The ongoing US-Turkey Trade War is the classic example of “power politics” where national interests are on top priority. US being a superpower and center of international gravity tries its best to use so-called ‘economic sanctions‘ to contain Turkey in the region, Middle East, South Caucasus, Central Asia and of course Asia. Emerging socio-economic, geo-political and geo-strategic trends within the region and beyond verify the “US Containment Policy” is in action to achieve the “mission impossible”. US is behaving like “wild wolves” as stated by Turkish President Recep Tayyip Erdogan and indeed the wolf is knocking at the door.

Protectionism Vs. Nationalism

A fierce battle of “protectionism” and “nationalism” is going on between the USA and Turkey. The US sweeping steel (50 percent) and aluminum tariffs (20 percent) has already deteriorated the true spirits of globalization and international trade system which is now at high risk. Diplomatic ties between the US and Turkey is right now at its lowest ebbs because of many complicated reasons/facts and most especially after the detention of US pastor Andrew Brunson on terror-related charges, sending the Turkish lira into free fall against the dollar in recent times.

Speculative Attacks

It is evident that Turkey has been targeted by an economic war perpetrated by the US administration through its influence on international market players. Speculative attacks against Turkey are being carried out to weaken its economy and financial markets. In the past, the same punitive speculative attacks had been used against Argentine, Brazil and even Spain not for pure economic reasons but ironically political.

Negative Role of US Federal Reserve Bank

It is feared that recent announcement of the US Federal Reserve Bank of tightening of monetary policy would badly affect a number of emerging markets including Turkey and Pakistan which will find themselves squeezed between rising borrowing costs, diminished capital inflows and a stronger US dollar, all of which will conspire to make the servicing of their dollar-denominated debts increasingly expensive and in some cases outright unaffordable.

US Sanctions on Turkish Ministers

The US imposed sanctions on the two key ministers of Turkey which deteriorated the diplomatic ties between the two NATO allies. Moreover, the US demand/order to get released it citizen allegedly involved in toppling of Turkish government and a diehard supporter of Fethullah Gülen has turned strategic priorities.

Rejection of Bail

A Turkish local court has already rejected the bail of the so called “man of faith” pastor Andrew Brunson, who faces charges of terrorism. Earlier the US authorities started “dirty blame game” by convicting Mehmet Hakan Atilla the deputy director general of Turkish lender Halkbank on charges of helping Iran evade US sanctions on billions of dollars of oil proceeds.

Consequences of Real Power Politics

Real power politics dominated over the economy and resultant was the free down fall of Turkish national currency “lira” which badly performed during 2018 i.e. 45 percent against dollar. Capital flight is on the rise and people feel insecure. Inflation (16 percent) is at its peak and price hike has become a monster in Turkey. The Turkish financial system is under immense pressure to support the quick revival of its macro-economy. Banking industry, stock exchange and the US-Lira exchange rate parity have fallen dramatically during 2018 resultantly; borrowing costs have risen.

IMF Chief (2018)

According to latest statement of the IMF Chief, the ongoing trade and tariff wars may create an international crisis in which the global economy may badly suffer. Similarly the WTO has also shown serious concerns about ongoing tit-for-tat economics-cum-politics at the international stage which would create serious repercussions in the days to come. Ultimately humanity will suffer. Ratios of poverty will be high and goals of sustainable economic development will be hard to achieve.

Boycott Dollar

In a televised speech, President Tayyip Erdoğan passionately requested his countrymen to boycott the dollar and convert their personal savings to national currency. Most of the people followed this advice but seemingly the economic crisis is too big to be managed through economics of humanity alone. It badly needs pure economic reforms and structural changes in the Turkish economic system.

Turkish Central Bank

Turkey ought to settle its high debt accumulated in foreign currencies. Moreover, the central bank must raise interest rates to support the currency. Subsequently, Turkish Central Bank has initiated many meaningful short terms policies to rescue its national economy and has promised to bail out the sinking companies and institutions. Turkish Treasury and Finance Minister Berat Albayrak has also assured that no foreign currency accounts will be forcibly converted to liras.

Turkey’s Alternative Plans

He also announced alternative plans for the revival of lira and boosting of national economy by trading in the national currencies with Iran, Russia, and Ukraine. Russia is also feeling the heat and apparently ready to “switch over” from dollar to Chinese “Yuan” as a reliable replacement for international trade and payments system. Iran has immediately supported Turkey in the time of crisis and even Qatar boldly announced investment of US$ 15 billion in Turkey which has somehow, left good impact on Turkish lira and economy as well. Pakistan’s Prime Minister Imran Khan also extended his support to Turkey which is embroiled in an intense dispute with the United States.

