Dear Readers,

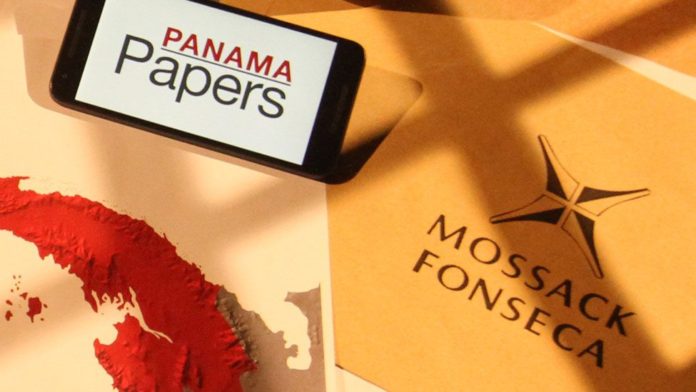

Last year the “Swiss Leaks”, a veritable “Who’s who” of over 100000 clients globally holding 30000 accounts with HSBC in Geneva revealed massive tax avoidance. Now we have the Panama Papers, a massive leak of 11.5 million files from the database of a single offshore law firm, Mossack Fonseca wherein Is shown how the rich can exploit secretive offshore tax regimes. Among those holding offshore tax havens are national leaders, politicians, their families and close associates, businessmen, celebrities, industrialists, etc. In Pakistan it stirred up a storm as three of Prime Minister Nawaz Sharif ‘s children were named (220 other Pakistanis also made the list). While the PM himself has done no wrong, having companies in the name of his children has raised eyebrows and some tough questions are being asked, with the Opposition and other political parties calling for an impartial investigation and a forensic audit for answers. The use of offshore structures is entirely legal, people may use offshore for reasons of inheritance or estate planning or when a public figure may want to purchase property without divulging ownership. But when such large funds are secreted abroad and are unaccounted for, suspicions will rise that these were generated through unlawful activities and that they were transferred out of the country to evade taxes. The Sharif family has said its offshore companies are legitimate since the PM’s sons are not living in Pakistan and are not liable to pay taxes here; that might be true, but they will have to prove beyond doubt the source of all that money and whether it has been taxed. For the benefit of Readers I am reproducing my article titled “TARGITTING ILLEGAL MONEY”.

The Panama leaks brought out in graphic detail the lack of understanding in Pakistan of how multi-national companies (MNCs) and individuals evade taxes, hide illegal wealth, engage in money-laundering, etc. (called “illicit financial flows” (IFFs)). Well known chartered accountants are busy explaining on primetime TV shows how offshore companies and their off-shore accounts are “legal”, reluctantly conceding that they are invariably used to hide illegal financial flows (IFFs). They conveniently forget to mention that an offshore account without an offshore company cover is totally illegal meant to facilitate IFFs. The more prestigious the chartered accountant firm the greater their capacity to manipulate the avoidance of paying due taxes by their clients.

Media persona Arshad Sharif has done an outstanding job, bringing the missing pieces of the financial scam into the public domain despite our motivated “experts” deliberately fostering confusion on behalf of vested interest. With fast-paced technological advances, manually conducting of forensic audits to catch white-collar criminals has morphed into state-of-the-art methods of investigation, the process speeded up by electronic means. Procedures for examining hard drives of suspects’ computers, DNA analyses, etc., found mostly in the technologically better equipped nations are more adept at accepting change.

Globalisation requires co-operating real-time on a fast-track and co-ordinated basis using all the means and resources available to root out corruption along with the Global Agenda Council (GAC) on “Anti-Corruption and Transparency”, the World Economic Forum (WEF) set up the ‘Partnering Against Corruption Initiative’ (PACI) in 2004 as a global multinational, multi-industry, multi-stakeholder anti-corruption initiative that is multi-beneficial because it is multidimensional. By raising business ethical standards PACI aims at contributing to a competitive, transparent and accountable business society. The PACI website says, “Corruption is widely recognised as a major obstacle to the stability, growth and competitiveness of economies.” Interestingly on being inducted into the Council in the WEF’s GAC 2014 meeting on “Anti-Corruption and Transparency” in Abu Dhabi, Panama Vice President Isabel De Saint Malo de Alvarado, also Panama’s Foreign Minister, vowed to clean up Panama’s act.

