The Kingdom of Saudi Arabia is the only Muslim country exists in the G-20. It is also the fourth ideal destination for the foreigner expats. It is the Gulf Cooperation Council (GCC) and Middle East North Africa (MENA) number one economy and Foreign Direct Investment destination.

Despite regional socio-economic meltdown, deteriorating law and order situation in many parts of the region and above all high level of political uncertainty, the Kingdom of Saudi Arabia’s macro-economy has surpassed the previous levels of productivity, efficacy, expansion and above all profitability. Prevalent societal divide in many key regional countries, the society of the Kingdom is united and harmonized. System of governance has been at stake in many regional countries, but in case of Saudi Arabia, system is intact, dynamic and articulated. According to many regional research studies and international monetary agencies data, its macro-economy’s major indicators are positive, stable and strong.

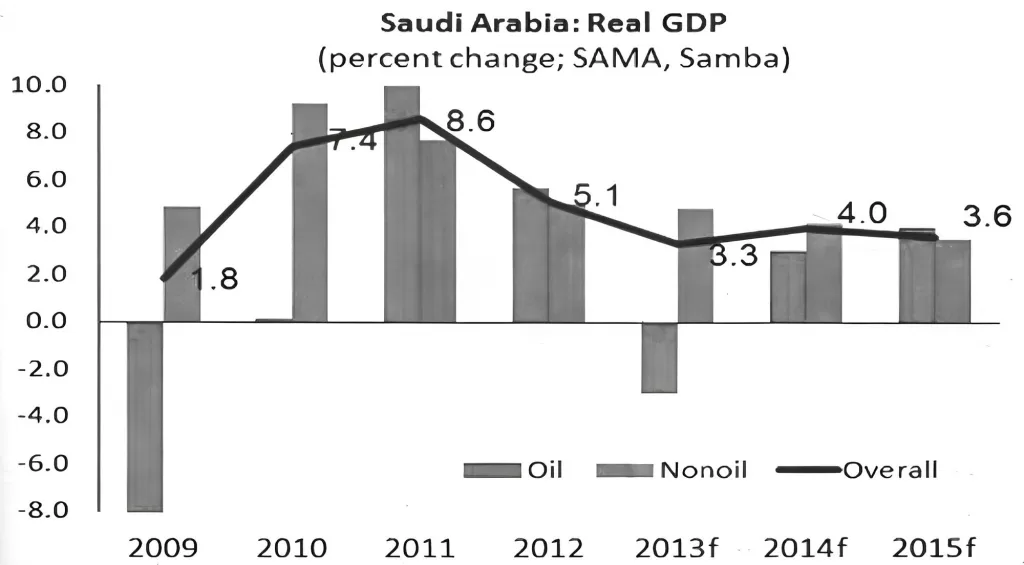

According to the IMF latest report (August, 2013) Saudi Arabia has had one of the best performing economies of the G-20 countries in recent years and has played a positive role in the global economy by stabilizing oil markets, The Saudi economy grew by 5.1 percent 2012 due to overall economic productivity having strong private sector growth, and government spending. The report said that credit growth has remained strong, the banking system is well-capitalized and profitable, fiscal and current account surpluses remain large, and international reserves have grown. The IMF (August, 2013) expected a continued positive economic outlook for the Kingdom, with growth expected to continue at 4 percent during 2013. Furthermore, the latest report also acknowledged the Kingdom as an important source of financial assistance and remittances for developing countries. The IMF also praised the Saudi government’s efforts to strengthen fiscal management and its large investments in education and infrastructure.

SAMBA Projections (2013-14)

| Indicators of macro-economy | 2011 | 2012 | 2013f | 2014f | 2015f |

| Nominal GDP ($bn) | 669.6 | 727.6 | 742.5 | 768.9 | 806.8 |

| GDP Per Capita ($ 000) | 23602.4 | 24789.9 | 24477.6 | 24516.6 | 24901.2 |

| Real GDP % (CHANGE) | 8.6 | 5.1 | 3.3 | 4.0 | 3.6 |

| Non-Hydro-Carbon GDP | 7.7 | 5.0 | 4.8 | 4.2 | 3.5 |

| Commercial bank deposit (SR bn) | 1103.6 | 1215.0 | 1390.8 | 1571.6 | 1760.2 |

| % Change | 12.1 | 10.1 | 14.5 | 13.0 | 12.0 |

| Commercial bank deposit loan (SR bn) | 890.2 | 1038.0 | 1173.0 | 1290.3 | 1393.5 |