Bank for International Settlements (2018)

According to the Bank for International Settlements (2018) the amount of dollar-denominated debt in the world has nearly doubled to $11.4 trillion since the start of the recession of 2009, with emerging markets accounting for $3.7 trillion of the total increase. Between now and 2025, governments, companies and financial institutions in these countries will need to find a way to repay or refinance $2.7 trillion of this external debt mountain. Most recently, the US Federal Reserve Bank has announced to have a “tight monetary policy” which would make tougher to manage dollar-denominated obligations of all the Turkish as well as the international companies.

Current Status of Foreign Exchange Markets

It seems that foreign exchange markets have been stabilized because of diversified but integrated measures of the Turkish central bank and a pledge of $15-billion in direct investments by Qatar. But still the lira is down 40 percent to the US dollar during 2018 raising widespread concerns over the sustainability of the country’s sizeable dollar-denominated debts.

Turkey’s Befitting Response

Most recently, President Tayyip Erdoğan raised the levy on the US electronic commodities including passenger cars by 120 percent, on alcoholic drinks by 140 percent and on leaf tobacco by 60 percent. Tariffs were also increased on goods including cosmetics, rice and coal which showed Turkey’s political strong will to fight against all odds and international pressure. It is now evident that the Trump administration will intentionally delay the delivery of F-35 to Turkey. The ongoing trade war has entered into the personal lives of the people. There may be a battle between US Apple and Turkish Venus in the days to come. Turkish Airlines has also bluntly announced on Twitter that it would join a campaign circulating on social media with a hashtag #ABDyeReklamVerme [don’t give ads to America].

Turkish Industry and Business Association (TUSIAD)

The Turkish Industry and Business Association (TUSIAD) and the Union of Chambers and Commodity Exchanges of Turkey (TOBB) stressed the need to use diplomatic channels to resolve the ongoing stand-off and eye-ball-to eye-ball situation between the US and Turkey. According to Turkey’s state-run news agency and US officials, US National Security adviser John Bolton had met with the Turkish ambassador to Washington and discussed the ongoing situation which produced “feel good” gesture in the financial markets and lira stabilized somewhat near record lows. It was up 10 percent during this week at 6.05 per dollar.

Before the US sanctions, Turkish business people were working on a new strategy to boost sales to the United States. The plan involved the creation of a Turkish industrial zone in the United States where unpackaged food products from Turkey would be packaged and put on the market. The exportation of goods in bulk was meant to duck tariffs and make Turkish products more competitive in the US market. The Turkish American Business Association (TABA) was leading the effort to establish the industrial zone, which would be the first of its kind for Turkey in the United States.

The association was already in contact with governors’ offices and organized industrial zones in all of Turkey’s 81 provinces to find entrepreneurs willing to invest in the US project. Some 170 business people have so far applied to join the initiative, which hopes to attract 500 entrepreneurs. Things have changed after the US sanctions.

Turkish Treasury and Finance Minister

Turkish Treasury and Finance Minister Berat Albayrak has also announced the “New Turkish Economic Model” based on the new set of economic steps aimed at securing an economic growth of three to four percent in 2019 and decreasing the inflation rate to single-digits by virtue of which the current account deficit would be balanced around four percent. The ministry added that it would continue to take steps to cut the budget deficit to around 1.5 percent of the country’s GDP. Moreover, the Treasury’s debt rollover ratio will be reduced below 100 percent. The minister also announced a workable plan to target a non-interest surplus of $925 million (5 billion Turkish liras) by the end of 2018 through savings and income-generating measures.

