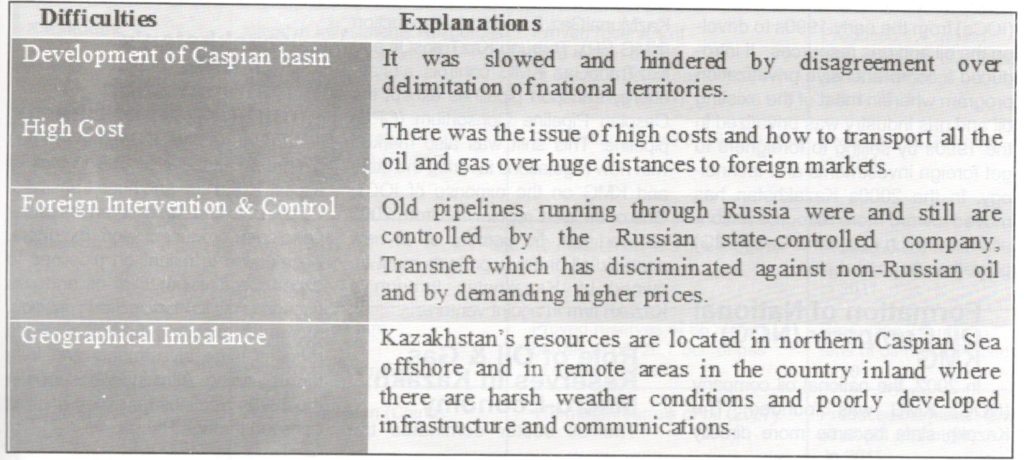

Kazakhstan has been striving hard to discover, extract and produce oil since its inception. It faced many difficulties towards energy self-reliance, security and massive production.

Development of Kazakh oil and gas has been hampered and delayed by relative high costs, long development time and technical difficulties. The most important part or about 90 percent of Kazakhstan’s proven oil reserves are concentrated in 15 large fields: Tengiz, Kashagan, Karachaganak, Uzen, Zhetybai, Zhanazhol, Kalamkas, Kenkiyak, Karazhanbas, Kumkol, North Buzachi, Alibekmola, Prorva Central and East, Kenbai and Royal. Most of the reserves are located in the western part of the country or in the Caspian Sea. According to EIA (2012) about 80 percent of gas reserves are located in the four fields of Kashagan, Tengiz, Karachaganak and lmashevskoe. Below in Tables 3 and 4 is an overview of major oil and gas projects in Kazakhstan.

State’s Response

President Nursultan Nazarbayev played an important role to develop oil and gas industry in the country due to which short span of time Kazakhstan has become a champion of oil and gas reserves in the region. He is a genuine strategist who also knows the art of international marketing, owing to which he announced and subsequently institutionalized diversified but integrated policies for the development of oil and gas industry in the country.

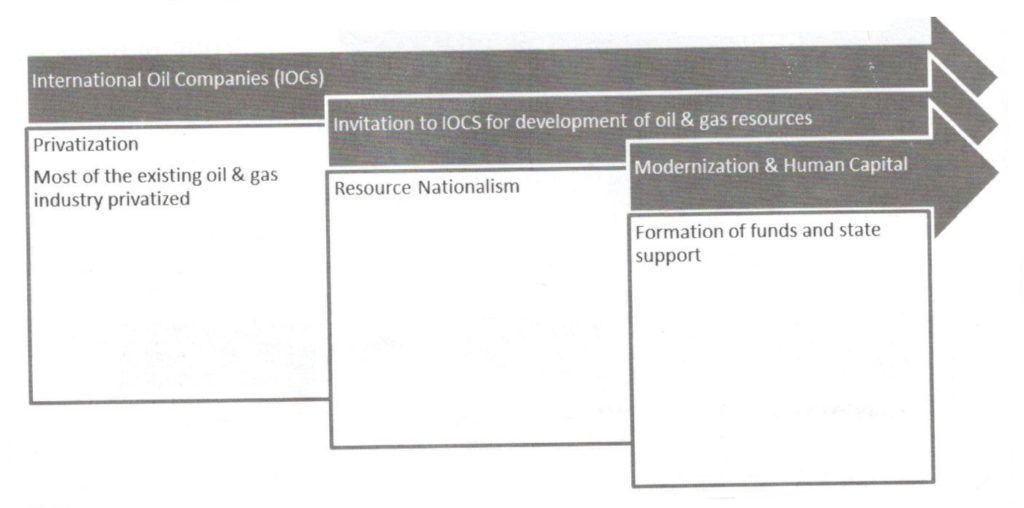

Figure VI

It demonstrates comprehensive state’s initiatives to overcome various difficulties pertaining to investment’s, technological backwardness human capital and geo-graphical imbalance.

Western International Oil Companies (IOCs)

The Kazak State invited many western International Oil Companies (IOCs) from the early 1990s to develop the oil and gas resources. It introduced a comprehensive privatization program wherein most of the existing oil and gas industry was privatized in the 1990s by selling to foreigners to get foreign investments and technology. In the 2000s Kazakhstan has moved toward more resource nationalism, in which KazMunaiGaz (KMG) played an important part.

Formation of National Oil Company (NOC) KMG

In 2002, the national oil company (NOC) KMG was founded. The Kazakh state became more directly involved in production and development of the oil and gas resources. KMG has several subsidiaries such as KazTransGaz, KazTransOil and KazMunaiGaz Exploration Production (KMG EP). Through KazTransOil and KazTransGaz KMG controls a state energy transport pipelines except the Caspian Pipeline Consortium (CPC) pipeline. This shift was also marked with new regulations favoring the state and KMG on the expense of IOCs. One of the new regulations from 2002 required that 50 percent of all new strategic oil and gas projects must be owned by Kazakhstan through a Kazakh firm in a joint venture.