| % Change | 10.2 | 16.6 | 13.0 | 10.0 | 8.0 |

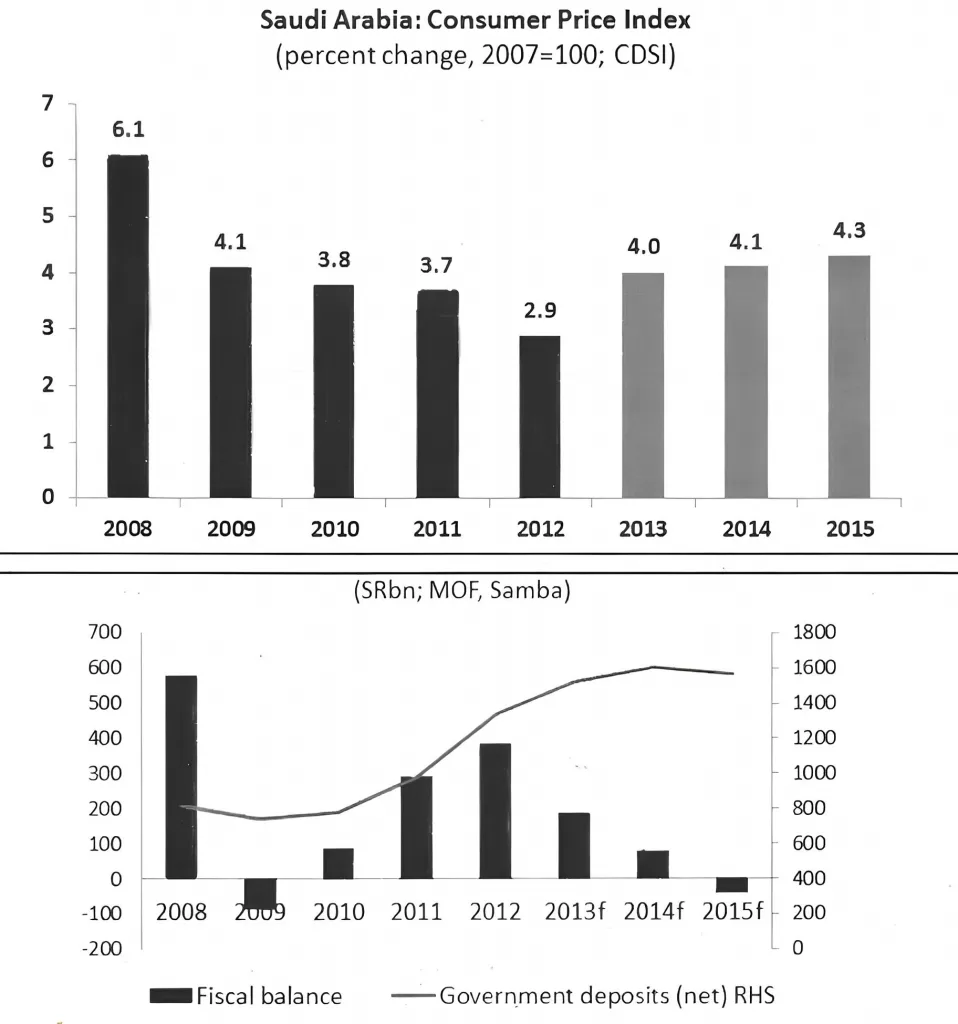

| CPI Inflation (% change) | 3.7 | 2.9 | 4.0 | 4.1 | 4.2 |

| Current Account balance ($bn) | 159.8 | 177.4 | 123.1 | 93.3 | 73.0 |

| Fiscal revenue (SR bn) | 1117.4 | 1239.5 | 1102.6 | 1032.5 | 989.6 |

| % Change | 50.7 | 109 | -11.0 | -6.9 | -4.2 |

| Fiscal spending (SR bn) | 826.7 | 853.0 | 915.5 | 971.3 | 1029.4 |

| % Change | 26.4 | 3.2 | 7.3 | 6.1 | 6.0 |

Real GDP growth (percent change, year-on-year)

| Sectors | 2011 | 2012 | |||

| Q1 | Q2 | Q3 | Q4 | Q5 | |

| Agriculture | 0.7 | 1.3 | 4.4 | 5.2 | 1.4 |

| Oil | 1.3 | 2.6 | 6.0 | 5.7 | 7.7 |

| Manufacturing | 12.0 | 14.9 | 9.0 | 20.6 | 8.4 |

| Electricity, gas, and water | 9.1 | 3.4 | 6.7 | 2.5 | 9.0 |

| Construction | 8.8 | 12.7 | 12.3 | 13.3 | 9.1 |

| Wholesale & retail trade | 7.3 | 7.4 | 7.0 | 8.1 | 6.6 |

| Transport & Communication | 11.2 | 11.7 | 11.7 | 10.9 | 9.0 |

| Finance | 1.0 | 3.9 | 6.0 | 1.5 | 1.8 |

| Personal services | 1.1 | 9.2 | 9.2 | 9.2 | 8.1 |

| Government services | 1.6 | 18.9 | 7.3 | 4.6 | 2.8 |

| GDP | 5.6 | 9.6 | 7.5 | 7.4 | 5.9 |

In another local study conducted by the Riyadh-based Jadwa Investments (August, 2013), its real GDP is projected to expand by around 4.2 percent and growth will be fuelled by the non-hydrocarbon sector as the oil GDP is expected to decline due to lower output and prices. Furthermore, the non-oil private sector is expected to rise by around 5.3 percent while the government sector will grow by 4.3 percent.

The monthly bulletin of the SAMA (August, 2013) says that in nominal terms, Saudi Arabia’s GDP will expand by around 3.3 percent to SR2,819 billion in 2013 from SR2,727 billion in 2012. GDP in current prices would climb to a new record of SR 2,905 billion in 2014 according to the said report. The earnings would remain far above budgeted revenues of SR829 billion. It will create a much bigger actual fiscal surplus of nearly SR177 billion, nearly 20 per cent the budgeted surplus of SR nine billion. It is hoped that the high surplus would allow Saudi Arabia to further trim its public debt to just around SR90 billion at the end of 2013 from SR99 billion at the end of 2012 and nearly SR135 billion at the end of 2011.