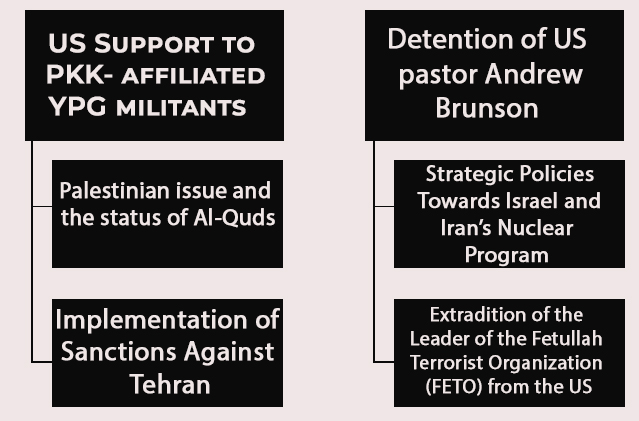

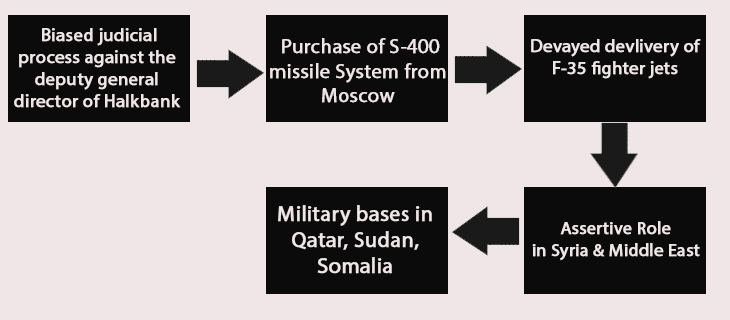

US-Turkey relation has been deteriorating due to many complicated reasons which are not confined to the US support to PKK-affiliated YPG militants in Syria; the detention of US pastor Andrew Brunson, the Palestinian issue and the status of Al-Quds; strategic policies towards Israel and Iran’s nuclear program; implementation of sanctions against Tehran; extradition of the leader of the Fethullah Terrorist Organization (FETO) from the US; the biased judicial process against the deputy general director of Halkbank; Turkey’s intensifying strategic relations with Russia; purchase of S-400 missile system from Moscow and the delivery of F-35 fighter jets to the Turkish Air Force.

Turkish Probable Strategies

(a) Pouring extra/excess liquidity in the markets & Strict control of capital flight

In the ongoing trade war the Turkish government must take serious steps to overcome the freefall of its national currency lira by pouring extra/excess liquidity in the markets. Strict control of capital flight may also be suggested to control the elements of “speculative attacks” in the stock exchanges and banking industry too. Sincere national response and the government’s assurance of foreign currency account holders would be catalyzed.

(b) Regulate Foreign Exchange Markets

The Turkish Central Bank must also initiate short as well as long term policies to stabilize lira and the regulate foreign exchange market liquidity management. Financial stability must not be derailed by providing extra liquidity to the banks to sustain the effective functioning of markets. The CBRT provided extra liquidity amounting to 10 billion TL ($6 billion) and $3 billion equivalent of gold liquidity to the national financial system.

(c) Channelization of Turkish Domestic Savings into Investments

Proper channelization and optimization of domestic savings may be useful to boost Turkish Economy. Attractive schemes in the banks would be an effective tool.

(d) Say No to Cheap Credit/Money Supply Chains

Turkey was one of the main beneficiaries of regional and international tidal wave of cheap money which is now over due to many complicated socio-economic and geo-political overlapping reasons. Provision of cheap money/credit fueled a construction boom in Turkey during the last one decade which rapidly transformed the skyline of Turkey’s main cities and sent its economy soaring to new heights, making it one of the most rapidly expanding emerging markets in the world.

Negative Impacts of Cheap Credit/Money

Cheap credit/ money has also produced negative impacts in Turkish economy due to which it piled up large dollar-denominated debts. According to Wall Street Journal (2018), almost 90 percent of loans to Turkish real estate companies belonged to cheap credit/ money supply chains. Turkish real estate companies contributed 20 percent of the country’s economic growth in recent years were denominated in foreign currencies. Since the earnings of these firms are mostly in domestic currency, the fall of the lira makes it increasingly difficult for them to service their debts.

Institute of International Finance (2018)

The Institute of International Finance estimates that the foreign-currency debt of Turkish firms, financial institutions and households now stands at 70 percent of annual economic output. It is feared that Turkey’s banks would be in precarious position in the days to come by having over $100 billion in external debts.

European Banks Risk

Moreover, the European banks that carry the largest exposures to Turkish borrowers would be in the line of fire. The EU banks have already concentrated in Spain ($82-billion), France ($38-billion) and Italy ($17-billion) and another financial loss in Turkey may put the EU banking industry at potential risk. It is also estimated that if Turkey’s economic meltdown does not stop, currencies of India, Pakistan, Argentina and South Africa would also feel the heat in the days to come. Some markets in sub-Saharan Africa like Angola, Ghana, Ethiopia, and Mozambique have also been identified as highly vulnerable. The same even holds for more developed economies like Chile, Poland and Hungary, all of which carry relatively large foreign-currency debts in excess of 50 percent of GDP.