Role of Oil & Gas Reserves in Kazakh Macro-Economy

The oil sector dominates the Kazakh economy by accounting for more than 25 percent of gross domestic product (GDP), 65 percent of total exports and 40 percent of total budget revenue by 2011-2017. Kazakhstan has experienced substantial economic growth since independence and especially in the 2000s after the economic hardships of the early 1990s. Kazakhstan’s economy has grown faster than the other Central Asian countries to become the leading economy in the region. This growth has been fueled by large foreign investments, mainly in the oil and gas sector, export of oil, high oil prices and export of other natural resources. The oil and gas sectors have a great impact on the rest of the economy and on social and economic development, and can be described as the driving force in the Kazakh economy.

The table below clearly shows that strategic vision of President H.E. Nursultan Nazarbayev paid off in the development of oil and gas industry of the country. It also confirms that Kazakhstan and China are strategic partners. It also verifies Kazakhstan balanced foreign policy which neither gave leverage to any specific international oil company nor any country to create any kind of monopoly.

Kazakhstan’s Pipelines Transportation and Export of Energy

Unfortunately, Kazakhstan has geographic imbalance due to lack of access to the sea and huge transit distances between Kazakhstan and other petroleum producers and exporters. Kazakhstan is reliant on pipelines to export large volumes of oil and gas because of its landlocked position. Moreover, exporting through pipelines requires large investments and long-term planning. After independence in the 1990s pipelines for export of oil all transited through Russia.

Kazakhstan’s Oil & Gas Projects

| Name of field/project | Project Partners | Estimated Reserves | Project Status |

| Aktobe | CNPC Aktobemunaigaz 85% | 1.17 billion barrels of oil (2007-8) | Produced 116 660 bbl/d of oil, and 69.6 bcf a year of gas (1.948 bcm) in 2005. |

| Zhanazhol Kenkiyak | In the block ADA: KNOC (South Korea) LGIC Vertom | ||

| Alibekmola & Kozhasai | KMG 50 % Caspian Investments Resources 50 % | Proven reserves of 102 million barrels of oil (2011). | Produced 1.14 million tons of oil (22 891 bbl/d) in 2011. |

| Amangeldy | Amangeldy Gas (KazTransGaz subsidiary) | 22-25 bcm of gas (2008). | Produced 0.32 bcm of gas in 200 |

| Arman | Caspian Investments Resources 50%, Shell 50% | Proven reserves of 2.8 million barrels of oil (2011). | Produced 76 500 tons (1536 bbl/d) of oil in 2011. |

| Emba | KMG 51% MOL Rt. Vegypszer (Hungary) 49% | 500 million barrels of oil (2007). | Produced 57 700 bbl/d of oil in 2004, 3.1 bcf of gas (0.086 bcm) in 2004. |

| Karachaganak | BG Group (UK) Uoint operator) 29,25%, -ENI Uoint operator) – 29,25 %, Chevron 18%, Lukoil 13,5 %, KMG 10% | Gross reserves of 2.4 billion barrels of condensate16, 16 Tcf of gas (2013). | Producing 202 900 bbl/d, 1.1 mmcf/d natural gas (2005). 244 000 bbl/d of condensate in first half of 2012. 70 % of oil is exported through CPC pipeline. |

| Karakuduk | Caspian Investments Resources Lukoil (Russia) 50% Sinopec (China) 50% | Proven reserves of 56.6 million barrels of oil, 22.7 bet of gas (0.635 bcm) (2011). | Produced 1.4 million tons of oil (28 112 bbl/d) and 120 mcm of gas in 2011 . |

| Karazhanbas | Karazhanbasmunai:-Citic Resources Holdings (China) 50% KMG 50% | 286 million barrels of oil (2011). | Produced 36 200 bbl/d in 2011. |

| Kazgermunai | KMG – 50% PetroKazakhstan17 (China) 50% | 100 million barrels of oil (2007). | Produced 3.0 million tons of oil (60 240 bbl/d) in 2011. |

| Kumkol North | Turgai Petroleum: Lukoil 50% PetroKazakhstan 50% | Proved reserves of 86 million barrels of oil, 29.7 bcf of gas (0.83 bcm) (2011). | Producing 2.5 million tons of oil (50 200 bbl/d) in 2011. |

| Kumkol South | PetroKazakhstan (China) | 116 million barrels of oil (2007). | Produced 3.2 million tons of oil (64 257 bbl/d) in 2011. |

| Mangistau | Mangistaumunaigaz: KMG 50% CNPC 50% | 1.4 billion barrels of oil (2007). | Produced 117 000 bbl/d of oil from Jan- June 2012, and 33.3 mmcf/d of gas in 2005. |

| North Buzachi | CNPC 50% Caspian Investments Resources (Russia/China) 50% | Proved reserves of 134 million barrels of oil (2011). | Produced 1.97 million tons of oil (39 558 bbl/d) in 2011. |

| Tengiz | TengizChevroil: Chevron (US) 50% ExxonMobil (US) 25% KMG 20% LukArco18 (Russia) 5% | 6-9 billion barrels of oil (2013). | Produced 25.8 mill tons of oil (579 000 bbl/d), 1.3 million tons of LPG and 6.9 bcm in 2011. The majority of oil is exported through CPC. |

| Uzen | Uzenmunaigaz (KMG subsidiary) 100% | Proved and probable reserves of 166 million tons of oil (1.2 billion barrels) (2011). | Produced 5.1 million tons of oil (102 409 bbl/d) in 2011. |

Diversification of Export Routes

The policy of Kazakhstan has since been to diversify export routes and has made progress in this regard in the 2000s with the new pipeline to China, oil swaps with Iran and export with tankers through Azerbaijan. Still most of Kazakhstan’s oil is exported though Russian territory. International Energy Agency (2010) export capacity was estimated to a little over 1.5 million bbl/d, while the export volume in 2009 was around 1.3 million bbl/d and about 1.4 million bbl/d in 2011. Kazakhstan needs to increase its export capacity because of the large planned increase in oil and gas production. When the Caspian Pipeline Consortium (CPC) pipeline became operational in 2001 Kazakhstan’s ability to export oil was increased.