Whereas, the SAMBA report (September, 2013), non-oil GDP growth may reach to 4.8 percent this year to 3.5 percent in 2015 which would be good sign for the macro-economy of the Kingdom in the days to come. The following given diagrams clearly show the elements of stability and sustainability exist in the national economy of Saudi Arabia.

Its wise leadership played remarkable role in the onward march of socio-economic prosperity. They introduced many meaningful short, medium and long term economic policies and financial reforms to make their economy competitive in the region and at international stage alike. Numerous schemes of socio-economy have already raised the levels of qualitative life, education, shelter, health and above all trust between the people and the prevailing system in the country.

Many ongoing mega industrial projects have further strengthened the productivity ratios. Ratios of FDIs, activities of construction, employment generation, higher education, consumer price stability, and the last but not the least increase in wages has merged the Kingdom as one of the ideal country to live in.

Government spending on people’s welfare has been one of the key priorities since its inception. It is now paving its dividends. Its federal budget has been remained surplus which has been used on different mega projects of social development throughout the country. Education, health care, housing and infrastructure have been main sectors of government spending in the past so many years. Women empowerment is slowly but surely on the increase. Now women are in government positions ranging from ministerial levels to the Shoura Council.

Fitch’s Saudi Arabia’s rating (September, 2013)

Most recently, Fitch Ratings has affirmed Saudi Arabia’s Long-Term foreign and local currency Issuer Default Ratings (IDRs) at “AA-“. The Outlook is Positive. Fitch has also affirmed Saudi Arabia’s Country Ceiling at “AA” and Short-Term foreign currency IDR at “F1+”.

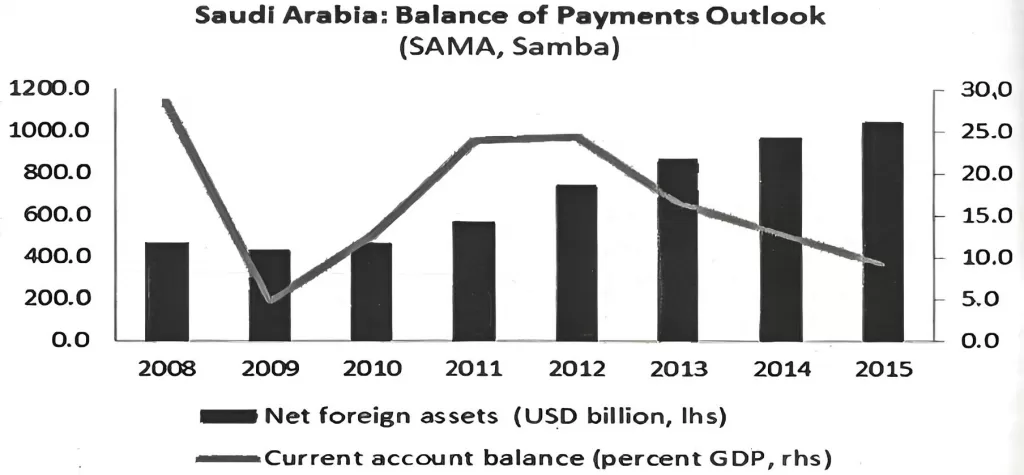

Fitch Ratings said Saudi Arabia’s external balance sheet has been bolstered so far in 2013. Central bank net foreign assets, the bulk of sovereign foreign assets, are up by 4.4 percent of GDP over the first seven months of the year and with no sovereign external debt, the net external creditor position is likely above 100 percent of GDP (from 96 percent of GDP at end-2012). Double-digit current account surpluses are expected each year to 2015, which will further bolster the external position.

In case of fiscal out-look, its ratios have been enhanced, with rising government deposits and falling government debt over the first seven months of the year reinforcing a net creditor position that is the second-strongest of all Fitch-rated sovereigns.

Capital adequacy and loan-loss coverage were up (at 17.9 percent and 166 percent, respectively) and NPLs had fallen to 1.63 percent. Banks remain liquid and the sector is well regulated. Risks arising from the banking sector are judged to be low.

The Global Competitiveness Report (2013) again upholds Saudi Arabia position among top 20 most competitive countries and maintains its first position in the region. The latest Fitch Ratings (2012-2013), shows the Kingdom’s political and financial stability. The Kingdom is determined to continue modernizing its infrastructure and accelerating economic activities in order to realize diversification of the sources of income.

The official figures showed the surge in nominal GDP boosted its per capita income to around $20,244 in 2011 from $15,246 in 2009 and expected it to reach $19,449 in 2012. It expected the assets to further swell to $1,128 trillion at the end of 2016 and break another record of $1,213 trillion at the end of 2017. According to the official report (April, 2012), foreign investments in Saudi Arabia jumped to $34 billion in 6 years.

The official data (SAMA) showed that the inflation rate in Saudi Arabia was recorded at 3.70 percent in July of 2013. Inflation Rate averaged 2.80 percent from 2000 until 2013, reaching an all-time high of 11.10 percent in July of 2008 and a record low of -2 percent in January of 2001.

