China has effectively checkmated American “Pivot to Asia” rhetoric by mobilizing the support of 57 countries for its economic venture, Asia Infrastructure Investment Bank (AIIB). We in Pakistan welcome the setting up of AIIB and view it as an instrument of regional development. At the same time caution is due for AIIB, it should watch out for the overt and covert behavior of its competitors as some of them are known for scuttling such initiatives by making them controversial by attaching negative tags of money laundering, drug trafficking etc.

AIIB will be an important platform to channelize abundant savings available in the region into investment to help regional economies achieve sustainable and rapid development. Energy and communications infrastructure development is much needed in the region and AIIB aims to cater to these needs of the region and complement the availability of monetary resources in the region. Developing countries have taken a sigh of a relief as they expect better treatment from this new entrant. Pakistan has seized the opportunity by being the founding member of the Bank and has signed the articles of agreement (AoA). Pakistan also hopes to draw financial support for communications and energy infrastructure projects including projects for construction of roads, dams and power generation.

AIIB shall have an equity of $100 billion. Pakistan has been actively involved in the consultations at all levels and after intensive consultations amongst the members the AoA signing was made possible in a short span of nearly eight months since the MOU on establishment of the AIIB was signed in October 2014. The bank is a regional entity with a legal status of treaty.

AIIB shall launch with China having a 30.4 percent share of the equity, followed by India (8.5 percent) and Russia (6.7 percent). The two notable absentees are the United States and Japan. Key NATO allies of the US like Germany, France and the United Kingdom, have opted to join the AIIB. AIIB limits the influence of large shareholders because 15 percent of voting rights are allocated equally to founding members regardless of equity stakes. Though China’s stake is over 30 percent, its voting share is 26 per cent. Pakistan shall have 1.05 percent share and 1.06 percent voting rights. “China does not seek veto authority in the bank”, said Chinese Deputy Minister of Finance Yaobin Shi.

The bank would be operational by the end of this year. The AIIB can be construed as a natural international extension of the infrastructure development vision that has sustained rapid economic growth of China since the adoption of economic reforms. It stems from the notion that long-term economic growth can only be achieved through massive, systematic, and broad-based investments in infrastructure assets in contrast with the more short-term “export-driven” and “domestic consumption” development models.

Pakistan has embarked upon a gigantic venture of China-Pakistan Economic Corridor (CPEC) and other infrastructure projects requiring huge financial resources, and hopefully the AIIB would come handy in borrowing on affordable rates. CPEC involves a cluster of communications infrastructure and power generation projects that would provide an integrating platform for over three billion people in Central, West and South Asia, the Middle East and Africa Regions. The increase in financial flows, investment, trade, digitalization etc would bring peace and prosperity to the region, enhance the competitiveness of the economies of these countries, contribute to reducing regional disparities and social inequality, and improve life expectancy and quality of life in Pakistan and in the region. They way trade flows in and out of Asia would stand greatly altered when CPEC projects materialize.

Setting up of AIIB by the states representing 5 continents may be the first step towards reducing the IMF and WB monopoly on the world financial system. IMF and WB policies are responsible for the current economic instability in the world. Taking advantage of this evolving opportunity, Pakistan should diversify its borrowing, benefit more from the AIIB and bring its dependence on IMF and WB within manageable limits.

The US and Japan have declined to join the China-led economic outreach project, citing concerns over debt sustainability, environmental protection and governance. There are also misconceptions that Beijing could use the AIIB to push its own geopolitical and economic interests as a rising power. According to the Articles of Agreement, “regional countries” such as Asia and the Middle East region will shoulder 75 percent of the total capital base while “non-regional countries” such as European nations will contribute the remaining 25 percent.

The AIIB will symbolize China’s rise as a financial superpower, guiding the world’s biggest infrastructure financing institution. Whatever their reservations about China’s financial rise, most countries see it as a fact of life that cannot be stalled by staying out of the AIIB. They would rather be inside it, getting a share of the infrastructure orders that the AIIB will finance.

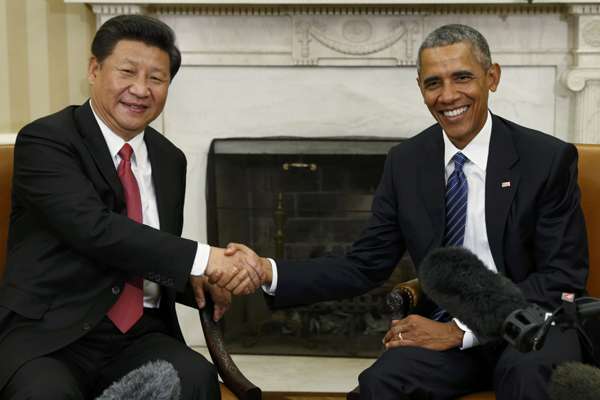

US President Barack Obama says China may steer AIIB loans to meet political or strategic considerations rather than economic. The US as chief shareholder of the World Bank has always viewed it as a foreign policy tool. During the Cold War, the US happily backed loans to the third World countries in exchange for their willingness to toe US foreign policy objectives. Similar is the case of Japan, which is major shareholder of the ADB. Obama sees the AIIB as a lending rival that will reduce the leverage the United States gets through domination of the World Bank. Japan has kept out of AIIB for the same reason, it too will suffer erosion of its leverage as chief financier of the Asian Development Bank.

Head of the IMF, Christine Lagarde, said the IMF and the World Bank are ready to work with AIIB. “The developing world’s infrastructure investment needs are too huge for any single institution,” said Jim Yong Kim, World Bank president. “We view the AIIB as an important new partner.” Takehiko Nakao, Asian Development Bank president, also welcomed the new bank’s launch. “ADB is committed to working closely and co-financing with AIIB to address the vast infrastructure needs facing Asia by using our long experience and expertise in the region,” Mr Nakao said.

China’s Minister of Finance Luo Jiwei said the bank will operate according to the highest standards and follow international rules. “Our motivation was mainly to meet the need for infrastructure development in Asia and also satisfy the wishes of all countries to deepen their co-operation,” he told member countries. The AIIB is one component in China’s broader regional infrastructure plan, known as “One Belt, One Road”, which aims to expand rail, road and maritime transport links between China, central Asia, the Middle East and Europe. “This is China assuming more international responsibility for the development of the Asian and global economies,” said Lou Jiwei. He termed the new $100 billion bank a “win-win for Asia” and a “new type of multilateral bank for the 21st century.”

As Greece struggles to manage its debt trap, it has already swallowed the humble pie of being a defaulter. Negotiations for a cash-for-reform package between Athens and its creditors broke down recently and Greek Prime Minister Alexis Tsipras called a surprise referendum to vote on whether to accept further austerity or risk going out of the euro zone. Greece has failed to pay a 1.6 billion euro loan instalment due to the International Monetary Fund (IMF) after failing to secure new rescue funding. The global financial system, as well as the global capital market, will be affected by what happens in Greece. Incidents of similar difficulties faced by other European and non-European are not infrequent. Under these circumstances, launching of AIIB by China is certainly refreshing.