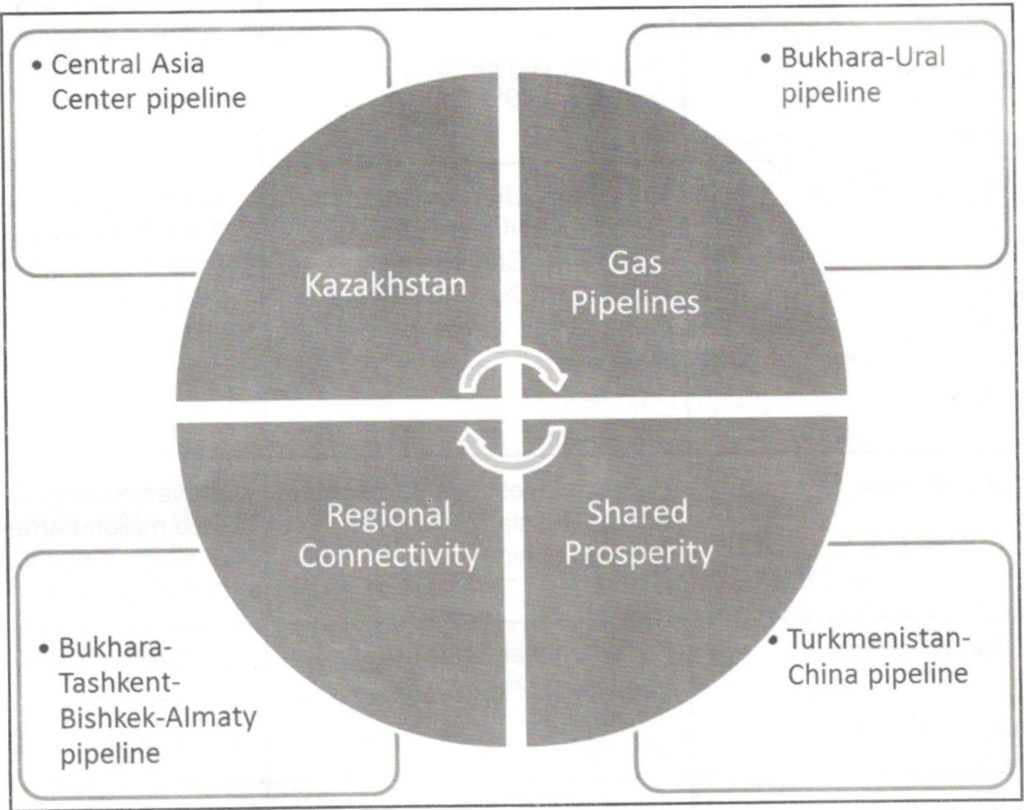

Kazakhstan’s Gas Pipelines

Kazakhstan has rich gas reserves with four main gas pipelines: the Central Asia Center pipeline, the Bukhara-Ural pipeline, Bukhara-Tashkent-Bishkek-Almaty pipeline and the Turkmenistan China pipeline. The pipeline system is operated and control by KazTransGaz, which is a KMG subsidiary. Producing regions in the west have not been connected with the major population and industry centers in the east and south because of the geographical imbalance in the country.

Kazakhstan is an important transit country for gas from Turkmenistan and Uzbekistan to Russia and China. The total export of gas in 2009 was only 7.0 bcm, while the amount of gas transited through Kazakhstan was 73.3 bcm.

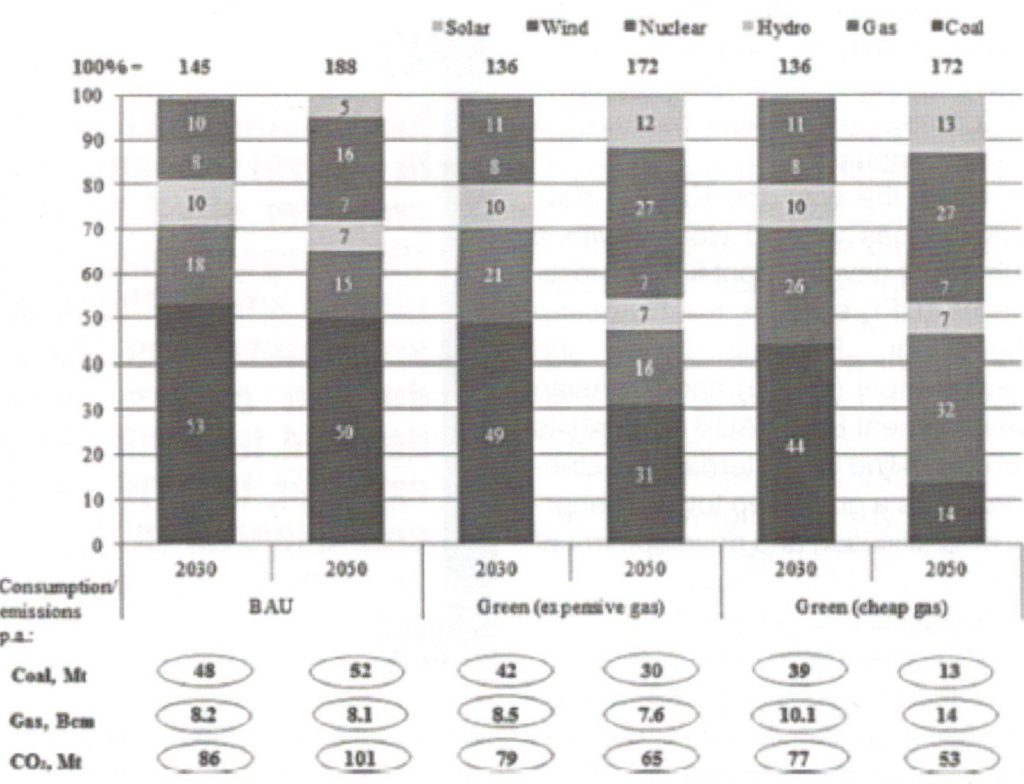

Kazakhstan’s Pursuits of Renewables

According Nazarbayev ‘s to President ambitious 2050 Strategy, Kazakhstan will use renew able and alternative energy sources to create 50 percent of the electric capacity generated in Kazakhstan. This is just one component of Kazakhstan’s comprehensive initiative to transfer from one of the world’s premier hydrocarbon energy producers to a model “green” economy”. In addition to green energy creation, Kazakhstan’s transition also focuses on water resource conservation, agriculture and waste management, and measures aimed at reducing carbon emissions. Kazakhstan will be the first CIS country to launch a cap-and-trade system to curb greenhouse gas emissions.