The National Commercial Bank, releases the D&B Business Optimism Index survey (August, 2013) for Saudi Arabia for Q3 in Jeddah according to which inflation in Saudi Arabia is moderating. “Due to strengthening of the dollar 2013 imported inflation dropped significantly. There is also an increase in local capacity, which will help moderate the level of inflation in the range of 3.7 percent to 3.8 percent in 2013.

| CPI/ Different categories | % |

| Foodstuffs and beverages | 26 |

| Renovation, rent, fuel and water | 18 |

| Transport and telecommunication | 16 |

| Home furniture | 11 |

| Fabrics, clothing and footwear | 8 |

| Education and entertainment | 6 |

| Medical care | 2 |

| other expenses and services | 13 |

The Current Account outlook (2013)

According to latest report of SAMA (September, 2013), the fiscal and current account positions have similar profiles. The current account is expected to record healthy surpluses over the next three years. It recorded a Current Account surplus of 34310 USD Million in the first quarter of 2013 by SAMA. Its Current Account averaged 14965.58 USD Million from 1971 until 2013 reaching an all-time high of 90060.70 USD Million in December of 2005 and a record low of -27509.30 USD Million in December of 1991.

| Saudi Exports (Year-2012) | Amount SR billion |

| Asian countries(non-Arab and Islamic) | 748.39 |

| North American countries | 218.09 |

| European Union | 176.21 |

| GCC | 96.34 |

| Islamic countries (non-Arab) | 62.54 |

| other countries | 118.91 |

Saudi foreign Assets at all-time high

The Saudi Arabian Monetary Agency (SAMA) June, 2013 said that Saudi Arabia’s foreign assets reached above the SR2.6 trillion mark for the first time. The assets controlled by the SAMA, peaked at an all-time high of around SR2.601 trillion (Dh2.57 trillion) at the end of May compared with about SR2.485 trillion (Dh2.46 trillion) at the end of 2012. It showed the assets, comprising investment in foreign securities, deposits with banks abroad and other funds, swelled by nearly 4SR43 billion month-on-month as they stood at around SR2.558 trillion at the end of April.

| Saudi Imports (Year-2012) | Amount SR billion |

| Asian countries(non-Arab and Islamic) | 198.43 |

| North American countries | 87.34 |

| European Union | 147.52 |

| GCC | 38.80 |

| Islamic countries (non-Arab) | 30.85 |

| other countries | 80.50 |

Moreover, net foreign assets are projected to reach well over $1 trillion by the end of 2015, equivalent to 130 percent of GDP. The Saudi Arabian Monetary Agency (SAMA) the net foreign assets increased by nearly $94 billion to its highest level of $560 billion at the end of 2011 $466 billion at the end of 2010. Year-on-year, SAMA’s assets were higher by a staggering SR362 billion as they stood at SR2.239 trillion at the end of May 2012. The assets were also higher by around SR900 billion compared to their level at the end of 2008 and nearly triple their level at the end of 2000.

According to the kingdom’s largest bank (March, 2013), Saudi Arabia’s budgeted fiscal surplus for 2013 could end the year nearly 30 times higher because of an expected surge in oil export earnings as a result of high prices.

| Country | Pledged | Details |

| Bahrain and Oman | GCC package of $20 billion split the GCC States | |

| Egypt | 3.99 | A combination of budget support, central bank deposits, project financing, and trade credit. |

| Yemen | 3.60 | Total pledge including diesel and crude oil grants |

| Jorden | 2.65 | $1.4 billion in budgetary support and a GCC package of $5 billion split equally GCC States. |

| Morocco | 1.25 | GCC package of $5 billion split equally among GCC States |

| Tunisia | 0.75 | $0.5 billion for project financing and $0.25 billion for export financing |

| West Bank and Gaza | 0.34 | Budgetary support |

| Suden | 0.24 | Infrastructure loan |

| Djibouti | 0.04 | Budget support and project loans |

High Ratios of Credit to Private Sector

The Riyadh-based Jadwa Investments (July, 2013) credit to the private sector by the Kingdom’s 12 commercial banks surged by nearly 16.5 per cent in May, 213 to extend a boom in lending after near zero growth in the aftermath of the 2008.

“The expansion in credit and low funding costs continue to contribute to a pick-up in bank profits”. Banks recorded a profit of SR3.2 billion, 11 percent high than in May last year, taking the year-to-May profit to SR15.7 billion. The Kingdom remained positive on bank profit growth, based on a solid path for credit growth and low funding costs in 2013. It is hoped that this year’s bank profit to surpass the all-time high of SR34.7 billion recorded in 2006.”

In nominal terms, banks increases their credit portfolio by SR12.8 billion in May leading to SR61.8 billion of new net credit issued so far this year compared with SR52.6 billion for the same period last year. Loans, advances and overdrafts combined to make the largest contribution (16.4 percentage point) to the year-on-year credit growth in May, the report showed.

According to report, in 2012 Saudi banks earned around SR33.5 (Dh33.2 billion), their second highest profits since the 2006 record income and analysts attributed the surge to credit recovery, higher investment return and project upturn.