Highly trained investigators looking for clues and evidence in the background of the accused use a range of tools including surveillance, records checks, informants, etc., to help solve crimes. Companies can tap into a global network of resources, supported by cutting edge intelligence and information technology for surveillance, due diligence, forensic accounting, undercover financial investigations, fraud, asset searches, etc. Investigations include alleged violation of laws, by non-disclosure of means of income and assets, allegations of bribery and financial mismanagement including kickbacks, money-laundering, internal control lapses and other financial improprieties, etc.

Money-laundering converts the proceeds of crime into legitimate money and/or assets using various means. Established in 1989 to combat money laundering, Financial Action Task Force (FATF) co-ordinates the work with a number of international and regional bodies. The integrity and fairness of the US system of taxation is based on the premise that all income is taxable, including any income illegally earned by fraud or through money-laundering. Unable to get witnesses against Al Capone’s many heinous crimes, the law enforcing agencies ultimately got him for money-laundering and tax evasion. Today’s sophisticated white-collar crime demands a comprehensive financial analytical ability in tracking the money wading through complex paper and computerised financial records. Links between terrorism, transnational organised crime, international drug trade and money-laundering came to light after the 9/11. In September 2001, the United Nations Security Council unanimously adopted Resolution No 1373 as the international response to counter terrorism and terrorist financing.

Most of our problems about witness credibility can be traced to an easy willingness to tell lies, even under oath with impunity, forge documents, and erase, alter, deface, mutilate, etc. evidence as may be required. False representation of facts and distortions, ‘outright lies’ is the order of the day, a “perjurer” being a criminal acting either for personal monetary gain or otherwise. Moreover lawyers must satisfy themselves they are not presenting false evidence to try and exonerate their clients, accounting firms must ensure money not being diverted for bribes, etc., otherwise they should be blacklisted.

World organisations like the UN’s Office of Internal Oversight Services (OIOS) assists the Secretary-General in investigating all activities under his authority through audit, investigation, inspection and evaluation services. UNDP’s Office of Audit and Investigations (OAI) collects and collates factual and evidentiary basis for appropriate action. All investigative findings are based on facts and related analyses; these include reasonable inferences. Procurement officers in UN entities (both expatriate and Pakistani) in Pakistan get away with blatant corruption by cleverly manipulating the awarding of contracts by sleight-of-hand processes (in one particular contract at 30% more cost to the UN), this include concealing facts and/or deliberately obfuscating them. Instead of holding them accountable, their bosses are forced into a cover-up.

Despite effective laws for anti-money laundering and countering financing of terrorism (AML/CFT) in line with an action plan agreed with FATF, this continues to be a serious problem in Pakistan. Without effective implementation of laws, we cannot conform to international standards. To its credit State Bank of Pakistan (SBP) is putting in electronic measures having a bio-metric electronic footprint to eliminate “Hawalas”. It is almost impossible to prove a crime in court without conducting a thorough investigation while our methods of investigation remain outdated, invariably political influence waylays criminal investigations.

The pursuit of accountability is a zero-sum game; unfortunately political nuances and self-interest compromises its implementation. “Democracy” is a camouflage for the criminals using unscrupulous chartered accountants to hide their illegal money stashed abroad in banks and assets while soldiers die for their country in the Shawal Mountains, Fata, Swat, etc. Unfortunately those ordering those soldiers into situations embracing “Shahadat” still salute those looting the country in the name of the “Constitution”. Consider the irony of Zardari lecturing us on the Constitution while “Mr. Constitution” himself, Senator Raza Rabbani, who “hears no evil” and “sees no evil” about the rampant corruption about his boss, frequently threatening the Army with Article 6. A Constitution that facilitates the looting of the countries till in the name of democracy is a meaningless piece of paper.

The public perception is that the PM’s visit to London, setting off turmoil in PML (N), is medico-legal (signing some legal papers for Panama leaks for “damage control” which requires his physical presence), and for formulating a joint anti-accountability strategy with Zardari to thwart targeting of their illegal money. Those having the power to correct things must not sit on the Constitutional fence anymore; they either face up to their moral obligations or gracefully give way to others who can.