There are already more 35 large renewable energy projects in Kazakhstan generating solar, wind and hydro-electric power. More projects are due to start this year.

| Pipeline | Ownership | Length/Capacity | Details |

| CPC pipeline: (Tengiz-Novorossiisk pipeline) | Caspian Pipeline Consortium (CPC): Russia/Transneft 31% KMG 19% Chevron (US) 15% LUKARCO B.V. (Russia) 12.5% ExxonMobil (US) 7.5% Rosneft-Shell (Russia/UK/Nederland) 7.5% BG Group (UK) 2% ENI {Italy) 2% Kazakhstan Pipeline Ventures (Kazakh) 1.75 25 Ventures (Kazakh) 1.75 25 Oryx 1.75% | 1511 km from Tengiz field to the port of Novorossiisk in Russia, Black Sea. Phase I capacity of 565 000 bbl/d; Phase II capacity of 1.3 million bbl/d (2015). | First tanker loaded in 2001. Transported about 670 000 bbl/d in 2012. |

| UAS pipeline (Atyrau, Samara; Connecting With Russian pipeline system) | KazTransOil (KMG Subsidiary) 100% on Kazakh side of the border | From Uzen via Atyrau to Samara in Russia and linking up with the Russian pipeline system. Capacity of about 300 000 bbl/d. | Old pipeline built in 1970s. Upgraded in 2002 to about 300 000 bbl/d, and are in discussions to expand further. Transported 15.4 million tons (309 000 bbl/d) of oil in 2011. |

| China pipeline (Atasu- Alashankou or KCP) | KMG/KazTransOil 50% CNPC (China) 50% | Initially 7 million tons of oil, then upgraded to 10 million from 2008. From 2011, a capacity of 12 million tons a year (240 000 bbl/d). | First oil reached China in 2006. Plan to expand capacity to 20 million tons a year (400 000 bbl/d) in 2013. |

| BTC (Baku-Tbilisi-Ceyhan pipeline) | The Baku-Tbilisi-Ceyhan Pipeline Company : BP (UK) 30.1% SOCAR (Azerbaijan) 25% Chevron 8.9% Statoil (Norway) 8.7% TAPO (Turkey) 6.5% ENI 5% Total (France) 5% Itochu (Japan) 3.4% Inpex (Japan) 2.5% ConocoPhillips 2 .5% Hess Corp. (US) 2.4% | 1768 km long route from Baku in Azerbaijan via Georgia to the Turkish Mediterranean port Ceyhan. Capacity of 1 million bbl/d. | First shipment of oil in 2006 from Ceyhan. Exported 1.9 million tons of Kazakh oil from Tengiz in 2009, but stopped in 2010 over disagreement on tariff . |

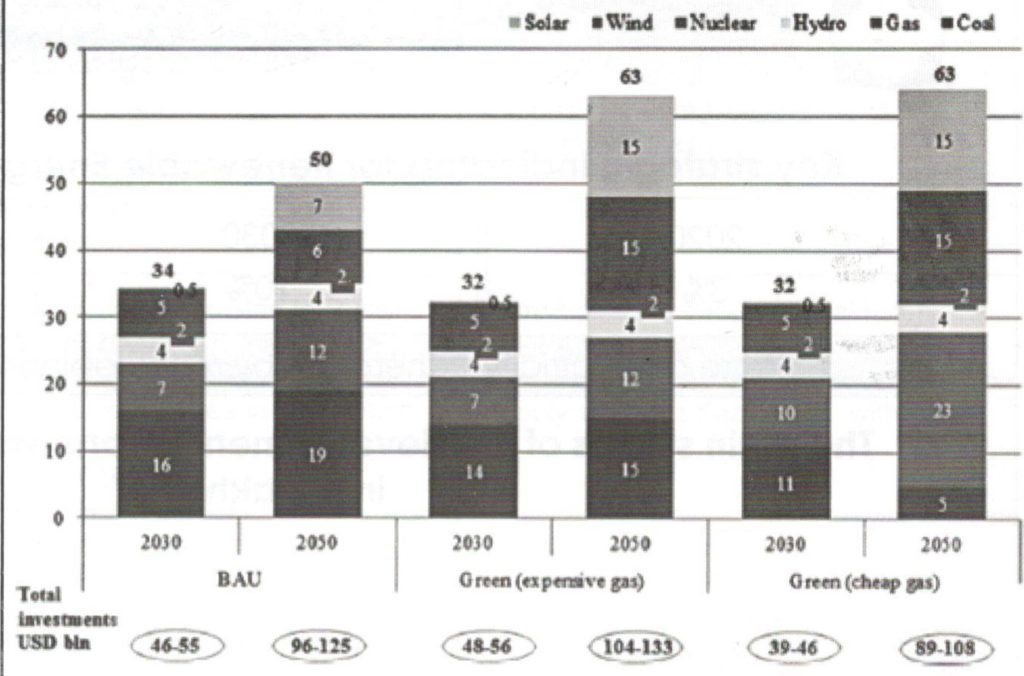

Green Economy

Green Economy is good macro economic policy of Kazakhstan. It projects the Green Economy will create 500,000 jobs and 1 percent GDP annually. The Kazakhstan 2050 strategy sets the goal for 50 percent of Kazakhstan’s energy consumption to come from renewable and alternative energy sources. Kazakhstan’s Green Bridge Initiative (KGBI) addresses sustainable resources development in the areas of green growth, low carbon development, climate change. It will decrease GHG emissions by 15 percent by 2050, both equaling 1992 levels.