The earnings last year were nearly 8.4 percent above the 2011 net income of around SR30.9 billion but the profit growth in 2012 was much slower than in 2011, when it stood at around 18.3 percent. Net earnings of the Saudi banks, with the second largest assets in the Arab world after UAE banks, were relatively low during 2009-2010.

| Countries | Outcome of mix of diplomatic efforts |

| Tunisia & Libya | Its rigorous diplomatic efforts saved Tunisia from further socio-economic degradation, political impasse and the last but not the least ethnic division. It played an important role in marginalizing Libya’s war theater and succeeded to bring some hope of better future and prosperity for its people. |

| Yemen & Sudan | It prevented Yemen’s horrendous incidents. It played facilitating role in turbulent Sudan reconciliation process. It succeeded to thwart its people from further cleansing. |

| Palestine & Rohingyas | It’s strong political has been extending its moral, economic, political and diplomatic support to the suffering souls of Palestine. It was the first country to understand the human tragedy of the Muslims of Myanmar and donated US$ 50 million. |

Preferred Areas of Pak-Saudi Cooperation

| Country | Preferred Sectors/Areas |

| Pakistan | Hydropower projects. Exploration of the possibility of entering into industrial co-operation including joint ventures in agriculture, light & heavy industry and petroleum sector along with SMEs. Insurance and financial sectors. |

| Exports-to-Kingdom | Rice, ready-made garments, cotton fabrics, synthetic fabrics, made up textiles, tents and canvas, fruits and vegetables, spices, towels, carpets and rugs, sports goods, fish and fish preparations, handicrafts, leather manufactures and printed matters. |

| Imports-to-Kingdom | Crude petroleum, polythene, plastic moulding powder, aluminum waste, urea, dates, copper wire and rods, ships and boats, ether and its derivatives, chemicals machines, paper waste, parts of aircraft and sulphur. |

| Saudi Arabia | Infrastructure Key production industries situated in Pakistan, Energy Pipri Thermal Power Project, Tarbela Dam repairs, Sea Port Port Qasim, Fertilizer Mirpur Mathelo plant |

Kingdom’s Foreign Aid Drive

While addressing to the Gulf Cooperation Council (GCC) and Swiss Forum in Geneva, Deputy Foreign Minister Prince Abdul Aziz bin Abdullah shared that around $103 billion in financial aid has been provided by Saudi Arabia to 95 developing countries over the past 30 years.

| (millions Rs.) | ||||

| Country | July 2012 to Aug 2012 | July 2011 to Aug 2011 | ||

| Exports | Value | %Share | Value | %Share |

| Saudi Arabia | 6,736.13 | 1.81 | 5,827.17 | 1.65 |

| Imports | ||||

| Saudi Arabia | 40,994.16 | 5.91 | 74,441.99 | 11.51 |

“Saudi Arabia has been one of the largest donor countries and a key partner in international development. The Kingdom has spared no effort in the pursuit of achieving stability on the world’s oil markets as part of its initiatives to boost the global economy.” It shows its genuine concerns towards poverty, hunger, famine, discrimination and sustainable economic development in the world.

Diversification of Energy Resources

Many mega projects of renewable energy, food security and water are being carried out in different parts of the Kingdom, which is hopefully would pay dividends in the days to come. The SMEs sector represents nearly 96 percent of total businesses in the Kingdom and its share accounts for 28-33 percent of GDP. Saudi banks provided $247 million loans to 1,113 small and medium enterprises (SMEs) during the period 2006-2010.

Moreover, according to a GCC-wide study (July, 2013) Titled ‘Renewable Energy Readiness Assessment Report: The GCC Countries 2011-2012’, the report (2013-The EU-GCC-Report) suggests that initiatives undertaken so far in the GCC represent a proactive approach to addressing energy security and environmental issues at international, regional and national scales and Saudi Arabia ranks first with 4.60.

Saudi exports surge

A report released by the Central Department of Statistics and information (CDSI), June, 2013 revealed that the value of nonoil exports stood at SR 190.95 billion which represented 32.73 percent of the Kingdom’s total imports in 2012. Saudi commodity exports rose by 6.5 percent last year valued at SR 1.45 trillion compared to SR 1.36 trillion in 201. Based on the CDSI report, the value of Saudi imports increased by 18.2 percent to reach SR 583.47 billion compared to SR 493.44 billion in 2011.

The value of non oil exports stood at SR 190.95 billion which represented 32.73 percent of the Kingdom’s total imports in 2012. For comparison reasons, nonoil exports of the Kingdom valued at SR 41.14 billion in 2003, which represented 26.31 percent of the total imports at the time, the report said. The overall exports stood at SR 1.45 trillion.