Concluding Remarks

The ongoing trade war between the US president Donald Trump and Turkish president Recep Tayyip Erdogan has unleashed a diplomatic firestorm between the two countries. It is indeed a prime example of power politics where associations, affiliations, allies and friends have nothing to do only “Vested Interests” rule the game of engagements and the world.

The ongoing tussle is a complicated issue and the detained pastor Andrew Brunson is not solely responsible for it. The US dissident role and support for the Gulenist Movement is also one the main reasons behind deteriorating diplomatic ties between the two countries. The US appears to be applying a policy of ‘containment’ against Turkey with the aim of reducing its growing geopolitical presence in the Middle East and, possibly, frustrate its recent rapprochement with Russia. US president is particularly concerned about Turkey’s good relations with Iran and Qatar, its role in the Syrian Civil War and its escalating dispute with his most important Arab ally, Saudi Arabia.

Turkey has adopted a more ambitious foreign policy than its traditional Western-oriented diplomacy before 2002. Under Erdogan, Turkey has been asserting its political independence and seeking to combine NATO membership and EU ties with greater involvement in the Middle East. Its normal relations with Iran have been a major irritant for Israel, Saudi Arabia and the US. Turkey‘s role in the Syrian Civil War especially its opposition to the upgraded role given to the Kurds by the US, have been a further source of tension with Washington, Tel Aviv and Riyadh. Also, its vocal stance on the Palestinian question has been another source of similar discomfort.

Moreover, some daring actions of Turkey i.e. stationing of Turkish troops in Qatar, establishment of military bases in Somalia and potentially Sudan has created sense of insecurity for the UAE and Saudi Arabia due to which the US has now used “lobby of interest” as described by Turkish president a tool to contain Turkey in the region and beyond.

The US support to PKK-affiliated YPG militants in Syria, the detention of US pastor Andrew Brunson, the Palestinian issue and the status of Al-Quds, strategic policies towards Israel and Iran’s nuclear program; implementation of sanctions against Tehran, extradition of the leader of the Fethullah Terrorist Organization (FETO) from the US, the biased judicial process against the deputy general director of Halkbank, Turkey’s intensifying strategic relations with Russia, purchase of S-400 missile system from Moscow and the delivery of F-35 fighter jets to the Turkish Air Force are some of the key actors for the deteriorating diplomatic ties between the two countries.

It is feared that Trump’s trade war with Turkey could spark off a global currency crisis. As a result, the French and Italian governments, whose banks are exposed to the Turkish market, would prefer a speedy resolution to the crisis. Turkey claims to have received positive assurances from President Macron about his commitment to the stability of the Turkish economy. At the same time, Germany is opting for a more cautious approach. Although it, too, has an interest in avoiding the spread of the crisis to the Eurozone, Chancellor Merkel has a more complex set of priorities to balance. From her early moves, it appears that she prefers to facilitate a negotiated settlement between her two NATO allies, but in so doing, she would probably try to avoid clashing with the US President over this issue.

Switching trade to other currencies which the Turkish President publicly called for is something that cannot happen overnight. Such a strategy would require a great deal of preparation and collective planning involving several committed economies. But somehow swapping of national currencies of other countries like Pakistan, Iran, Russia, Qatar, China and even Ukraine must be accelerated. There is an urgent need to institutionalize tight monetary policy in the country. Search of new allies within NATO, the Europe Union (EU), Middle East, Gulf Cooperation Council (GCC) and South East Asia may stimulate Turkish Economy.

In the short and medium term, what could sustain the Turkish economy is a combination of smart diplomacy and the possible containment of Trump’s unilateralism by the EU. Several reports indicate that French, Italian, Spanish and to a lesser extent German banks are fairly exposed to the Turkish market. Consequently, if the US extends its trade war with Turkey, a further fall in the rate of the lira could force Turkish businesses to default on their European creditors, thus spreading their national crisis to the whole of the Eurozone. That is why Erdogan has turned to France and Germany. For the same reason he also made other gestures of good will toward the EU, like the recent release of the two Greek soldiers which European Commission President Jean Claude Juncker had urged him to do.

Recep Erdogan has a strong charter which may be used for rescuing the Turkish economy. Being expert on Turkey it is my humble suggestion not to prolong on rhetoric but conflict of resolution may be a good and timely option for Turkey as well as the US. Diplomatic engagements, dialogue and development in right direction would be mantra of both the countries.