Kazakhstan is striving hard to maintain its status as a big player in the regional and international energy markets. It is also developing its capacity in renewables energies as alternative energy source.

| Pipeline | Direction/Capacity | Details |

| Central Asia Centre (CAC) | The eastern part origins from south- eastern Turkmenistan (2.2 tcf), western part from Turkmen Caspian coast (120 bcf). They link up at Beineu in Kazakhstan and go to Alexandrov Gai in Russia. | Two branches controlled by Gazprom. Exports gas from Central Asia to the Russian gas system. |

| Bukhara – Ural | Uzbekistan via Kazakhstan to Russia. Capacity of 706 bcf. | Transit pipeline through Kazakhstan. |

| Bukhara Gas Region-Tashkent- Bishkek-Almaty (BGR-TBA) | From the Bukhara area in Uzbekistan to Kazakhstan with a link to Kirgizstan. Capacity of 160 bcf. | Supply southern Kazakhstan with gas. |

| Kazakhstan-China (also known as Turkmenistan-China gas pipeline) | From Turkmenistan, along BGR-TBA to Almaty and China. Export capacity of 30 bcm to China, 10 bcm for domestic use. | First line commissioned in 2009. Supply China with Turkmen gas, and can supply China with Kazakh. Expansion is planned. Section two, Beineu-Shymkent is expected finished in 2015, with a capacity of 10 bcm. Development financed by China. |

Hydro Power

Hydro power accounts for approximately 13 percent of Kazakhstan’s total generating capacity delivering around 7.78TWh from 15 large (450 MW) hydro-power stations with a total capacity of 2.248GW. Hydropower Hydropower’s major contribution to electric power generation in Kazakhstan dates back to the Soviet era when it played a major part in efforts to increase the Soviet Union’s energy potential. They generate around 8 TWh per year, equivalent to about 8 percent of power generation. More recently, a few small and medium scale hydropower plants have been developed. These are attractive in terms of cost, speed of construction, reliability and reduced environmental impact.

| Hydro Power Stations | Capacity |

| Large hydro power plants | |

| Bukhtyrma | 750 MW |

| Shulbinsk | 702MW |

| Ust-Kamenogorsk | 315 MW |

| Kapshagai | 364 MW |

| Moinak | 300 MW |

| Shardarinskaya | 104 MW |

| East Kazakhstan | 349 MW |

| Almaty | 421 MW |

| Zhambyl | 175 MW |

Solar Power

Kazakhstan’s solar power potential is estimated at 3.9 to 5.4 TWh, or around 5 percent of annual power consumption. There is high solar irradiance in most regions of the country, but as Kazakhstan is located in the northern hemisphere, the general trend is to develop the solar sources in the south, such as in the Burnoye area near Shymkent, which addresses imbalances in the energy net work. Although the current installed solar power capacity in the country is getting momentum, the number of fully permitted and ready-to-build projects is predicted to rapidly increase from 2015. According to the Ministry of Energy’s Plan of Activities for Alternative and Renewable Energy, about 28 solar energy projects are scheduled for operations by the end of 2020, with a total installed capacity of 713.5 MW.

EBRO & Utility Scale Projects

Many utility-scale projects have been realized in Kazakhstan both with the backing of the European Bank for Reconstruction and Development (EBRO): The 50 MW Burnoye Solar-1, in the southern region of Zhambyl, and a 50 MW wind power park near the capital Astana. EBRO is currently co-financing the expansion of Burnoye 1 by another 50 MW, and the construction of the 50MW Baikonur Solar Park in the Kyzylorda region in the south of the country, close to the border with Uzbekistan. The Baikonur Solar Park will also be co-financed by the Clean Technology Fund and Asian Development Bank in a first joint international renewables project.

Kazak Energy Ministry (March 2018)

In March 2018, the Kazak energy ministry unveiled details of the planned series of auctions, allocating a total of 1 GW of large scale renew able energy capacity, including 290 MW of solar PV. Auctions planned for May, August and October will allocate not only capacity but also projects in specific regions. In fall 2018 Audi tax Management is planning to take part in the auction.