Healthy Contribution of Private Sector

According to the latest report of the central department of statistics and information of Saudi Arabia (2012-2013), the private sector growth, at 9.9 percent, outpaced the state sector’s 3.6 percent expansion. Private sector GDP amounted to SR112.91 billion in the fourth quarter compared to SR102.75 billion in 2010. Moreover, the construction sector expanded 13.3 percent because of a real estate boom and heavy government spending on infrastructure. Saudi Arabia’s exports increased by 32 percent to reach SR38.61 billion compared to SR29.30 billion in the same period last year while the weight of the imports of Saudi Arabia amounted to 4507,000 tons against 3135,000 tons in the same period of last year, an increase of 44 percent.

| Economic Sectors | Mechanism |

| Trade & Commerce | Early finalization of Pakistan-GCC Free Trade Agreement (FTA) and Bilateral Investment Treaty (BIT). |

| FDI & FPI | Joint ventures and seeking private investments from the Saudi investors and businessmen |

| Banking & Finances | Opening of banking branches & finance agreements etc. |

| Military Cooperation | Great collaboration, joint armed forces and naval exercise, training etc. |

| Exports | Supply of commodities and services |

| Energy Cooperation | Heavy investment in the energy mix especially in hydro-power generation |

| HRM Exports | Greater exports of manpower to Saudi Arabia |

| Source | Study of different joint statements, MOUs and Agreements |

King Abdullah’s Arab Development initiative

Custodian of the Two Holy Mosques King Abdullah recently announced to increase the capital of Arab financial institutions and joint companies by at least 50 percent. It reflects the King’s keenness in further boosting efforts for Arab development and bringing about direct and immediate benefits for Arab citizens.

Initiative of interfaith dialogue

The Kingdom has been very active in promoting interfaith dialogue between the West and Islam especially after 9/11. It succeeded to bring closer the people of different religious faiths and cultures to deepen mutual understanding and promote global peace and cooperation. It was launched by Custodian of the Two Holy Mosques King Abdullah in 2008 resulted in the opening of the King Abdullah bin Abdulaziz International Center for Interreligious and Intercultural Dialogue in Vienna, Austria. The Kingdom has been extending its extending its cooperation with the international community, to achieve peace and stability in the Middle East. Most recently its principal stance to go with the “Will of People” received immense appreciation in the world.

(2011-2013)

| Remarkable Visits Saudi Arabia) | Purposes |

| Commerce and Industry Minister Dr. Tawfiq Al Rabeah led the Saudi side of the JMC. Dr. Rabeah | Enhancing economic cooperation with Pakistan |

| A delegation of Saudi Food and Drug Authorities undertook a visit to Pakistan in March 2012 | Initiating a process, which will soon result in the licensing of 14 Pakistani food companies in the Kingdom? |

| Abdulaziz Khoja, Minister of Information and Culture, visited Islamabad on April 3 | Held fruitful meetings. Worked out several proposals on increasing collaboration between the media houses. |

| Prince Abdulaziz bin Abdullah, Vice Foreign Minister visited Pakistan on April 10 last year. | Two sides agreed to work out a road map for bilateral relations with special emphasis on institutionalizing the partnership. |

| Remarkable Visits (Pakistan) | Purposes |

| PM Yousaf Raza Gillani visited the Kingdom twice, July 2012 | Both countries agreed on further steps to institutionalize bilateral cooperation and to translate the brotherly sentiments existing between the two countries into practical cooperation. |

| Chief of Army Staff, Gen. Ashfaq Pervez Kayani also visited the Kingdom on April 3. | Enhanced the military cooperation between the two countries. |

| The foreign minister visited Saudi Arabia on January 1-2 | She termed the bilateral relationship as “solid and historic” and said that the two countries saw “eye to eye” on all issues. |

Saudi Arabia’s Reconciliatory Role and Current Middle East

Saudi Arabia is qualified to play this role through its scientific, economic and social capabilities. It is one of the largest and most influential of the six Arab Gulf countries. The Saudi regime, by contrast, gave its lavish humanitarian support to troubling regimes in Tunisia, Egypt, Yemen and Bahrain.

The above data clearly indicates the Kingdom’s financial support for the people of these countries in order to save from them from hunger and budgetary deficits. It has been helping the GCC states and MENA region in their national crises since its inception. Saudi Arabia reiterated its support for Egypt to reinforce its security and stability. The Kingdom had given $500 million in soft loans to finance energy projects in developing countries and donated $300 million for the establishment of a fund for energy, environment and climate change research.

Due to its rigorous diplomatic, political, moral, economic and military support Bahrain stood against all kinds of internal conspiracies and external infiltrations. It extended its financial and economic assistance to Oman, Jordan, and Morocco. In case of falling Yemen Saudi Arabia arranged a peaceful transition of power. In cases of, Libya and Syria, Riyadh has been taking principal stance to support the “Will of People”. Its continued humanitarian assistance in Libya and Syria show its genuine concerns towards helpless humanity at large.

Pak-Saudi Arabia Bilateral Relations (2013)

Since the beginning Saudi Arabia and Pakistan have maintained close religious, cultural, economic and strategic ties. Pakistan has maintained the closest bilateral ties as a non-Arab Muslim country with Saudi Arabia. Defense cooperation between the two countries is very unique too.

The Kingdom is among the top 15 export partners of Pakistan. It is home to 1.5 million Pakistanis who contributed heavily for the development of the country through their about $ 3.7 billion remittances per annum. Pakistanis are playing a significant part in building the physical and institutional infrastructure of the Kingdom. Whether it is in the field of finance, commerce, medicine, construction or business, Pakistani community members have contributed to Saudi Arabia’s development with passion and devotion.