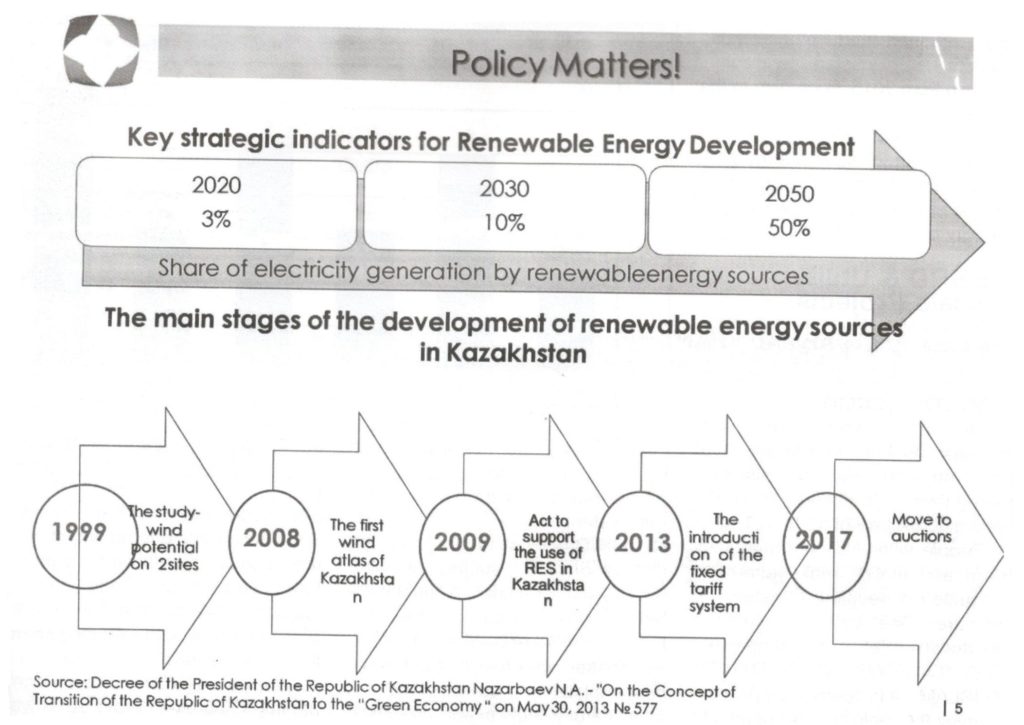

President Nursultan Nazarbayev

President Nursultan Nazarbayev unveiled his strategy to modernize the economy. Under his plan, the share of renewable sources in electricity generation should increase from 1 percent to 3 percent by 2020, to 10 percent by 2030 and to 50 percent by 2050. The country has introduced fixed feed in tariffs and a number of incentives, including grid access and tax exemptions. In 2017, Kazakhstan hosted a World Expo under the slogan “Future Energy” in an attempt to improve the international image of the country, and to attract investors and high technology.

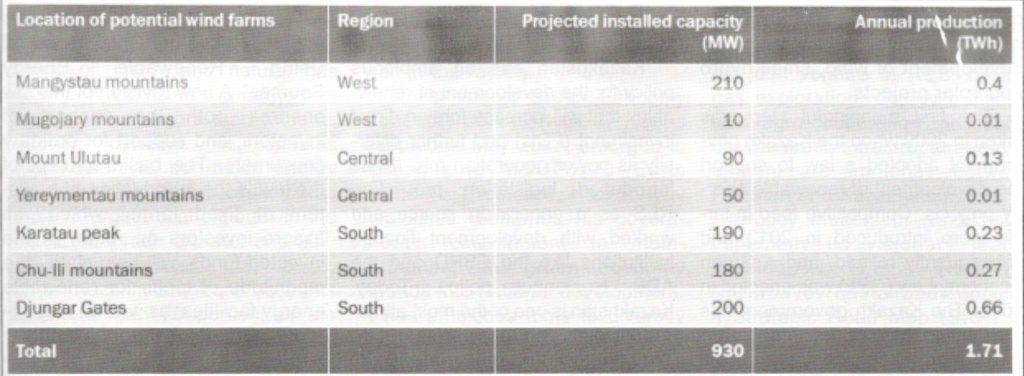

Wind Energy

Kazakhstan’s geography makes it suitable for the development of wind energy. Roughly 50 percent of the country’s territory has average wind speeds of 4 to 6 meters per second, suitable for energy generation. The most promising areas include the northern and central region, as well as the Caspian Sea region. Nevertheless, in order to access these abundant resources, fundamental work in understanding the potential, and outlining the policy challenges need to be initiated.

Wind power has the potential to produce 25 times more energy in a year than Kazakhstan’s current production from hydrocarbons. It is estimated that 10-15 percent of the land in Kazakhstan has average wind speeds or over 6 m/s making Kazakhstan prime for an increase in wind power. Wind power will play a large part of the 2020 goal to expand the renewable energy generating capacity to 1,040 megawatts from 110 megawatts last year.

One of Kazakhstan’s powers companies Samruk-Energy JSC was recently awarded a $94 million loan from the Eurasian Development Bank to build Kazakhstan’s largest wind farm. The project will produce 172 million kilowatt/ hours of electrical energy per year, save more than 60 million tons of coal, and reduce emissions of greenhouse gases.

Kazakhstan is a suitable country for the production of wind energy having wind energy capacity of 760 GW. According to many regional as well as international reports 50 percent of total territory has average wind speeds suitable for energy generation (4-6 m/s) with the strongest potential in the Caspian Sea, central and northern regions.

Bioenergy

Kazakhstan has 76.5 Mha agricultural land, 10 Mha forest and 185 Mha steppe grasslands providing abundant biomass wastes and residues which have the potential to generate a range of bioenergy services. It has been estimated that electricity generation potential in Kazakhstan from biomass is 35 billion kWh per year and heat generation potential is 44 million Gcal per year. Various external funding agencies have supported the development of biogas initiatives including the Biagas Training Centre at the Eco-Museum in Karanga (2002- 2003) and the ‘Azure Flame’ Central Kazakhstan Biagas Education Centre (2004-2005).

Significance of the Astana Expo 2017

The Astana Expo 2017 granted the country more “global recognition and respect.” With its theme of “Future Energy,” the Expo demonstrated the Kazakh government’s purported commitment to green energy solutions as part of a broader national development strategy. It showcased its true potential in terms of renewables and attracted many national, regional as well as international investors to make investments in the sector of RES. The government of Kazakhstan also announced an economic transformation centered on sustainable development, greater foreign investment, and a push toward renewable energy.

National Concept for Transition to a Green Economy

In 2013, Kazakhstan adopted the “National Concept for Transition to a Green Economy up to 2050” outlining a future development path guided by green energy policies. The ambitious plan aims to increase the share of renewable energy in electric power generation to 30 percent by 2030 and 50 percent by 2050. Foreign investors, such as the European Bank for Reconstruction and Development, are funding several high-profile pilot projects in the north and south of the country. As part of the Kyoto Protocol, Kazakhstan vowed to reduce carbon emissions by 15 percent by 2020 and up to 30 percent by 2050.

Kazakhstan is also the leading proponent of renewable energy in Central Asia, it has been home to conventional renewable energy sources (RES), primarily large hydro and geothermal projects, since the Soviet era. But in the late 2000s it began to pursue more liberal policies designed to make use of the country’s fortuitous topological conditions for the development of wind, small hydro and solar projects.

The first meaningful step was taken in 2009 when the Kazakh government adopted a law to support the development of renewable energy projects. Competitive feed in tariffs were introduced in 2013 and subsequently refined, and a Green Economy Law (GEL) was enacted in 2015. The Kazakh government has also set ambitious decarbonization and energy efficiency goals: it intends to make RES 50 percent of its power generation mix by 2050 and to increase energy efficiency in heavy industry, the largest source of C02 emissions in Kazakhstan, by 3 percent annually.