Its bilateral trade volume has gone above US$ 4 billion per annum and which would be further increased in the days to come. The Saudi leadership has always stood by the people of Pakistan during challenging times. Pakistan always lauded Saudi Arabia’s important role in promotion of global peace and stability. Pak-Saudi Arabia bilateral relations also geared-up during 2013. High official meetings at different levels were held in Islamabad and Riyadh during which both the countries agreed to cooperate in the fields of trade‚ textile‚ pharmaceutical‚ banking and other fields.

In his first tour to Saudi Arabia the Prime Minister Nawaz Sharif said Pakistan’s relationship with Saudi Arabia was unparalleled, deep-rooted and time-tested and the Saudi leadership also had the same sentiments for Pakistan. He held separate meetings with King Abdullah Bin Abdul Aziz and Crown Prince Salman Bin Abdul Aziz in Makkah ul Mukarramah. During the meetings‚ the two sides discussed ways to promote bilateral cooperation in diverse fields. During meeting with King Abdullah, Prime Minister Nawaz Sharif discussed issues of mutual interest including bilateral relations and the challenges facing the Muslim Ummah. Saudi King warmly received Nawaz Sharif on arrival at the palace and felicitated him for becoming prime minister for the third time. Nawaz Sharif thanked King Abdullah for the kind gesture and said that both the countries always helped each other in difficult times. The prime minister also met Crown Prince Salman bin Abdul Aziz and discussed bilateral relations between both the countries.

According to finance ministry of Pakistan (March, 2013), goods shipped to Saudi Arabia in 2010-11 rose to $418 million compared to exports worth $393 million in 2009-10. Bilateral trade between Pakistan and Saudi Arabia has increased from 2830 million dollars to 4974 million dollars from 2004-5 to 2010-11.

Saudi Arabia contribution to Agriculture & Reconstruction

| Different Sectors | Utility |

| Agriculture | In recent years, it pledged an additional $400 million at the Pakistan Development Forum (PDF). The $100 million credit for urea fertilizer import was part of that commitment while for remaining $300 million Moreover, to fulfill the requirements of agriculture, Saudi Arabia has provided Urea loan which is for a short period at an interest rate of London Interbank Offered Rate (Libor) plus 1.25 per cent. Under the agreed loan/program, the Trading Corporation of Pakistan (TCP) will import urea from Saudi Arabia and provide the fertilizer to National Fertiliser Marketing Limited (NFML) for its fair distribution. |

| Reconstruction | It provided a loan of $72 million. It would be spent for reconstruction in the Malakand Division, Bajaur Agency and North and South Waziristan. The reconstruction activity, including repair of roads, would contribute to increasing agricultural productivity and enhance educational and health standards for the people of the region. Rehabilitation work includes construction of 283 KMS of major roads and 887 KMS of other roads along with 43 bridges and 78 culverts. The loan will also be used for construction of main and branch canals with flood protection work, water storage, supply of lift pumps, construction of educational facilities in South Waziristan, North Waziristan and Bajaur and rehabilitation of power network and transmission lines. |

Investment Friendly Policies/Conditions

The conditions of investment in Saudi Arabia are one of the best in the world now. Fuel, Gas and Electricity are subsidized and are very cheap. Taxation regime here is very reasonable. Other regulations are business friendly. And, above all there is peace and stability and rule of law. Saudi Arabia offers a huge market in all kinds of products building materials, foods and fruits and all kinds of consumables. Pakistani investors and businessmen should invest in construction, hotelier, chemical industry and SMEs in Saudi Arabia.

During the past years, the Saudi Fund for Development (SFD) of the KSA and the United Nations Office of Project Services (UNOPS) signed a memorandum of understanding (MoU), under which the SFD would be providing $3 million for the reconstruction of flood-affected bridges and irrigation canals in Kalam region in Khyber Pakhtunkhwa. SFD Vice Chairman and Managing Director Yousef Ibrahim al Bassam and UNOPS Pakistan Country Director Mikko Lainejoki inked the accord. Yousef Ibrahim al Bassam commented, “We are very keen to partner with UNOPS and look forward to helping the people of Pakistan and continuing this long standing partnership.”

Defense Relations

Since form the beginning, both the countries maintain close military ties. The government of Pakistan provided extensive support, arms and training to the military of Saudi Arabia. Pilots of the Pakistan Air Force flew aircraft of the Royal Saudi Air Force to deter a raid from South Yemen in 1969. In the 1970s and 1980s, approximately 15,000 Pakistani soldiers were stood tall in Saudi Arabia. Saudi Arabia showed great interests to purchase of Pakistani ballistic missiles capable of carrying nuclear warheads. Pakistan and Saudi Arabia have information mechanism on different subject relating to defense production, security apparatus and above all martial training etc.

The 10th Joint Naval Exercises named Naseem Al Bahr (Sea Breeze) was held between Pakistan and Saudi Arabia in Karachi March 2013. Naseem Al Bahar (NAB) is a biennial exercise, which is evolved as manifestation of the unique Pak-Saudi strategic bilateral and interpersonal relationship and mutual resolve to enhance bilateral cooperation in facing the common challenges. These exercises were a clear manifestation of Pakistan’s commitment towards maintaining peace and stability in the region. Participation of Royal Saudi Naval Force (RSNF) ships in the exercise further strengthened existing bilateral relations between two brotherly navies. It was also a milestone in history of Pakistan Navy in which the complete exercise was conducted from Jinnah Naval Base, Ormara. It was lasted for one week.

The aims and objectives of the 10th Joint Naval Exercises was to foster friendship and develop common understanding. It was carried out to increase interoperability with RSNF in the domains of traditional as well as non-traditional warfare in order to maintain peace and stability for the larger good of the region.

Naseem Al Bahar-X highlighted the combat management system on the ship, which includes torpedoes, missiles and oceanographic technologies. An impressive demonstration of Live Weapons Firing by ships and aircraft was supposed to be culminating point. The Joint Naval Exercises included a wide range of operational manoeuvres encompassing major facets of maritime warfare. It related to counter terrorism, convoy protection, anti-air, anti-submarine, mine counter measure and intelligence based operations conducted in multi-threat environment. It would further strengthen the maritime cooperation between Pakistan and the Kingdom of Saudi Arabia.

Armed forces of both the countries had joint military exercises named Al-Samsaam-IV in Pakistan in 2011. Army chief General Ashfaq Kayani said that these drills would boost bilateral strategic ties between the two countries. He praised Saudi forces for their bravery, valor and marital skills. During exercises, military personnel troops from both the armies successfully attacked the dummy hide-outs of the terrorists. The drill was part of three week joint military exercises that aim at sharing information through training. The exercises enhanced the combat efficiency, of participating troops against terrorism operations.

The brotherly ties between Pakistan and Saudi Arabia provide a model for other nations to emulate. Pakistan being the fifth largest army of the world has developed strategic ties with Saudi Arabia. Joint military exercises between armies of two brotherly countries aim to enhance existing bilateral relations and to benefit from each other’s experience in counter terrorism operations. Pakistan-Saudi Arabia alliance would guarantee larger regional reconciliation and stronger ties of survival, production, socio-economic prosperity and above all security.

Thanks for generosity

According to Pakistan’s embassy in Saudi Arabia, some 250,000 Pakistani workers have been legalized their status with the help of various legal resources with the help of government of Saudi Arabia. The number of illegal Pakistani workers has declined. Thanks to Custodian of the Two Holy Mosques King Abdullah for his kindness in extending the amnesty deadline.

Concluding Remarks

Pakistan and the Kingdom of Saudi Arabia are strategic partners and brothers in true sense of socio-economic, geo-politics and geo-strategic parameters. Upheavals in the Middle East, withdrawal of allied forces from Afghanistan, economic interdependencies and above all war against terror have already given new dimensions to bilateral relations of both the countries.

In modern arena of market economy and globalization 3.0 the Kingdom of Saudi Arabia is known for its lavish humanitarian diplomacy, conflict resolution and reconciliation spirits throughout the world. In religious realms it stands for brotherhood, charity and divine revelations. In the sphere of mysticism it is also famous because of the birth place of last Prophet Muhammad (peace be upon him) and magnificent edifice of Kaaba. In the field of economic liberalization it is the only Muslim country in G-20. It has been icon of the Muslim Ummah and Muslim nations the world over since its inception. On part of Pakistan, it terms its bilateral relations with Saudi Arabia as unique, time-tested and strategic.

On strategic levels, the government of Pakistan anticipated a formal ‘security bloc’ to GCC (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) to combat any external or internal security threats in the region. It has multiplier effects. Moreover, it would also ensure food safety and further economic integration in the days to come.

Pakistan could provide common military/security bloc to GCC which would be paradigm shift in the region. It would be curial for the GCC short and long terms geo-political and geo-strategic vested interests. The existing Peninsula Shield in the GCC would be further strengthened and streamlined. There would a joint military to face any potential or emerging regional threats and confronting realities. The prospects of having new weapon system and unifying military training would also be initiated under this planned joint strategic security bloc between the Pakistan and the GCC.

Moreover, formation of common strategy against terrorism, extremism, human & drugs trafficking and the last but not the least maritime piracy could be rigorously followed afterwards. Therefore, Pakistan-GCC security bloc would jointly cope with this widespread menace in the days to come.

On economic levels, enhanced cooperation in the field of civil aviation would bring improvement in cargo & shipment mechanism. There should be larger exports of surgical instruments, furniture, leather goods, fruit and vegetable to Saudi Arabia. Joint ventures in the fields of energy production especially in solar, wind and hydro would be win-win situation for both the countries.

On forum levels, close coordination and information sharing between the business community of both sides would be game changer. Administrative simplification of visa issuance would be essential for further enhancing of socio-economic integration in the days to come. Active role of Pakistan-Saudi Joint Ministerial Commission (JMC) and Pakistan-Saudi Business Council (JBC) etc. would definitely increase the trade volumes.

On commercial levels, cooperation & collaboration between the Council of Saudi Chambers of Commerce & Industry (CSCCI) and Pakistan’s Chambers of Commerce & Industry (FPCCI) would promote high ratios of imports-exports.

On culture levels academic institutions should hold spoken Arabic classes to facilitate communication between both countries. Exchange of journalists would bring desired dividends.

To sum up, Pakistan and the Kingdom of Saudi Arabia must have joint security shield, energy cooperation, food security, joint strategy against terrorism, extremism. Above all both countries must initiative integrated efforts to bring peace in the region especially in Afghanistan.