Along the way, the Kazakh government has worked closely with a number of development finance institutions (DFI) such as the European Bank for Reconstruction and Development (EBRO) and the Asian Development Bank (AOB) to bring its policies in line with international standards. It is a giant step towards energy diversification and development of renewables in the country.

Kazakhstan’s geography is suitable for the development of RES. More than 50 percent of the country, particularly in the country’s northern regions, have average wind speeds of between four and six meters per second, making them suitable for utility scale wind farm development, where as southern Kazakhstan receives consistently high levels of solar irradiation. Moreover, Almaty is located in the country’s extreme south and far from the majority of Kazakhstan’s existing power generation fleet. Developing new capacity from RES in both the north and south could limit the need to transmit electricity over large distances, reduce efficiency losses and eliminate mandatory electricity imports from other states in Central Asia.

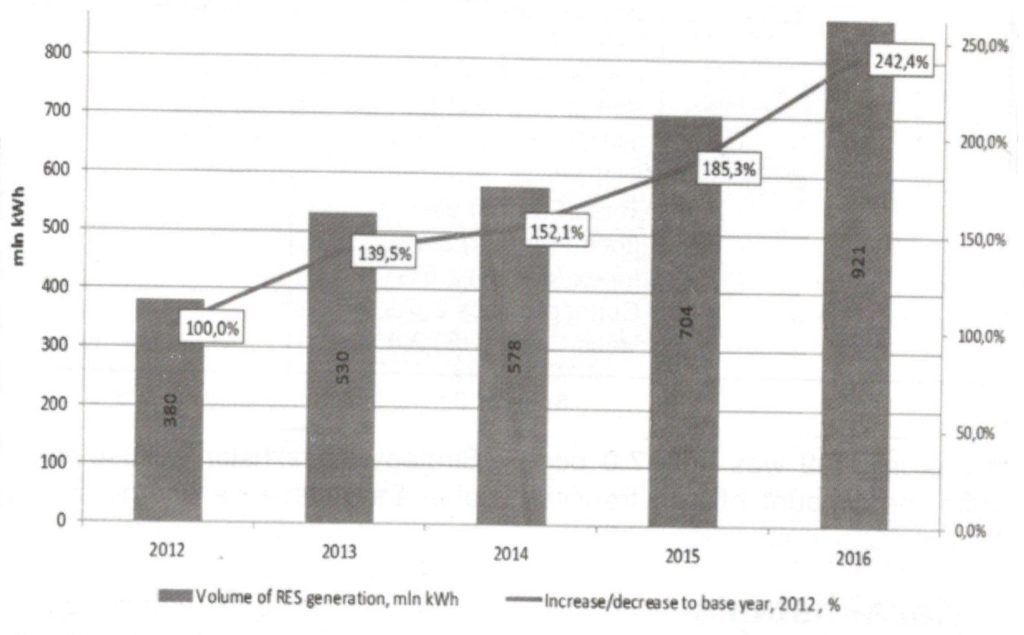

RES & Kazakhstan: A Way Forward

Kazakhstan has an ambitious policy for the development of renewables that will increase foreign direct investment (FDls) and further diversify its power generation mix. It has introduced legislation promoting RES as a generation source and worked with development finance institutions like the EBRO and the ADB to enact policy. Today, Kazakhstan is one of the most attractive markets for renewable energy. The country is actively developing its legislation in this field. Kazakhstan Ministry of Energy plays a key role in renewable energy development.

According to the Energy Minister Vladimir Shkolnik, Kazakhstan expects to increase the share of renewable energy in the overall energy mix to a minimum of 3 percent by 2020. In particular, about 28 solar energy projects are planned to be put in operation until the end of 2020 with total installed capacity of 713.5 MW.

Green Tariff

Kazakhstan has adopted “green tariff’ which allowed the country to become an industry leader not only in Central Asia but also in the CIS as a whole. Moreover, it has also adopted the law “On Support of Using Renewable Energy Sources”. A new revision of this law ensures both the support of investors, and support for ordinary consumers. The basic concept of the law is the introduction of a system of fixed tariffs, which will assure investors on return of the invested funds, will help clarify the magnitude of tariffs for renewable energy facilities, as well as to guarantee the purchase of electricity through the establishment of settlement and financial center.

According to the Kazakhstan Ministry of Energy it already has 44 objects producing renewable energy with total capacity of 227.52 MW, which includes 55 MW solar power plants, 53 MW of wind farms and 119 MW of small hydropower stations. Also one biogas plant with a capacity of 0.4 MW already operates in Kazakhstan.

Concluding Remarks

Kazakhstan is a real champion of energy reserves in Central Asia and CIS. Kazakhstan is a very large producer of all fossil fuels. Kazakhstan was the 10th largest coal producer in the world. It also ranked among the top producers of crude oil (16th) and natural gas (23rd). Kazakhstan’s energy pro duction covers more than twice its energy demand. It enables Kazakhstan to be major energy exporter. In 2016, the country was the 7th largest coal exporter in the world, 12tti rude exporter and 20th natural gas exporter.

In Kazakhstan, coal accounts for more than 70 percent of the electricity production followed by natural gas (19 percent). Renewable energy accounted for 9 percent of electricity generation (0.2 TWh from solar and wind, 9.3 TWh from hydro).

Kazakhstan possesses one of the largest energy potentials in the world and strives to establish stable structure of the global energy security, which is built on the principles of justice, balance of interests of both supplying countries and transit countries and consumers. Energy cooperation based on beneficial and long-term partnership, formed on the basis of common principles and rules, is a condition of steadfast development of the world community.

It has a comprehensive energy policy which stipulates its national economy. It caters its energy demands and creates balance even in supplies mechanism. Its energy policy is the ideal combination of energy security, energy efficiency and of course energy diversification. It enhances national as well as regional connectivity. It utilizes its vast energy reserves for regional development. It supports greater socio economic prosperity in the region and beyond. The energy policy is very attractive and provides a befitting proposition for both the producers and consumers. It gears up channels of production as well as supports massive industrialization in the country as well in the region.

Kazakhstan’s Green Economy Concept policy (KGECP) was adopted in May 2013, emerged in response to the Rio+20 ‘ Earth Summit’. President Nazarbayev has since reaffirmed his government’s commitment to main streaming the green economy agenda into national development. It has ambitious aims to diversify the economy with alternative, cleaner sources of energy that will transform its agricultural and industrial sectors and motivate economic drivers of green development. It shows sustained political commitment, significant long term investments and a range of other enabling conditions.

Kazakhstan ‘s energy policy facilitates its macro-economy due to which it has been achieving highest GDPs percentage in the Central Asia and the CIS since its inception. Immense social development has been the resultant of its unparalleled growth in oil & gas sector. It has been one the main reasons in reduction of poverty in the country. It supports infrastructural development in the country. Its oil & gas reserves are the life line to national as well as regional human survival as well as industrialization. It cements concept of energy security and efficiency in the region. It is playing a significant role in the massive industrialization drive of China. It is one of the key players to achieve strategic development goals in the country.

Kazakhstan’s geographic imbalances are one the main rea sons of its greater regional connectivity in terms of energy cooperation with South East Asian Countries including Pakistan. Although the scope of greater bilateral relations in terms of trade & commerce, science & technology, joint venture in RES, oil and gas exploration, energy transmission, agro-cooperation and last but not the least, infrastructural development are immense between Pakistan and Kazakhstan.

Policy makers in Kazakhstan especially its visionary leader President H.E. Nursultan Nazarbayev has already outlined a Strategic Road Map (SRP) for the further development of oil & gas reserves as well as Renewables Energy Mix (REMs). His National Concept for Transition to a Green Economy up to 2050 reflects his strong commitments towards a safer and better world where climate change will be managed. It is a giant step to reduce carbon foot notes and achieving the concept of de-carbonization in the country. It is a right step in the right direction achieving the goals of “green economy”.

Kazakhstan has a vast potential for renewable energy sources. There is no shortage of wind and solar energy. According to Kazakhstan Ministry of Energy as of January 1, 2017, there are 50 enterprises operating in the country using RES with a total capacity of 295.7 MW (HPP139.8, WPP-98.2, SPP-57.3, biogas plants-0.35 MW). For 2016, the installed renewable energy capacity in Kazakhstan increased by 18 per cent. In 2016, 4 renewable energy projects with a total capacity of 50.39 MW were implemented; in 2017, 12 RES facilities with installed capacity of 114.25 MW were also implemented. The installed capacity of WPP increased by 37 percent up to 98.2.

The total capacity of renewable energy sources in Kazakhstan during will reach 490 megawatts. “In 2018 Kazakhstan intends to intro duce another 138 megawatts of renewable energy sources, 58 enterprises using RES are operating in the country, their total capacity is 352 megawatts. As a result of 2018, the total capacity of renewable sources in Kazakhstan will be about 490 megawatts.

According to Kazakhstan Ministry of Energy about 1.1 billion kWh of green energy was generated in Kazakhstan, 5 projects of RES with a total capacity of 35.6 MW were realized in Almaty and South Kazakhstan regions and in Astana in 2017. 1 gigawatts of capacity will be auctioned during 2018.

President H.E. Nursultan Nazarbayev 2050 provides policy framework to gradually lessen dependency on conventional energy resources especially oil & gas. Kazakhstan is blessed with conventional as well as non-conventional energy resources and mix. Its geography has a comparative advantage for the development of solar, wind and biomass energies in the region. Attractive tariff in the formation of green economy is one of the main rea sons for regional as well as inter national investors in the fields of renewables in the country.

There is an urgent need to reduce the emission of greenhouse gases and other pollutants, in the country which burns mostly fossil fuel, namely coal, oil, and gas. Resultantly, primary sources of energy are on the decline and get ting dried. The consumption of oil will increase by 15 percent, gas-by 38 percent, and coal by 5 percent. The relevance of developing alter native energy based on RES is caused by extremely high infrastructure wear and tear: 70 percent, generation capacities, 65 percent, electric networks, 80 percent, heating networks.

Kazakhstan has a significant potential for the development of alternative energy. The potential of wind energy is estimated at 760-920 GWh per year, which is 10 times higher than the current electricity consumption in the country. Northern Kazakhstan, where winds reach 7.5 m/s, is a promising area, as well as other ideal characteristics for the Aeolian Park, such as the Shelek Gorge, which is in 100 km from Almaty, Zhambyl district in East Kazakhstan Region, Mangystau Mountains in Western Kazakhstan, etc.

The hydro potential of Kazakhstan is estimated at 62 billion kW, which is 70 percent of the total consumption in the country. As for the potential of solar energy in the south ern regions of the country, it is about 2500-3000 thousand hours of sun shine per year, which corresponds to a capacity of 1200-1770 kW/m2 per year, and allows the southern regions of Kazakhstan to be competitive with the sunniest countries in the world. This is approximately 2.5 billion KW per year. The construction of a plant for solar panels production in Astana will also contribute to the development of solar energy.

Kazakhstan is a major energy supplier and contributor towards diversification of energy sources for the EU markets. Kazakhstan now supplies around 5-6 percent, of EU oil demand and meets more than 21 percent of the EU uranium demand.

Kazakhstan strives to give its unlimited energy resource potential to the disposal of the mankind, realizing the energy policy based on the principles of combined modernization of fuel and energy complex and diversification of energy supplies to the world markets.

Energy policy of Kazakhstan is based on diversified operationalization and channelization of energy resources, efficiency and saving of energy, optimal use of energy resources, energy security, investments, energy diplomacy, innovations and the last but not the least development of renew able or green energy resources. Moreover, increasing internal/ national production capacity to meet external demands, diversifying energy export routes, increasing export capacity, securing energy transportation and networks to external markets are also salient features of its energy policy.